“This market is predicted to have CAGR (compound annual development charge) of 14 per cent within the subsequent 5 years, fuelled by components such because the rising prevalence of persistent illnesses, development in geriatric inhabitants, demand for preventive assessments, and better penetration of presidency insurance coverage schemes,” Aryaman Tandon, Managing Accomplice and Co-founder of Praxis International Alliance, informed businessline, based mostly on the agency’s analysis report.

Furthermore, there’s a shortfall of about 3 million beds to realize the goal of three beds per 1,000 individuals by CY25, suggesting substantial room for growth within the diagnostics sector.

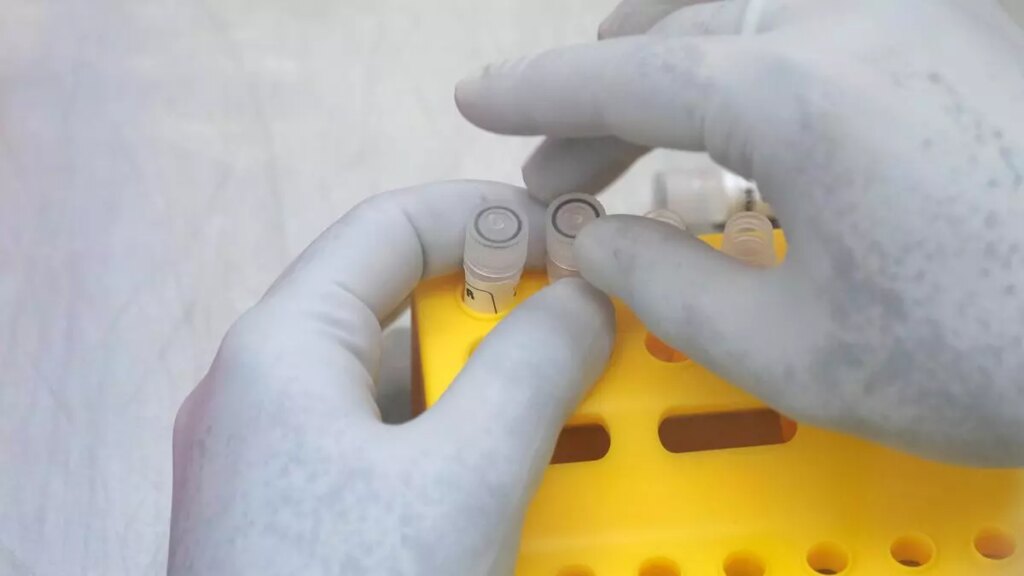

Of the 2 foremost segments of the sector, pathology includes prognosis of illnesses by way of the examination of tissues, cells, and physique fluids, whereas radiology includes use of medical imaging methods to diagnose and deal with illnesses and accidents.

Radiology is break up into mushy (x-ray and ultrasound); and superior radiology (CT-scan, MRI, nuclear imaging, and interventional radiology).

The pathology market measurement is about $7.5 billion, or 58 per cent of the diagnostics market. Radiology accounts for the remainder, with mushy radiology commanding 55 per cent share in comparison with superior radiology.

The home diagnostics business is fragmented, with standalone centres at 46 per cent, personal hospital labs at 28 per cent, and nationwide chains at 6 per cent.

The pathology market is projected to achieve $14.4 billion by FY28. Of the estimated 1.32 lakh pathology labs, 60-plus per cent are standalone.

Rising illness complexity, technological developments, and the tier 2 and tier 3 markets are the important thing drivers of development for the radiology market, which is projected to achieve $11 billion by FY28.

The Indian radiology market consists of standalone laboratories, regional chains, nationwide chains, small and medium personal hospitals, giant personal hospitals, and authorities hospitals and establishments. Of the estimated 55,000 radiology labs, over 80 per cent are standalone.

“India’s pathology and radiology check costs are decrease in comparison with developed international locations, suggesting potential for future value realisation enchancment,” mentioned Tandon.

“The diagnostics business is on the cusp of a change, pushed by rising alternatives. Whereas the fragmented nature of the business presents challenges by way of capabilities and scalability, it additionally provides alternatives for consolidation and the emergence of latest enterprise fashions, he added.

#Indian #diagnostics #business #attain #FY28 #Report