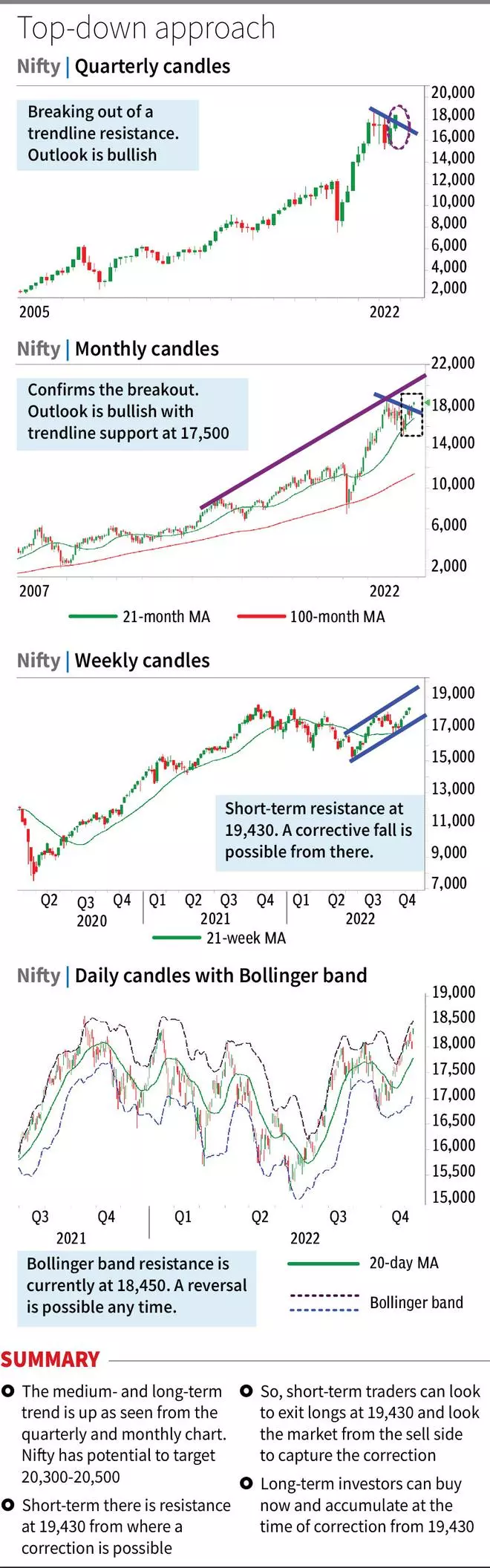

In such unsure conditions, technical evaluation turns out to be useful. Right here’s detailing what charts and technical indicators can ideally be used for forecasting, relying on the time frames you propose to be out there. We additionally inform you how the charts for various time frames might be mixed collectively to make a holistic determination utilizing a top-down method.

Timeframe, charts, indicators

In terms of time frames, the definition varies with every market participant. So, we now have labeled the time frames as intraday, positional buying and selling (one month), short-term (three to 6 months), medium-term (six to 12 months) and long-term (multiple yr).

For the aim of ease, we use candle stick charts for examine. Additionally, among the many numerous indicators, we take only a few, reminiscent of shifting common, Fibonacci retracements, trendlines, and so forth, which we really feel will work one of the best, primarily based on our expertise. So, right here’s how you need to use candlestick charts and our most popular indicators for the time-frame of your selection, to make a examine:

Intraday buying and selling

Charts used

15-minute and 1-hour chart

Why?

Charts that seize the value actions inside a single day are one of the best match for intraday merchants. For inventory markets reminiscent of India which are open solely throughout the day for somewhat over six hours, any chart that’s multiple hour will not be ideally suited to seize the motion inside a single day.

In case of currencies the place the market is open round the clock, 4-hour chart is right. This can be utilized together with the 1-hour charts as a substitute of a 15-minute chart.

The way to use?

Utilizing two sorts of charts collectively is an effective follow to determine the pattern and the entry and exit ranges for buying and selling. For intraday, trying on the one-hour chart for at least two to 4 weeks will give the massive image of the prevailing intraday pattern. The extra the info, the higher. So, you possibly can transcend 4 weeks too.

The 15-minute chart can then be used to determine the micro actions throughout the huge intraday pattern.

Indicators

A trendline shall be an necessary indicator to determine the foremost helps and resistances. Together with that, the 20- and 50- hour shifting averages can be used on the hourly charts to determine the helps and resistances.

Positional buying and selling

Charts used

Day by day chart

Why?

To seize the broader pattern for a interval of 1 month, that’s as much as 4 weeks, each day charts are ideally suited.

The way to use?

The each day chart might be mixed with indicators like shifting averages and pattern strains. A minimal historic information of 45-trading days ought to be used to get a transparent image of the pattern and robust helps and resistances. As talked about above, the extra the info seen (past 45 days), extra the readability shall be on the massive image.

Indicators

10- and 21-Day Transferring Averages work properly on the each day charts. They can be utilized to determine helps and resistances. Along with this, to get the entry and exit factors, Bollinger bands can be utilized.

Quick- and medium-term

Charts used

Day by day, weekly and month-to-month charts

Why?

Month-to-month chart will give the massive image and the broader pattern. It should additionally assist in figuring out the common motion in a single month and due to this fact how far (most) the value can go for a interval of subsequent three, six and as much as twelve months. Trying on the weekly chart after that can give an image on the intermediate motion throughout the huge pattern.

The way to use?

Establish the massive pattern within the month-to-month chart first. This may give an thought of the place the value is headed for the subsequent three to 6 months atleast. Then take a look at the weekly chart. That can give the course for the short-term. Figuring out the helps and resistances on the weekly chart will assist in deciding whether or not to enter/exit instantly or watch for higher ranges.

Indicators

Day by day chart: 100- and 200- day shifting common

Weekly chart: 21- and 100- week shifting common

Month-to-month: 21- month shifting common

Together with the shifting averages the trendlines should be used. Fibonacci retracements will assist in getting intermediate helps or resistances throughout the broader pattern.

Lengthy-term

Charts used

Month-to-month and Quarterly

Why?

Day by day and weekly chart is not going to disclose the long-term pattern. A quarterly chart will give an thought on how a lot the value can transfer in a single quarter. This may be extrapolated for the longer vary that we intend to be out there. Month-to-month chart may give the course of motion inside one quarter.

The way to use?

The month-to-month and quarterly charts should be used collectively. As talked about above, the quarterly charts will give the broader pattern. Month-to-month charts, along with the symptoms, will assist in figuring out the helps and resistance for decision-making.

Indicators

Month-to-month chart: 21- and 100- month shifting common, Fibonacci retracements, Trendlines

Quarterly chart: Trendlines and Fibonacci retracements

Some pitfalls

Helps and resistances can all the time be damaged. Getting into at a assist and exiting at a resistance might not work on a regular basis. As an illustration, on the each day chart, the value can break under a shifting common assist throughout intraday trades however can bounce again and shut the day above the shifting common. So, affirmation and decision-making should be performed primarily based on the closing worth solely. Equally, there is no such thing as a rule that the value will flip round after touching the decrease or higher band of a Bollinger band. In a robust uptrend, the value can transfer up repeatedly alongside the higher band and transfer repeatedly alongside the decrease band in a downtrend.

To beat these hitches, it’s all the time higher to see how the symptoms and the costs have behaved previously. As soon as once more, the extra the historic information taken for examine, the higher the understanding of the symptoms’ behaviour.

Understanding the fundamentals

Candle Stick chart

A kind of chart constructed with the 4 factors, the open, excessive, low and shut worth for a selected time interval. The open and shut worth are related within the form of a bar, referred to as the physique of the candle. The excessive and low costs are related to the physique with a straight line and referred to as a wick. On the each day chart, a single candle will symbolize the open, excessive, low and shut worth for that specific day. Equally, on the weekly chart, a candle will symbolize the open, excessive, low and shut worth for a selected week. So, is the case for charts in different time frames

Transferring Common

Because the title implies, shifting common is the common of all of the closing costs for a particular time interval. That could be a 21-Day Transferring Common is the common of closing worth of the final 21 days (contains the present day). Day by day, this common is calculated and is plotted as a line graph. Equally, a 21-Week Transferring Common would be the common of closing costs of the final 21 weeks (contains the present week additionally). The shifting common is used as an indicator to determine helps and resistance. Mixture of shifting averages, like 10 and 21, 100 and 200 shifting common, can be utilized for getting a bullish or a bearish sign.

Bollinger Band

That is calculated by taking the 20-Transferring Common (MA) as a base. A 2 per cent customary deviation is taken above and under that shifting common. These two customary deviations are plotted as steady line and so they kind the higher and decrease finish of the band. They can be utilized as worth targets to enter and exit. The 20-MA would be the median line. So long as the value stays above the 20-MA, the pattern is up. As soon as the costs fall under the 20-MA, it signifies a pattern reversal, and the value can then go down until the decrease finish of the band. Equally, when the value crosses above the 20-MA, the outlook shall be bullish, and the value can transfer as much as the higher finish of the band.

Fibonacci retracements

How far can the value retrace a downtrend or an uptrend? The Fibonacci retracement ranges can be utilized to determine this. The size of a serious upmove (from the bottom to highest worth level) or a downmove (from highest to lowest worth level) is calculated. By idea, the value can retrace 38,2, 50 and 61.8 per cent of the entire size of transfer from the bottom level in a downtrend and the very best level in an uptrend.

Trendline

A line drawn connecting both the lows or highs on a candle stick chart is called the trendline. An up trendline is the one drawn upwards connecting at the least two main lows. A down trendline is drawn downwards connecting at the least two main highs. The up trendline will act as a superb assist in an uptrend. Equally, a down trendline will act as a superb resistance in a downtrend. Costs crossing under or above the up or down trendline respectively is likely one of the main indications of a pattern reversal.

Assist and Resistances

A assist is a stage at which the patrons will overcome the sellers to arrest the autumn and take the value increased. A resistance is vice-versa. It’s the stage at which the sellers will overcome the patrons to cease the value rise and drag the costs decrease.

#technical #evaluation #time #frames