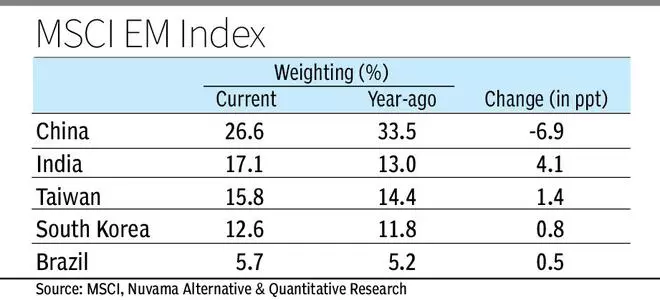

India’s weightage within the MSCI EM index stood at 13 per cent at first of final yr, behind Taiwan (14.4 per cent) and China (33.5 per cent). The weightage had remained regular at round 8 per cent from 2015 to October 2020, implying a doubling within the final three years. “The sturdy efficiency by Indian equities, notably within the mid-cap section, has led to quite a few inclusions in each assessment. India’s transfer to a standardised International Possession Restrict in 2020 and the relative underperformance by different EMs, particularly China, has additionally helped India’s trigger,” stated Abhilash Pagaria, head of Nuvama Different & Quantitative Analysis.

FPI, EM portfolios

International portfolio buyers pumped in a report $20.7 billion into Indian equities final yr. A part of the upper flows are an end result of India’s rising weightage in EMs; with its impartial weight in benchmark MSCI EM seeing a 3.5 proportion factors improve over the previous six quarters, in keeping with analysts. The Nifty returned 20 per cent final yr, outperforming MSCI EM by 11 proportion factors in greenback phrases. “The sectoral restrict out there to FPIs throughout sectors has elevated over time. Firms have been passing resolutions to lift FPI limits. Quite a lot of new issuances and divestment by promoters has elevated the free float of Indian corporations, all of which can have contributed to the rise in its weighting,” stated UR Bhat, director, Alphaniti Fintech. India’s relative positioning in EM portfolios nonetheless stays mild. Jefferies’ evaluation of huge EM energetic funds, as an example, signifies that India’s relative positions are a lot nearer to impartial now versus a mean obese of greater than 2 proportion factors. As such, the headroom for FPIs to take a bigger obese place on Indian equities might turn out to be an essential driver for flows. “Rising measurement is making Indian markets far more related for world mandated funds. Structural positives such because the anticipated political stability, rising funding cycle offering multi-year progress visibility and peaking greenback current ideally suited circumstances for larger overseas flows,” stated a be aware by Jefferies. A current white paper by Shopper Associates, a personal wealth administration agency, says that India deserves considerably larger illustration in each the MSCI EM and MSCI ACWI indices, given the nation’s rising financial significance, enticing risk-adjusted returns and diversification advantages for buyers.

A decrease free float and market accessibility are the 2 chief causes for the present under-representation. “Promoters’ important fairness holdings in bigger corporations restrict overseas possession and cut back accessibility for passive buyers. Regardless of ongoing coverage efforts like elevated FDI limits and a unified FPI regime, India continues to attain low on accessibility standards throughout the MSCI framework,” the wealth supervisor noticed.

#India #positive factors #heft #MSCI #index