This was in fact until the exterior forces of multi-decade-high inflation in lots of developed economies acted upon these inventory market tendencies. Since begin of the 12 months, there seems to have been a turnaround with development shares crashing in lots of markets the world over together with India, whereas the worth shares appear to be gaining in favour.

For instance in India, development shares like Zomato, which had grabbed investor craze and a spotlight from the time of itemizing final 12 months until early a part of this 12 months, is down 62 per cent year-to-date (YTD). On the contrary, a worth inventory like ITC, which was a laggard for years, is up 37 per cent YTD and has turned out to be the best-performing index inventory. The BSE PSU index, which ideally falls within the worth class, is up 2 per cent YTD, whereas the BSE Info Expertise index that may come within the development class is down 24 per cent throughout the identical interval. Within the 5 years ending 2021 when development shares had been in vogue, the BSE Info Expertise index returned a whopping 382 per cent, whereas the PSU index returned a mere 7 per cent.

The change in fortunes is equally stark in world markets, particularly the US, which has seen important spike in inflation and northward motion in rates of interest. The S&P 500 Pure Worth index has held its fort nicely amidst world market turmoil with a decline of simply 5 per cent YTD versus the S&P 500 Pure Progress index, which is down by 26 per cent. For the 5 12 months interval ending 2021, the expansion index considerably outperformed with 150 per cent returns versus the worth index returning 40 per cent.

Thus, trying on the efficiency thus far this 12 months, it does seem worth traders and funds, who had been creeping ahead like a tortoise within the earlier decade, look like assembly up with the hare halfway of their lengthy investing journey now. The one distinction right here is that the hare didn’t take a nap that allowed the tortoise to catch up; it has as an alternative walked a number of steps backwards.

Is development investing now within the sluggish lane and might worth investing get its mojo again? Allow us to analyse.

What’s worth investing?

Based on the ‘Dean of Valuation’ Aswath Damodaran, there is no such thing as a clear consensus amongst worth traders, aside from the truth that worth investing is shopping for low cost firms. And inside worth investing, there are a number of kinds with very completely different views of how markets work.

Whereas the place to begin in worth investing is figuring out and choosing shares based mostly on their PE, P/B multiples, dividend yields and so forth, further standards similar to administration high quality, stability sheet energy and predictability of future earnings and so forth are additionally added. Worth investing, basically, focuses on guaranteeing security of principal whereas concentrating on larger danger adjusted returns.

The inspiration for worth investing was laid by Benjamin Graham, whereby he harassed on shopping for firms buying and selling nicely beneath their intrinsic value — the measure of worth of an organization based mostly on its belongings, liabilities and discounted future money flows. This calculation being an estimate which might go flawed attributable to varied uncertainties, Ben Graham additionally harassed on making use of margin of security — shopping for firms which might be low cost after making use of a margin of security low cost to the estimated intrinsic value.

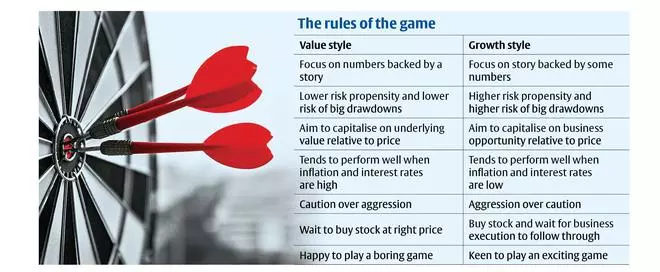

It is a essential distinction between worth and development fashion of investing. Progress fashion of investing often doesn’t have a margin of security. The main target is on the enterprise alternative and scope for execution in development fashion of investing. Rather a lot is dependent upon many issues going precisely as anticipated, by which case the payoffs could be big, however simply few issues turning out to be worse than expectations — company-specific or macro — may end up in important losses. For instance, when the main social media shares had been hitting the bourses within the earlier decade, the main target was on subscriber metrics and information factors like month-to-month lively customers. Whereas financials had been essential, it was secondary to this. One other instance is the case of Netflix, which gave 50x returns between December 2011 and December 2021. The main target of traders was totally on subscriber development. Money flows getting delayed to attain larger subscriber development was obtained with enthusiasm. The flip facet to development fashion of investing is that when the story hits a pace bump, the adverse response could be extreme. Within the case of Netflix, after it missed on subscriber expectations in current quarters, returns made during the last 4 years had been misplaced in lower than 4 months.

In worth investing you count on the market will, over time, repair the pricing anomaly, whereas in development investing you count on that development prospects will play out with out a lot deviations.

The worth investing artwork, propounded by Ben Graham, was practised with close to perfection and popularised by his pupil and worth investing legend – Warren Buffett. Whereas Buffett modified Benjamin Graham’s worth investing philosophy to incorporate facets like moats, few different worth investing legends like Jeremey Grantham and Sir John Templeton developed their very own kinds as nicely. Jeremy Grantham centered on a worth investing fashion that gave significance to imply reversion — after excessive strikes in both course, inventory valuations are likely to revert to their long-term common or imply.

Tutorial analysis additionally additional validated this fashion of investing throughout 1970-2000, broadly indicating that lower-valued shares tended to outperform higher-valued shares and had higher pay-offs.

What’s modified

The last decade 2010-20 is taken into account a misplaced one for worth investing. Whereas many worth traders emerged as heroes throughout the unwinding of the housing bubble and monetary disaster of 2007-08, efficiency of their picks began falling behind, a number of years down the road. The alternatives of the worth investor had been getting overrun by new-age shares centered on expertise that had been disrupting the way in which enterprise was being achieved and scaling up quickly. In lots of situations, the bets on highly-valued development shares was validated. This pattern continued to realize traction as low rates of interest pushed traders to chase development shares of their starvation for additional yields. Low rates of interest additionally benefited development shares greater than worth shares. Progress shares had most of their money flows back-ended. In a low rate of interest regime, the online current worth of those money flows was larger attributable to decrease discounting charges, which was based mostly on rates of interest. A lot was the dominance of development investing that even Warren Buffett did some migration to comparatively highly-valued tech shares (like Apple).

In India too, whereas the universe of disruptive tech shares was few, the shares with constant development profile throughout sectors like shopper discretionary, shopper non-discretionary, and finance (Asian Paints, HUL, Bajaj Finance, and so forth) outperformed and PE ratios and P/B multiples expanded and stayed nicely above ranges that may have been deemed too costly within the earlier decade.

If you’re an investor who cannot abdomen an excessive amount of of volatility and can’t tolerate dropping cash, then worth investing is the trail for you

The explanation for this pattern in development shares outperforming worth shares varies. Some worth traders consider the worldwide central banks, particularly the US Fed and ECB, overdid the financial stimulus and there might be payback for that within the present decade. The expansion traders would say the world has modified attributable to quite a few improvements and disruptions because the begin of the millennium and investing guidelines of the 20th century/previous financial system don’t apply now.

Who is correct? We are going to know someday within the subsequent few years, for positive! However for now, the way in which worth and tech shares have reacted in a different way to the inflation check, point out the worth traders might get their spot again at some stage.

On the identical time, worth traders should additionally keep alert to prospects that some disruptive adjustments might have occurred. Fairly a number of firms which have made the very best use of expertise to enhance enterprise efficiency have began dominating their industries that will guarantee higher stability to earnings and decrease dangers. In such instances, there could also be a case for comparatively larger PE and P/B threshold for worth traders to contemplate.

Suitability

If you’re an investor who cannot abdomen an excessive amount of of volatility and can’t tolerate dropping cash, then worth investing is the trail for you. This doesn’t imply you must keep away from excessive development and disruptive tech shares, however you need to wait to purchase them on the proper value with enough margins of security when alternative presents (prefer it did in March 2020 throughout the board, and now as nicely in some pockets ). In worth investing, you’ll have larger fairness allocations inside your total portfolio because the volatility and danger profile is comparatively decrease versus development investing.

Inside worth investing, traders want to decide on the proper worth investing fashion that’s aligned with their targets, skill-sets and temperament. As talked about above, low valuations within the type of low PE or P/B, or excessive dividend yield is simply the place to begin. Then choosing from these shares based mostly on moats in enterprise, stability sheet energy, administration high quality, sustainability of earnings/dividends and so forth are further components to display screen from based mostly on one’s skill-sets.

Investing in mutual funds which might be centered on lively worth investing can also be an choice to contemplate.

Avoiding worth traps

In following the worth investing strategy, listed below are few key worth traps to keep away from.

One, low cost doesn’t imply there may be worth within the inventory. The Buffett maxim, ‘value is what you pay, worth is what you get,’ might be a great guideline to observe. A inventory may very well be low cost, however you may nonetheless be paying nicely above its intrinsic worth if the corporate’s enterprise mannequin is damaged and is anticipated to lose money without end. Many wi-fi telecom firms, together with Concept Mobile and Reliance Communications, appeared extraordinarily low cost on paper based mostly on value by e book a number of when Reliance Jio entered the telecom sector. Nevertheless, a wager on these firms would have resulted in important destruction of wealth since 2017. Therefore, search for the viability of the enterprise mannequin of the corporate and ranges of aggressive threats rising.

Additionally, some shares stay low cost for a motive. PSU shares have remained low cost attributable to issues on authorities interference, for example. That is, nevertheless, to not imply that these shares should not be purchased into when they’re low cost. It means larger margins of security would possibly have to be utilized over intrinsic worth earlier than betting on a few of these shares.

Two, don’t make concentrated bets. How a lot ever expert you’re on assessing a inventory, you would possibly nonetheless miss one thing. For instance, even famed worth investor Porinju Veliyath took an enormous hit to his portfolio in 2017-18 by taking an outsized place in LEEL Electricals, as the corporate gave the impression to be buying and selling for a pittance when adjusted for its money reserves. However subsequent alleged administration high quality points resulted in important wealth destruction within the inventory.

Three, don’t simply go along with PEs and P/Bs, but in addition assess the corporate’s money flows and leverage profile. Finally, earnings should be mirrored within the type of money and the corporate will need to have the liquidity to repay its money owed when due. A living proof is Tulip Telecom, which was buying and selling very low cost on PE metric within the early a part of final decade with good enterprise momentum, however its enterprise enlargement was constructed on intensive leverage and when it got here due it didn’t have the liquidity to repay its money owed.

4, heavy draw-downs in shares from 52-week highs doesn’t essentially imply there may be worth in shares. Typically, there may be tendency amongst traders to contemplate shopping for shares as a result of draw-downs have been like 50 or 75 per cent from peak ranges. This generally is a entice as shares may have been priced to irrational ranges (a number of occasions of intrinsic worth) throughout in a market bubble and even a 90-per cent correction may not indicate worth. Investments in lots of the dotcom-era shares in India and the US, infra and actual property shares from 2007 resulted in 100 per cent losses for traders. Some even turned out to be rip-off firms. There could also be some from the current market cycle as nicely that may trigger related losses. This too must be factored in earlier than zeroing in on worth shares.

#investing #making #comeback