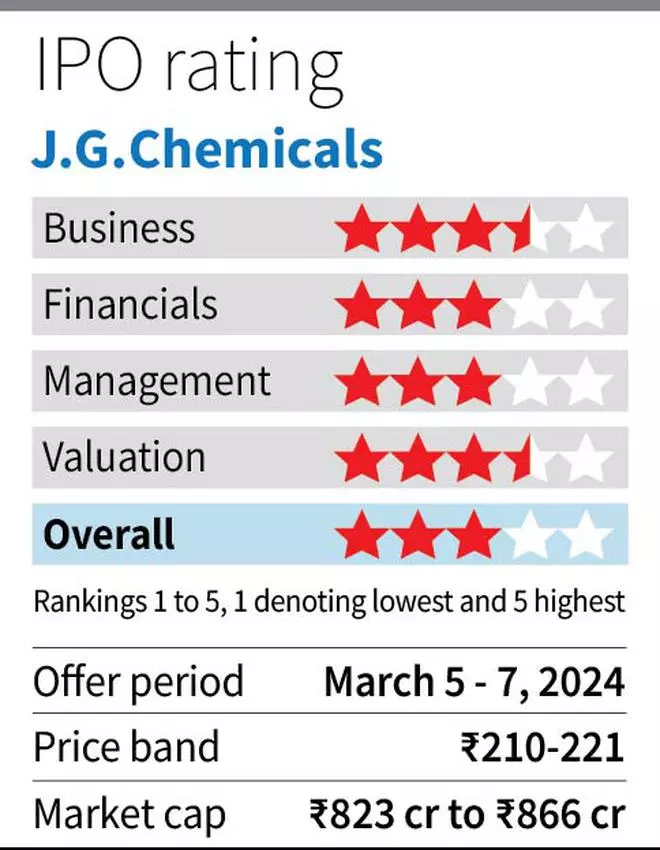

The IPO is open until March 7. We advocate that high-risk traders subscribe to the difficulty as scope for progress is strongin the long run.

Entry barrier

Zinc oxide, the first product of the corporate, is utilized in tyre business, which accounts for 90 per cent of the consolidated gross sales of the corporate. It’s an activator for sulphur vulcanisation for rubber which improves elasticity, resilience, and different properties. Owing to such essential nature and the excessive diploma of customisation concerned – which extends to plant design and engineering, there’s a vital shopper stickiness benefitting JG Chemical compounds. The approval course of, which can lengthen to greater than 5 years, additionally enhances the boundaries to competitors.

JG Chemical compounds’ progress is linked to the car business. Although the business is cyclical, the corporate is in a superb place as tyres have an enormous alternative market which can preserve gross sales going even when new car gross sales is in a downturn. Of the 90 per cent gross sales to tyre producers, 55 per cent is to alternative gross sales and 45 per cent to OEM producers at present.

Enlargement plans

After having added 17,000 mtpa in December 2022, the whole capability now stands at 77,000 mtpa. The added capability diversified into Zinc Ingot and Zinc Sulphate. The corporate has plans so as to add one other 15-20 per cent capability in Gujarat which can primarily deal with ceramics business together with pharma which now accounts for 7 per cent of gross sales in 9MFY24. This could diversify the shopper and shopper business base of the corporate within the subsequent two-three years. In contrast to tyre’s, ceramics or different industries have a lower than 6 months validation cycle and will help quicker scaling up. Because the lately added capability reaches most capability utilisation, this additionally drives progress within the interim. From a most capability utilisation of 60 per cent in FY21, the metric has declined to 52 per cent in 9MFY24 owing to gradual ramp-up in added amenities.

Zinc costs

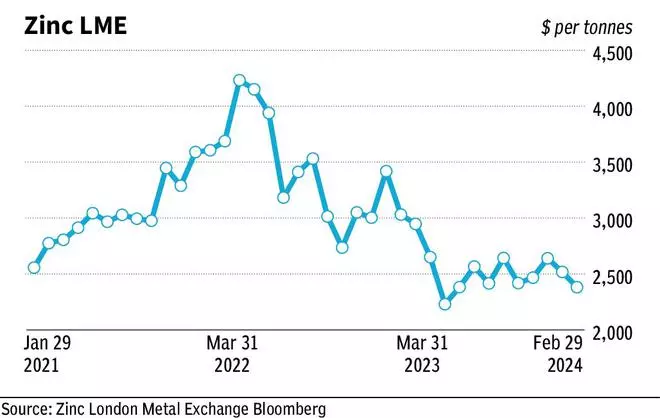

The corporate passes on the price of zinc (main uncooked materials) to its prospects on spot worth foundation and a pre-agreed upon mark up. This means that JG Chemical compounds solely retains stock threat for the interval it holds the stock, which is round 50 days. Zinc costs accelerated post-Covid and remained larger in FY23 as nicely, correcting just one per cent YoY (see desk).

In 9MFY24, zinc costs have corrected by 26 per cent YoY which impacted profitability. From a Gross and EBITDA Margin common of 20/10 per cent in FY21-23, 9MFY24 margins declined by 250/380 bps, respectively. With zinc costs stabilizing in a $2,400-2,600 per tonne vary within the final three months, JG Chemical compounds can cross by the costs, with out a listing threat from sharp worth actions. Enlargement and optimum capability utilisation, diversification to different industries, that are larger value-added merchandise, can additional strengthen the margin profile of the corporate.

From the ₹165 crore anticipated from the recent situation, ₹60 crore will probably be allotted for an R&D facility in Andhra Pradesh. That is to broaden the grades JG Chemical compounds produces — at present 80 grades of Zinc Oxide — and the economic functions that may be focused.

Financials and valuation

Based mostly on 9MFY24 earnings, JG Chemical compounds is valued at 35 instances EPS. However based mostly on FY23 earnings, which was not impacted by sharp actions in zinc costs, the IPO is valued at 15 instances earnings. Whereas the premium captures a restoration in margins, scope for natural progress can favour traders. JG Chemical compounds will repay debt (₹25 crore) and add to working capital (₹95 crore) from the recent situation, which ought to additional cut back the Internet Debt to EBITDA, which stands at 0.47 instances in 9MFY24 (annualised).

#Chemical compounds #IPO #subscribe