Aggressive hybrid funds make investments predominantly in equities in a spread of 65-80 per cent and 20-35 per cent in debt devices. The mounted revenue half is to defend from fairness downturn aside from mounted revenue fashion returns, and fairness phase for progress publicity.

The case for aggressive hybrid funds is presently convincing. The bond yields have corrected from peaks, however that is in anticipation of charge reduce cycle to start. The worth features in bonds, particularly long-dated bonds on charge cuts, regardless of nominal change in yields, can profit the bond portfolio. The fairness outlook, although remaining tentatively constructive, does carry a number of pockets of over-valuation which wants time-correction to return to progress. Shifting the fairness features of the final 4 years to a hybrid portfolio could be thought-about for a small portion of investor allocation on the present juncture.

Aggressive hybrid universe

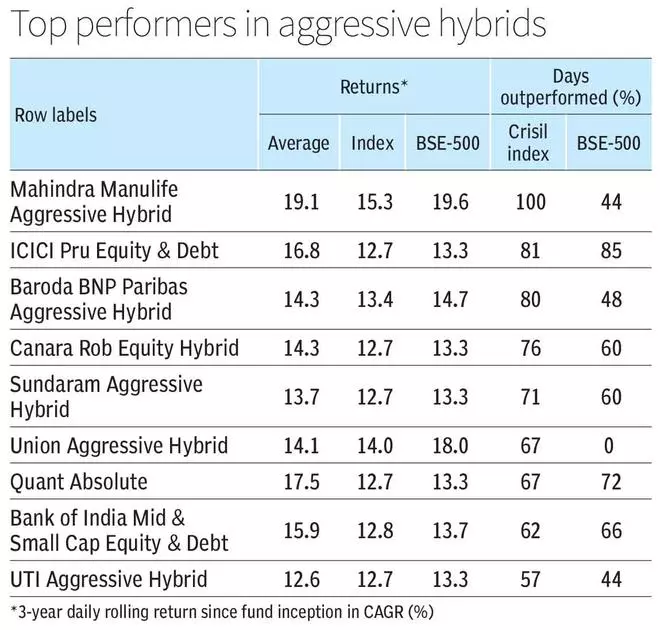

The sector has 30 funds with greater than three years of operations, making for a large menu to select from. We have now used Crisil Index (CRISIL Hybrid 35+65 – Aggressive Index) because the benchmark over a three-year rolling return to filter the most effective performers.

Solely seven funds have crushed the index every day (on three-year CAGR returns) greater than two-thirds of the time. Of the seven, three have greater than a decade of operations behind them – ICICI Pru Fairness and Debt, Canara Robeco Fairness Hybrid, Sundaram Aggressive and Quant Absolute Fund. Mahindra Manulife and Union Aggressive even have constantly crushed the index, however on a shorter operational interval. Outperformance within the phase appears to be a excessive threshold, with a number of funds even with lengthy life failing to beat the index constantly.

ICICI Pru Fairness and Debt

Aggressive hybrid fund from ICICI Pru is a seasoned scheme, with good monitor file and has crushed the index 81 per cent of the time since its inception. The fund has even outperformed BSE-500 index 85 per cent of the times since its inception. The remainder of the funds have crushed BSE-500 solely 32 per cent in common with a highest of 72 per cent for Quant Absolute Fund. The comparability to BSE-500 is on an uneven keel favoring the fairness index, however regardless of this the outperformance of the fund is noteworthy. The fund has a mean 3-year CAGR of 16.8 per cent since opening in comparison with 12.7 per cent for the index and 13.3 for BSE-500. The fund delivered higher returns with a considerably decrease danger profile that features round 20 per cent mounted revenue portfolio.

The fund has a blended efficiency in important intervals. Firstly in Feb-20 to July-20 when BSE-500 returned -10 per cent, the fund has crushed the BSE-500 index solely 70 per cent of the time whereas the Crisil index has crushed the fairness index 100 per cent of the time. This means that whereas Aggressive hybrid funds can ship in an fairness downturn, the fund had a nominal file. However from Oct-21 to March-23 when BSE-500 returns had been flat, the fund beat the index 95 per cent of the time in comparison with Crisil index which didn’t outperform in that interval. This underlines the utility of aggressive hybrids in fairness downturns and particularly ICICI Pru Fairness and Debt fund.

Asset allocation

The fund presently has an asset allocation of 68:19:13 in fairness:debt:money. The money element consists of treasury repurchase agreements to keep up liquidity. You will need to word that the money element is increased than final two yr common of 10 per cent.

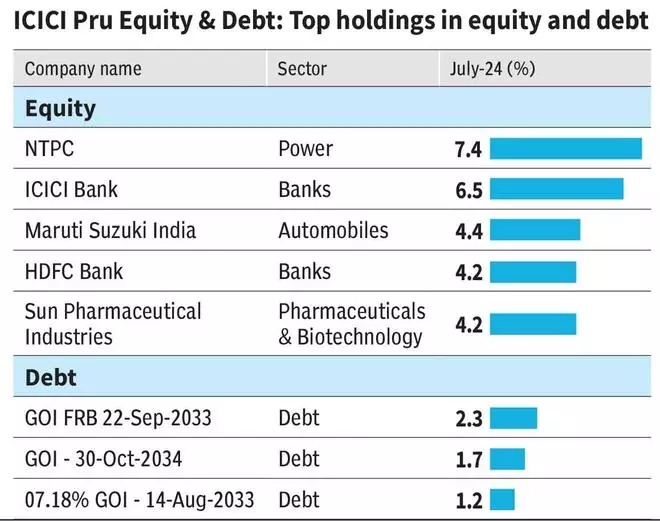

The fund’s fairness portfolio is nicely diversified with 48 per cent (of general) within the high ten holdings as on July-2024 and with giant cap focus. Near 60 per cent of the general is in giant caps and 4-5 per cent are in mid and small caps.

The fairness portfolio is led by banking shares with 15 per cent allocation which is 200 bps increased than in July-2022. NTPC has the very best allocation at 7.4 per cent and has been excessive within the final two years. The funds wager on energy progress of India has paid off and is predicted to proceed. The funds allocation to vehicles has grown from 2.3 per cent to greater than 7 per cent now which is a mixture of 4W and 2W.

The fund has constructed a debt portfolio with a mixture of authorities and company credit score, making for the next than anticipated danger profile. Authorities and treasury securities account for half of the debt portfolio. The company issuances although are solely funding grade and above, however can be of shorter length (cheaper price features on charge cuts) in comparison with authorities bonds.

#ICICI #Pru #Fairness #Debt #Fund #overview #slight #tilt #security