Hassle components

NIM derives its worth from what may be charged to a borrower on a mortgage and the way a lot of a financial institution’s value, together with that curiosity paid on deposits, may be absorbed. At current, almost 70 per cent of mortgage property are benchmarked on floating charge. So when charges go up, which is the course presently, it may be transmitted to the purchasers at once. Then again, liabilities (deposits) are nonetheless on a hard and fast charge tenure. Due to this fact, even when the repo has elevated by 190 bps to date, the price of deposits for banks till early November rose by nearly 100 foundation factors. Additionally, when repo will increase, the present and recent loans get repriced with out a lag, whereas the present inventory of deposits get repriced solely after they come up for renewal and it’s largely the brand new deposits that replicate the upper charges. This explains the mismatch in transmission of charge hikes and the hole has ensured that banks don’t endure margin pressures simply but.

Nevertheless, banks can’t endlessly play on this mismatch. Repricing of liabilities or deposits normally occurs with a 6-9 month lag. Contemplating that charge hikes started in Might, the upcoming December quarter outcomes ought to seize the rise in deposit prices. From the March FY23 quarter, buyers ought to count on the impression to be extra pronounced and the benefit of getting low value of funds — which was a significant component in earnings re-rating of banks within the final 12 months — might slim or vanish in FY24.

Merely put, the NIM growth get together for banks is nearing its finish. However the extent of stress on NIMs depends on how every financial institution is affected by the next points.

Product combine: Whereas demand in retail loans was buoyant and that continued to help NIMs even in Q2, it’s pertinent to notice that the expansion these days has been pushed by excessive yielding merchandise akin to gold loans, bank cards, unsecured private loans and automobile finance — and never a lot by house loans. Gold loans and unsecured loans carry larger danger vis-a-vis the secured ones and supply larger yields. However this can be a section that’s tends to be charge delicate and even a 20 bps differential might sway the needle. Till now, the propensity to borrow at elevated value was excessive as a consequence of pent-up demand. With the primary indicators of moderation changing into notably seen on the mortgages or house loans section, it’s a matter of time that the development catches up throughout retail merchandise. In such a case, banks can be extra snug to roll out secured merchandise fairly than unsecured and this can alter the NIM composition. Sometimes, banks keep 50:50 cut up between secured and unsecured retail loans, although in case of ICICI Financial institution, Axis Financial institution and SBI the proportion is extra in favour secured merchandise.

Potential to cost danger: Till about six months in the past, it was a debtors’ market. Somebody with a credit score rating of 800 or above would be capable to cut price for a superb charge. As we speak, with liquidity enjoying a figuring out issue, that’s not a lot the case as extra liquidity has dried up. But, banks should deal with mortgage development they usually have two choices — decrease the danger premium a bit to make the composite lending charge enticing or steer clear of dangerous prospects and cater solely to prime and above buyer section.

Both possibility will impression NIMs. When danger premiums are lowered, the speed of curiosity can be straightaway impacted. Then again, if a financial institution chooses to cater solely to prime-plus segments, the market alternatives might shrink. Contraction in development would have an oblique bearing on NIMs.

Potential to go on value: That is the derivate of the client pool a financial institution desires to cater to and the way a lot bandwidth it has by way of pricing dangers. One other underlying issue is the expansion charge it targets commensurate to the liquidity. So long as banks had entry to low-cost funds, these weren’t constraining components. However when liquidity is a matter and banks select to take care of development on the present ranges, then they might need to accomplish that with out inflicting a lot dent to their high quality of mortgage e book. As an illustration, if the target is to take care of a 50:50 mixture of secured and unsecured loans and have a median credit score rating of 720-plus, this could put downward stress on NIMs.

Right here’s a phrase of warning. If banks don’t see a lot disturbance on their profitability, going ahead, scrutinise their mortgage portfolio combine and the section of consumers they cater to. Sometimes if banks select to stick with unsecured merchandise and debtors with not-so-good credit score rating, they might have a better pricing flexibility and higher profitability. However the dangers possibly slowly constructing of their stability sheets. Then again, banks with the next share or enhance in secured loans and/or a bigger pool of ‘prime and above’ debtors can be vulnerable to a decline in NIMs.

Who can be impacted?

Let’s take a look at this from two views — personal banks vs public sector banks (PSBs) and banks with massive stability sheets vs comparatively small banks.

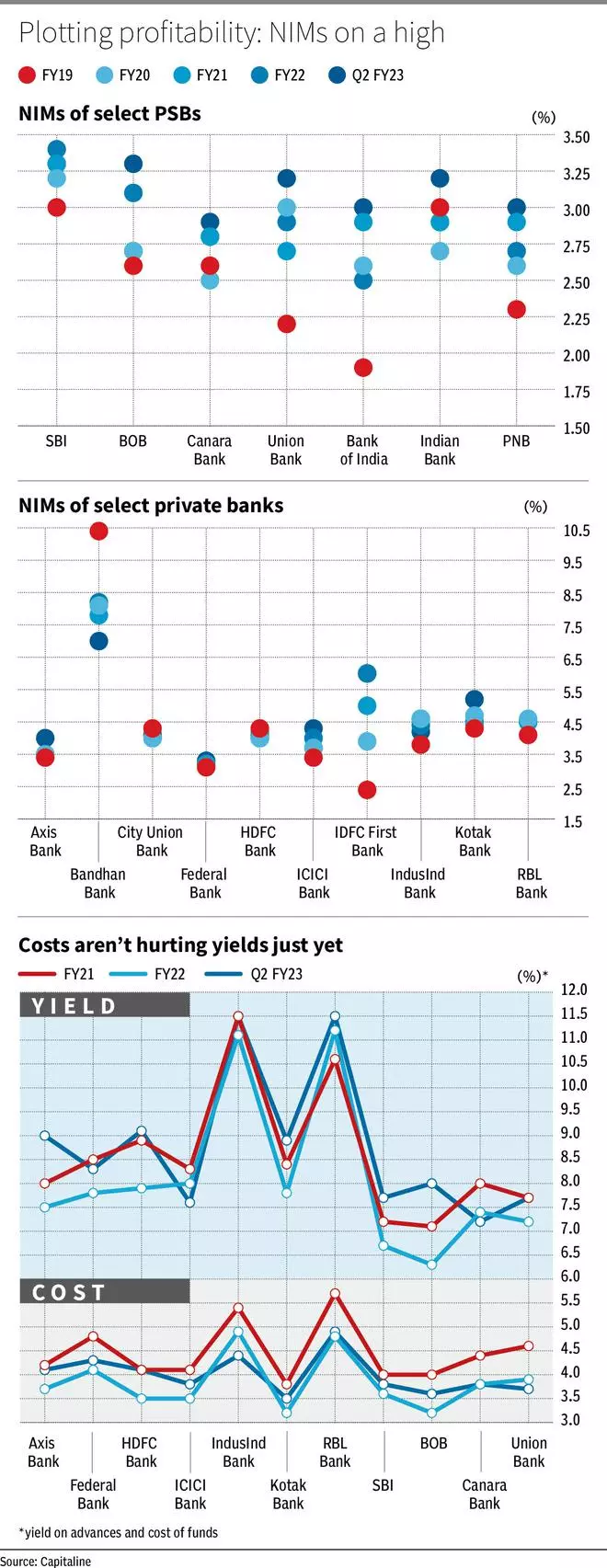

The common NIM for personal banks is slightly over 4 per cent now whereas for Bandhan and IDFC First Financial institution it’s upwards of 5 per cent. To an extent, this means the underlying dangers within the stability sheet. With larger share of unsecured loans, these banks have traditionally operated at excessive margins. At instances like these, , an additional enchancment in NIM and even sustaining it on the similar stage is a pink flag of some kind.

Publicity of microfinance (MFI) loans is a key issue driving NIMs for personal banks and that is notably prevalent in banks akin to RBL Financial institution and IndusInd financial institution along with Bandhan and IDFC First. Whereas RBL and Indusind might proceed to function above 4 per cent NIMs (although their share of unsecured loans is comparatively decrease in comparison with Bandhan and IDFC First), buyers ought to be careful whether or not RBL Financial institution and IndusInd Financial institution jack up their publicity to the MFI area to play the profitability or yield sport. Till now that’s not been the case, but when it adjustments, then it’s a warning signal.

Traditionally, personal banks have loved higher NIMs in comparison with PSBs and therefore when there’s a danger to profitability, PSBs take an even bigger beating. However this time it will not be so. On a median, value of deposits of PSBs is a minimum of 50–70 bps decrease than personal banks’. Due to this fact, at the same time as deposit charges enhance, the hit on PSBs could also be small in comparison with personal banks. Secondly, if banks select to recalibrate their product combine extra in favour of secured merchandise akin to house loans, automobile loans and gold loans the place the speed provided by PSBs is extra aggressive (invariably decrease) than personal banks, PSBs, which have already got the next share of secured loans, might not cede a lot NIMs. However that stated, NIMs of PSBs is 90–100 bps decrease than personal banks’. Due to this fact, whereas they might not face a lot profitability disturbances this time round, the room for enchancment is restricted.

Likewise, bigger banks akin to SBI, ICICI Financial institution, HDFC Financial institution and Axis Financial institution, which have established themselves strongly within the retail market, are well-equipped to go on and keep value equilibrium even when there are additional repo charge hikes. These banks haven’t seen a big stress on their yields to date and therefore if they need to take in some value pressures to maintain the demand undisturbed, they’ve a room of 10-30 foundation factors.

Smaller names akin to YES Financial institution, RBL Financial institution and Federal Financial institution could also be extra delicate to charge hikes, and that is reflecting on yield on property. Development might come at a price, they usually might have to soak up an affordable a part of charge hikes. Due to this fact, yield compression of 50-70 bps appears probably, which can translate to a minimum of 30 bps discount in NIM.

What subsequent?

How banks handle and re-balance their NIM is an effective signal of what to anticipate within the subsequent three to 4 by way of asset high quality and the product mixture of their alternative and luxury years. Due to this fact, whereas NIM motion is just not an alarm bell simply but, it units the tone for the long-term course of banking shares. Given how they’ve rallied within the final two years, now could also be a superb time to partially e book revenue throughout banking shares and acquire from the rally.?

#play #banking #shares #rising #charge #state of affairs