By the way, the very subsequent day, the US Buying Managers Index (PMI) knowledge confirmed a pointy fall to 46.8 in July from 48.5 within the earlier month. In the direction of the top of that week, one other knowledge launch confirmed that unemployment within the US shot as much as 4.3 per cent in July. Each these knowledge reignited the concern of a recession within the US, thereby growing the percentages for the US Federal Reserve to chop rate of interest as early as in its September assembly.

So, fee hike in Japan at a time when the US is preparing for a fee reduce cycle triggered a pointy fall within the USDJPY. The forex pair (USDJPY) fell sharply over 7 per cent from round 153 to 142 after this occasion. That, in flip, knocked down the worldwide fairness markets. The Dow Jones Industrial Common fell about 6 per cent from round 41,000 to 38,500 within the few days following Japan’s fee hike. Japan’s benchmark index tumbled about 20 per cent over the identical interval.

The key purpose cited for this sell-off within the equities is what known as the yen carry commerce. For the reason that rates of interest in Japan was at zero for a very long time, buyers had borrowed cash from Japan (in yen) and had invested in excessive yielding belongings comparable to equities inside the nation and out of doors the nation as nicely.

Unconfirmed studies point out that the yen carry commerce might quantity to as excessive as $20 trillion. Some studies additionally say {that a} vital a part of that carry commerce has already unwound.

Nonetheless, absolutely the quantum of the yen carry commerce isn’t identified and it isn’t simple to guess how a lot additional the carry commerce might impression international markets. However what we are able to undoubtedly do is give attention to the place the yen can go from present ranges and, in flip, what would that be the implication on the Nifty and the rupee.

For the aim of forecasting, we’ve taken just a few key indicators that affect the motion of yen and utilized technical evaluation on the identical.

It’s to be famous that the forecast made right here is for the long run, say a minimal of 1 12 months. So, the trail for the goal degree given for the yen goes to be gradual and never steep as was seen not too long ago.

Right here is the evaluation.

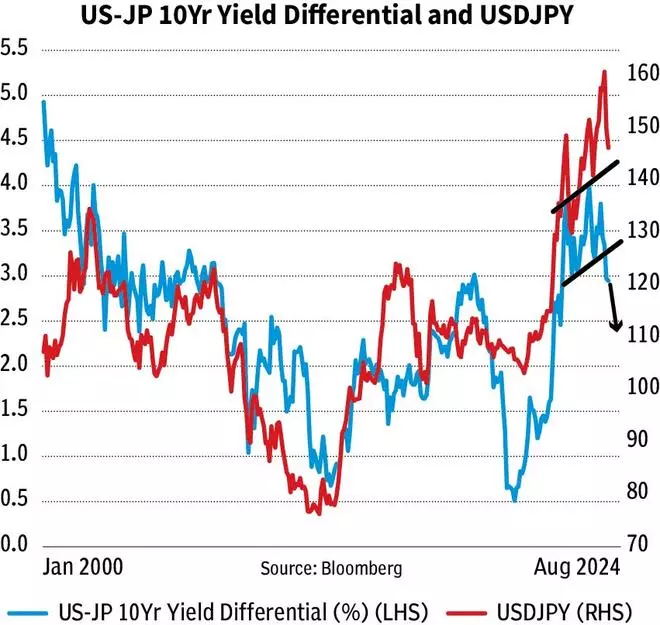

US-Japan yield differential

The yield differential between two nations is among the main components that drives the forex motion. The distinction between the US 10 Yr Treasury yield and the Japan 10Yr authorities bond yield (US 10Yr minus Japan 10Yr yield) has a really sturdy directional correlation with the USDJPY pair. That’s, if the differential will increase, the USDJPY strikes up and vice-versa. That is evident from the chart beneath.

The US-Japan 10Yr yield differential (2.92 per cent) appears to have topped out round 4 per cent and has come down. It’s at the moment at 2.92 per cent. Sturdy resistance is now at 3.3-3.4 per cent. Rapid help is at 2.9 per cent. A bounce from this help in direction of 3.3-3.4 per cent can’t be dominated out within the brief time period. However after that, the differential can fall again once more. That leg of transfer might break the help at 2.9 per cent. Such a break can drag the US-Japan 10Yr yield differential all the way down to 2.4 per cent and even decrease.

So, the USDJPY can transfer up within the short-term if the yield differential goes as much as 3.3-3.4 per cent. However finally, the forex pair can flip down once more and see a recent fall because the differential falls in direction of 2.4 per cent and decrease.

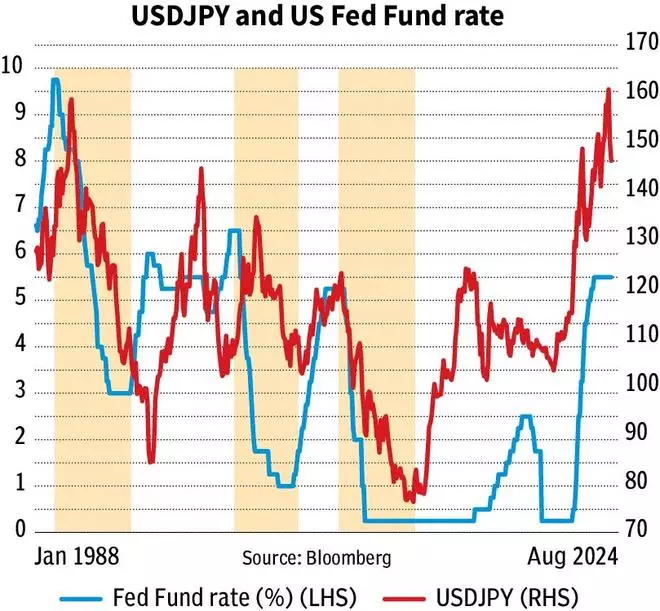

Yen and Fed fee cuts

Rate of interest reduce in September from the US Federal Reserve is nearly a given now. The US Federal Reserve Chairman Jerome Powell in his speech on the Jackson Gap assembly on Friday had mentioned that the time has come to make coverage changes.

As towards the standard 25 foundation factors (bps) fee reduce, some segments of the market is now anticipating even a 50-bps reduce subsequent month. Based on the CME Group’s FedWatch software, the chance of a 25-bps fee reduce in September is 76 per cent. It additionally reveals a 53 per cent chance for an additional 25-bps reduce in November. However the US Fed, in its financial forecast launched in June, has projected just for one fee reduce this 12 months.

Regardless of the case could also be, the US is now getting into into the speed reduce cycle. As seen from the chart above, the sooner cases of fee cuts from the Fed has taken the USDJPY pair decrease all alongside the speed reduce cycle. Though the autumn within the USDJPY had begun with a lag in some cases, ideally the forex pair had been knocked down badly.

So, because the Fed begins to chop charges, the USDJPY could possibly be heading for extra fall, going ahead. The quantum of fall within the USDJPY will rely on how lengthy the speed reduce cycle stays.

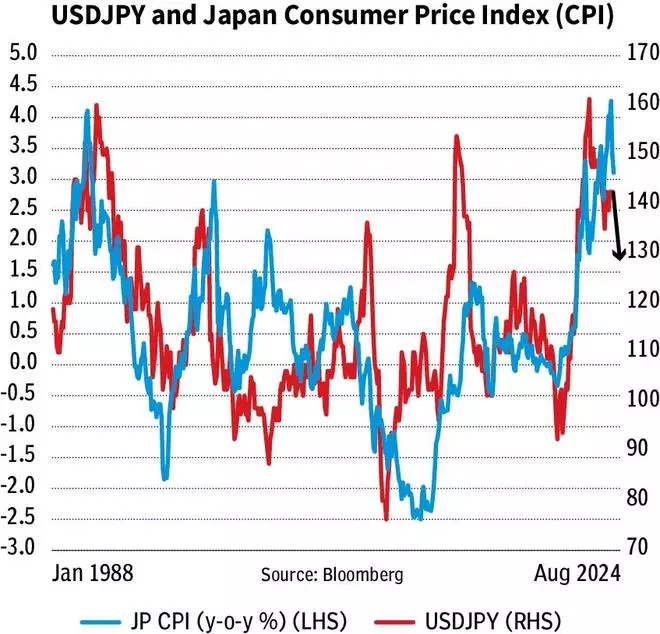

Inflation in Japan

Japan’s Shopper Value Index (CPI) had peaked in January 2023 and has been coming down. The CPI touched 4.3 per cent in January 2023 and is now at 2.8 per cent as of July this 12 months. The Financial institution of Japan initiatives CPI to be at 2.5 per cent in 2025.

Nonetheless, as seen from the chart above, the autumn in CPI has taken a number of years to discover a backside. So, Japan’s CPI could have extra room on the draw back from right here. It may most likely come all the way down to 1.5-1 per cent and even decrease through the years.

The USDJPY has a robust directional correlation with the CPI. So, the multi-year fall anticipated in Japan’s CPI can proceed to take the USDJPY additionally decrease together with it within the coming years.

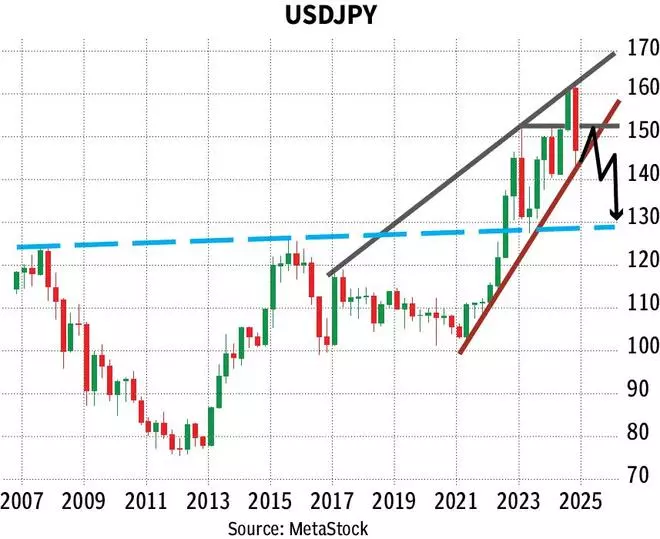

On the charts

All of the components talked about above point out that the USDJPY pair is prone to see extra fall, going ahead. To understand how a lot it will possibly fall, we check out the USDJPY pair worth chart and do an unbiased evaluation.

The sharp fall beneath 150 after the Financial institution of Japan fee hike has turned the outlook bearish for the USDJPY pair. The sturdy bounce again transfer from the low of 141.66 has additionally didn’t maintain. The pair has come down once more from round 150 over the past couple of weeks.

Rapid resistance is at 150. Above that, sturdy resistance is within the 151-152 area. Assist is now at 144. A sideways consolidation between 144 and 150 or 152 is a risk for a month or two.

Ultimately, we are able to count on the USDJPY to interrupt 144 within the coming months. Such a break could be very bearish. It may take the USDJPY pair all the way down to 130-128 over the subsequent one 12 months.

Intermediate help beneath 144 are at 139 and 132. So, the trail ahead could possibly be as follows:

* First a consolidation between 144 and 152 for just a few months now

* Then break 144 and fall to 139

* After that, see a corrective bounce from 139 to 144-145 and even 148.

* And finallly, fall again from round 145 or 148 to 132-130

* In case the help at 132 holds on its first take a look at, then a corrective bounce from 132 to 136-137 is a risk earlier than falling again to 130-128.

What the autumn in USDJPY will imply for the Indian markets

Nikkei 225 and Nifty 50

To know the impression of the autumn within the USDJPY to 130-128 on the Nifty 50, we first see the place the Nikkei 225 can go from right here.

The USDJPY and Nikkei 225 have a robust directional correlation. So, if the USDJPY falls to 130-128, going ahead, Nikkei 225 may fall together with it.

On the charts, Nikkei has sturdy resistance round 42,000-43,000. An increase previous 43,000 is much less possible now. The potential of a short-term rise to 150-152 on the USDJPY can take the Nikkei 225 additionally larger in direction of 42,000-43,000 within the subsequent few months.

On the draw back, so long as the Nikkei 225 stays beneath 43,000, it has the potential to focus on 33,000 and even 31,000 finally.

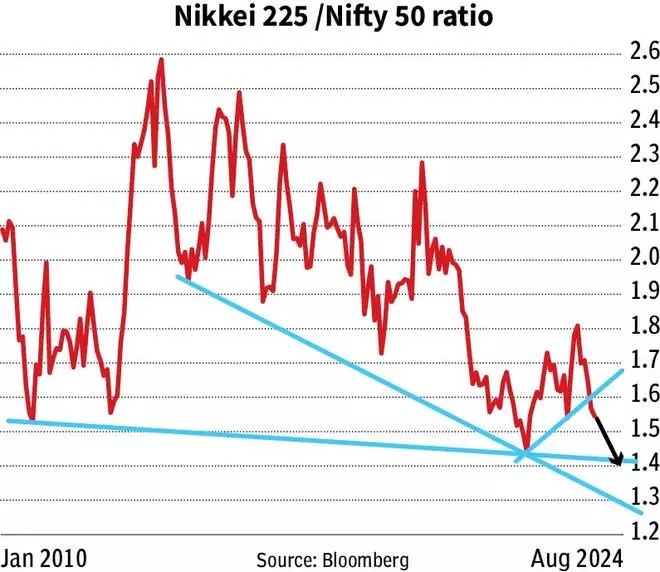

A ratio evaluation between the Nikkei 225 and Nifty 50 may also help in figuring out the place our home benchmark index can go primarily based on the autumn projected within the Nikkei.

The Nikkei 225/Nifty 50 ratio is at the moment at 1.55. It may rise to 1.6 from right here. So, if the Nikkei goes up in direction of 43,000, then Nifty 50 can rise to 26,875 to be able to take the ratio as much as 1.6.

Ultimately, the ratio can turnaround from 1.6 and fall to 1.4-1.3 over the long run. So, because the Nikkei comes all the way down to 31,000, Nifty 50 can fall to 23,850 or 22,150 to convey the ratio down in direction of 1.4-1.3.

So, broadly the trail of transfer for the Nifty could possibly be to see an increase to 26,875 after which fall in direction of 23,850 or 22,150. Please observe that the degrees arrived on the Nifty are purely primarily based on the ratio evaluation

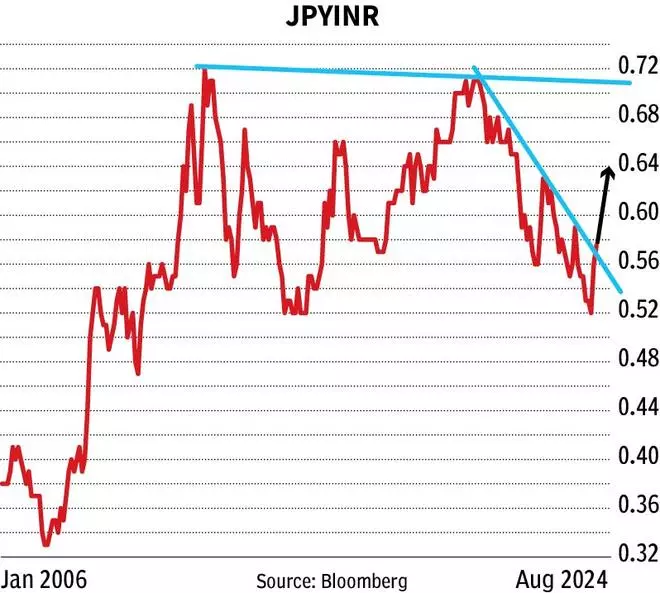

Yen and rupee

We attempt to arrive as to the place the Indian rupee (USDINR) is headed by making a forecast for the JPYINR Cross first. The JPYINR, at the moment at 0.58, has risen again very nicely from round 0.52 not too long ago. Failure to maintain the autumn beneath 0.54 and a robust bounce from 0.54 is a constructive. That leaves the possibilities excessive for the JPYINR Cross to interrupt the instant resistance at 0.59. Such a break can take the Cross as much as 0.64 initially after which to 0.70 finally over the long run.

So, if the JPYINR strikes as much as 0.64 and the USDJPY falls to 139, then rupee can fall to 89. Then because the JPYINR goes as much as 0.70 and the USDJPY falls to 132, then that may drag the Indian rupee to 92.40. From a long-term perspective, we are able to count on the rupee to say no beneath 90.

#Japanese #Yen #Carry #Commerce