2023 has ended on a really constructive be aware for the worldwide fairness markets. The benchmark indices, the Sensex and Nifty 50 had surged 18 per cent and 20 per cent respectively. The Nifty Financial institution index was up 12 per cent. The mid-cap and small-cap indices clearly outperformed by skyrocketing in 2023. The BSE Midcap and Smallcap indices have been up 45.5 per cent and 47.5 per cent.

Among the many sectors, the BSE Realty index surged probably the most in 2023. The index was up 79.5 per cent. This was adopted by the BSE Capital Items and BSE PSU indices which have been up 66.9 per cent and 55.3 per cent respectively. The BSE Oil & Gasoline and the BSE Bankex underperformed final yr. They have been up 12.8 per cent and 11.2 per cent respectively.

International inflows

The international portfolio traders (FPIs) turned web consumers of Indian equities in 2023 after promoting closely in 2022. The fairness phase noticed an enormous influx of $21.75 billion in 2023. There was a web outflow of $17 billion in 2022. Will the Indian equities proceed to draw international cash in 2024 additionally? We should wait and watch. Persevering with flows is a constructive for the Indian benchmark indices.

Outlook 2024

Nifty 50 (21,731.40)

Nifty has risen above the important thing resistance stage of 20,500 and has closed on a powerful be aware for 2023. An instantaneous resistance is at 21,850. Above that, 22,400 and 23,200 are the subsequent essential resistances. Contemplating the latest sharp rise, we are able to count on the rally to halt both at 21,850 itself or at 22,400 or 23,200. As such, we are able to count on the Nifty to see a corrective fall from 22,400 or 23,200 in the direction of 21,000 or 20,700 first. In a worst-case state of affairs, if the index declines beneath 20,700, then there may be an prolonged correction in the direction of 19,500-19,300.

The degrees of 20,700 and 19,500-19,300 are very sturdy helps. A fall beneath 19,300 won’t be very simple. So we are able to count on the Nifty to rise again once more both from round 20,700 itself or from the 19,500-19,300 area. That leg of rally could have the potential to take the Nifty as much as 24,000-24,500 in 2024.

Chart Supply: MetaStock

From a long-term perspective, so long as the Nifty stays above 19,300, an increase to 27,500-28,500 is extra more likely to be seen. This rise can occur in 2024 itself if the present momentum sustains or in 2025.

Nifty has to say no beneath 19,300 to develop into bearish. However for it to interrupt 19,300, a powerful and new destructive set off is required. Solely then it might probably break 19,300 and fall to 18,500-18,000. Our desire is to see the Nifty sustaining above 19,300.

Most well-liked transfer: Our most popular path of transfer for the Nifty in 2024 could be to see a check of twenty-two,400 or 23,200 first. Then a corrective fall to 21,000-20,700 or 19,500-19,300 is feasible. Thereafter, a contemporary leg of rally can take the Nifty as much as 24,000-24,500 initially and 27,500-28,500 finally.

Nifty Financial institution (48,292.25)

Sturdy assist is now at 47,200. So long as the index stays above this assist, the uptrend will stay intact. There’s extra room to rise from right here. Nifty Financial institution index can rise to 52,000 or 53,100 within the first quarter of 2024. These two ranges, 52,000 and 53,100, are essential resistances that may halt the present upmove.

We count on the Nifty Financial institution index to see a corrective fall from 52,000 or 53,100. That may drag the index right down to 48,000-47,000. In a worst-case state of affairs, there might be a steeper correction in the direction of 46,000 as nicely. Nevertheless, a fall beneath 46,000 is much less possible. We will count on the Nifty Financial institution index to renew the broader uptrend anyplace from the 48,000-46,000 assist zone. That leg of upmove can take the Nifty Financial institution index as much as 54,000-55,000 in 2024.

Chart Supply: MetaStock

From a long-term perspective, 44,000 is a vital assist. So long as the Nifty Financial institution index trades above this stage, it might probably goal 56,000-57,000.

The massive image will flip destructive provided that the index declines beneath 44,000. In that case, although much less possible a fall to 42,000 and even decrease ranges may be seen.

Most well-liked transfer: An increase to 52,000 or 53,100 first. Then see a corrective fall to 48,000-47,000 or 46,000. After {that a} new leg of upmove focusing on 54,000-55,000 initially and 56,000-57,000 finally.

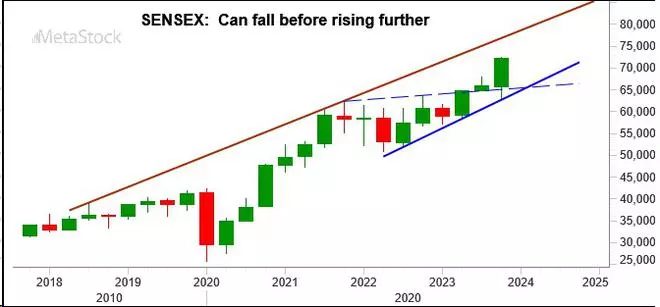

Sensex (72,240.26)

Sensex has instant resistances at 73,200 and 73,600. Above that, the 74,100-74,300 area is barely larger resistances. We count on both of those resistances to cap the upside for now. A corrective fall from 73,200-73,600 or 74,100-74,300 can drag the Sensex right down to 70,000-69,000. In case the autumn extends past 69,000, then 68,000-67,000 may also be seen on the draw back. Thereafter, Sensex can see a contemporary rise. That leg of upmove could have the potential to take the Sensex as much as 75,000-76,000 this yr.

Chart Supply: MetaStock

From a long-term perspective, the area between 65,500-65,000 is a really sturdy assist. So long as the Sensex stays above this assist, the outlook is bullish to see 82,000 on the upside. If the momentum and the draw back throughout the corrective fall will get restricted to 69,000-68,000, then the above-mentioned rise to 82,000 can occur in 2024 itself. Else, that rise might be pushed into the subsequent yr.

Most well-liked transfer: Take a look at 73,200-73,600 or 74,100-74,300. Then see a corrective fall to 69,000 or 67,000 most. After that, a contemporary rally focusing on 75,000-76,000 initially after which 82,000 finally.

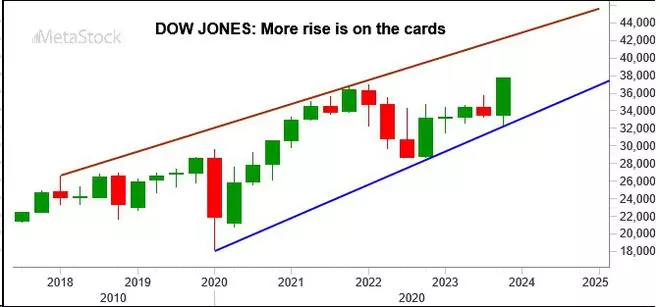

Dow Jones (37,689.54)

The sturdy surge and shut above the 35,500-36,000 resistance zone within the last quarter of 2023 is a giant constructive for the Dow Jones Industrial Common. Resistances are at 39,300 after which at 40,200-40,400. The possibilities are excessive of the upside to be capped at 39,300 for now. In case a break above 39,300 is seen, then there may be an prolonged rise to 40,200-40,400.

We count on the Dow Jones to see a corrective fall from 39,300 itself or from the 40,200-40,400 area. That leg of fall can take the index right down to 36,800 or 36,000. The 36,000-35,500 area may act as a superb resistance-turned-support zone and restrict the draw back. But when a break beneath 35,500 occurs, then there may be an prolonged corrective fall as much as 35,000-34,000.

We will count on the Dow Jones to reverse larger once more from round 36,000. That may take the Dow Jones larger in the direction of 41,000-41,500 this yr.

From a long-term perspective, so long as the index stays above 34,000, there’s potential to focus on 43,500-44,000 on the upside.

Most well-liked transfer: Rise to 39,300 after which see a corrective fall to 36,800-36,000. Thereafter, a contemporary leg of rally can see the Dow Jones focusing on 41,000-41,500 first after which 43,500-44,000 finally.

#Index #Outlook #Sensex #Nifty #Rally #Fizzle