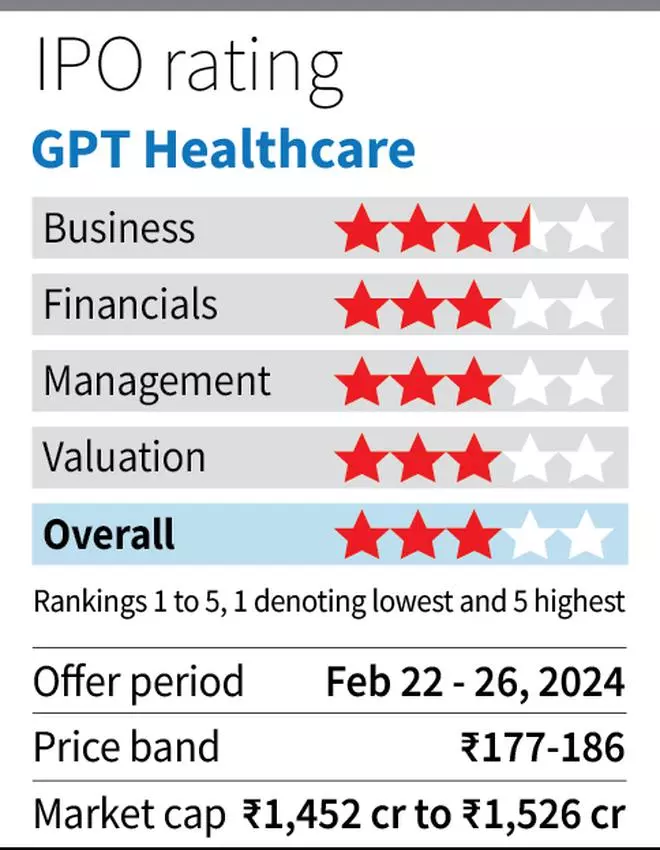

The IPO is pretty valued at 32 instances annualized H1FY24 earnings, which could be supported by its development plans in current and new ventures. However the steep low cost to look group valuation, which stands at 59 instances FY24 EPS, could not contract anytime quickly owing to the decrease working metrics. We suggest buyers subscribe to the difficulty with an eye fixed on earnings development. The IPO plans to boost ₹40 crore in contemporary situation and ₹485 crore in provide on the market by means of which investor BanyanTree LLC will fully exit.

Scaling up operations

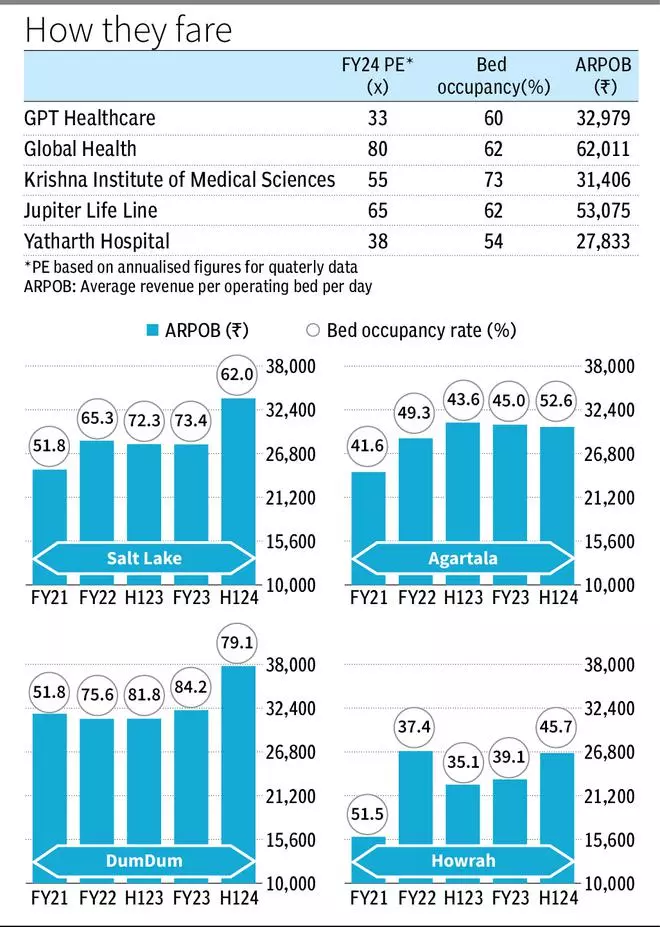

GPT Healthcare can drive development from current and new hospitals (but to be constructed). As could be seen within the desk, the occupancy charges of the Howrah and Agartala items are under these of the opposite two items. Howrah was commercialized in 2019, and with covid impression within the following two years, the unit has reported decrease occupancies. From 39 per cent occupancy in FY23, the unit already reported 45 per cent occupancy by H1FY24, which could be anticipated to maintain growing. Agartala, although commercialized in 2011, had a better share of renal and kidney transplant procedures, which elevated the common size of keep (ALOS) and pressured the occupancy charges. The corporate indicated an growing mixture of short-term procedures to enhance the metrics, which has resulted in an enchancment from 45 per cent in FY23 to 52 per cent.

Regardless of Salt Lake being the oldest facility (established in 2000), a current restructuring within the unit lowered the occupancy fee to under 70 per cent, and administration indicated that the restoration had occurred in Q3FY24 itself. Dum Dum (2013 established) is the gold customary for group operations, reporting 80 per cent occupancy ranges.

An enchancment in consolidated occupancy charges to an affordable 64 per cent by FY25 from 60 per cent in H1FY24, together with pricing development of 6-7 per cent per 12 months, can assist 12-15 per cent income CAGR and 20-25 per cent EPS CAGR in FY23-25 for GPT Healthcare.

New Amenities

GPT Healthcare has lined up Raipur and Ranchi for the following part of enlargement with a 140/150-bed facility, respectively, anticipated to be operational by FY25-26. The corporate will lease the finished facility (presently underneath development) from the personal lessors in trade for lease funds. At full utilization, anticipated in 2-3 years from commercialization, the services ought to add 15-20 per cent to revenues. Being mid-sized services by which GPT Healthcare has a powerful expertise in fast turnaround, bottom-line accretion can also observe. The corporate will look to develop in related centres within the East and North Jap areas sooner or later as effectively.

Financials and valuations

GPT Healthcare reported a income development of twenty-two per cent CAGR in FY21-23 to 360 crores. Within the interval, EBITDA margins remained steady within the 21 per cent vary. The corporate has a web debt to EBITDA ratio of 0.55 instances as on H1FY24, which can additional decline with repayments from the IPO proceeds.

In comparison with friends (see desk), GPT Healthcare is listed at a reduction. Trade development from new unit addition and powerful pricing development is frequent to all hospital shares, together with GPT Healthcare. However trade valuation appears to be driving on both a excessive occupancy ratio (KIMS) or a excessive ARPOB (World Well being and Jupiter). With GPT Healthcare on the decrease finish of each metrics, just like Yatharth, the decrease valuation vary could also be sustained.

ARPOB, being a perform of name positioning and market dynamics, will restrict additional development. Occupancy ratios have demonstrated 70-80 per cent in Dum Dum, however to persistently ship throughout the 4 mature hospitals remains to be a while away. For a better occupancy, the common size of keep should even be decreased from the present 4 days, and the product combine has to include a better proportion of short-stay procedures. Buyers can subscribe to the earnings development potential, regardless of the restricted headroom in metrics enlargement.

#GPT #Healthcare #IPO #Key #subscribe