- Additionally learn:Why India Inc is gradual to undertake AI tech

Nevertheless, excluding the mega LIC IPO of ₹21,000 crore in Might 2022, the mop-up elevated to 58 per cent year-on-year, in response to Prime Database.

Given the buoyancy within the economic system, 75 corporations hit the first market in comparison with 37 in FY23. The common deal dimension decreased considerably to ₹815 crore on this fiscal from ₹1,409 crore in FY23 because of extra variety of corporations tapping the market.

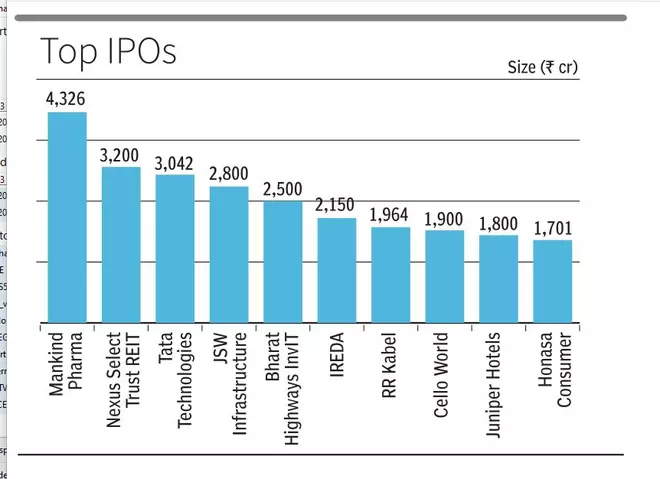

Among the many mainboard IPOs, Mankind Pharma was the most important with ₹4,326 crore, adopted by JSW Infrastructure at ₹2,800 crore. The smallest IPO was that of Plaza Wires, which raised ₹71 crore.

Common itemizing good points

With the important thing benchmark indices hitting a brand new excessive, the common itemizing good points rose to 29 per cent in FY24 towards 9 per cent within the earlier monetary 12 months.

Of the 75 IPOs, 48 delivered a return of over 10 per cent. Vibhor Metal delivered the most important return of 193 per cent on debut, adopted by BLS E-Providers (175 per cent) and Tata Applied sciences (163 per cent). Over 50 of the 75 IPOs are at the moment buying and selling above the problem worth with a mean return of 65 per cent.

Pranav Haldea, Managing Director, Prime Database Group, stated of the 75 IPOs that hit the market, 54 issuances had been subscribed over 10 occasions, out of which 22 IPOs had been subscribed greater than 50 occasions whereas 11 IPOs had been subscribed greater than 3 times. The opposite 10 IPOs had been oversubscribed between 1 and three occasions.

The response of retail buyers was additionally increased in comparison with the earlier monetary 12 months. The common variety of retail purposes rose to 1.3 million from about 0.6 million within the earlier monetary 12 months. Tata Applied sciences, the primary Tata Group IPO in twenty years, noticed the best variety of retail purposes with over 50 lakh, adopted by DOMS Industries (41 lakh) and INOX India (37 lakh).

- Additionally learn:India Inc. outperforms the globe with 39% girls CXOs: Report

In FY24, 96 corporations filed their provide paperwork with the market regulator SEBI in comparison with 75 within the earlier monetary 12 months. Nevertheless, 37 corporations planning to lift ₹59,000 crore let their approval lapse, whereas two trying to elevate ₹1,000 crore withdrew their paperwork. SEBI returned the provide paperwork of 5 trying to elevate ₹2,500 crore.

#India #mopup #IPO #rises #crore #FY24