Jim Simons — the maths wizard and founding father of one of many world’s most profitable Hedge Funds, Renaissance Applied sciences LLC, who died on Could 10, 2024 — was one such legend. He leaves behind a ‘Don Bradman’-like report and legacy that could be very difficult to beat for generations to return. His flagship fund, Medallion Fund, beat each funding up to date on the market by a large margin with a staggering efficiency of 66.1 per cent common annual returns (39.1 per cent web of charges) from 1988 to 2018. It had only one marginally down yr in that interval.

In the course of the years of the brutal dotcom crash when the Nasdaq composite fell by 80 per cent and S&P 500 by 50 per cent, the Medallion Fund gave returns of 128 per cent within the yr 2000, 57 per cent in 2001 and 52 per cent in 2002. Equally, in the course of the international monetary disaster in 2008 when the S&P 500 crashed 38 per cent, the Medallion Fund generated earnings of 152 per cent! Staggering annual returns mixed with consistency and returns uncorrelated to markets have been its hallmark. Whereas some a part of this was made doable by Medallion limiting the dimensions of the fund and investing throughout asset courses the world over, the numerous half was totally as a result of secret sauce that Jim Simons developed.

The passing away of Jim Simons is a superb loss for the worldwide funding neighborhood certainly, all of the extra so coming because it did inside months of the demise of one other investing legend, Charlie Munger, who died on November 28, 2023.

One can’t however marvel at how a lot the 2 had in frequent. Each didn’t begin out in life to develop into buyers: Jim Simons was a math professor initially, whereas Charlie Munger was an lawyer. Each launched their investing profession solely across the age of 40. Each have been deeply impacted by private tragedies at totally different instances of their lives, nevertheless, they efficiently coped with them by resorting to their ardour — arithmetic and buying and selling for Jim, whereas it was slightly little bit of physics, primary math, breaking down and deeply understanding how the world capabilities and investing, for Charlie.

So, what precisely was the key sauce that made them so profitable? Once more, borrowing a quote from the Batman collection, this time from Batman Begins – ‘Should you make your self greater than only a man, should you dedicate your self to an excellent, and if they’ll’t cease you, then you definitely develop into one thing else totally – Legend’

How they developed into legends is well-captured in two wonderful books — The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution and Poor Charlie’s Almanack: The Wit and Knowledge of Charles T. Munger

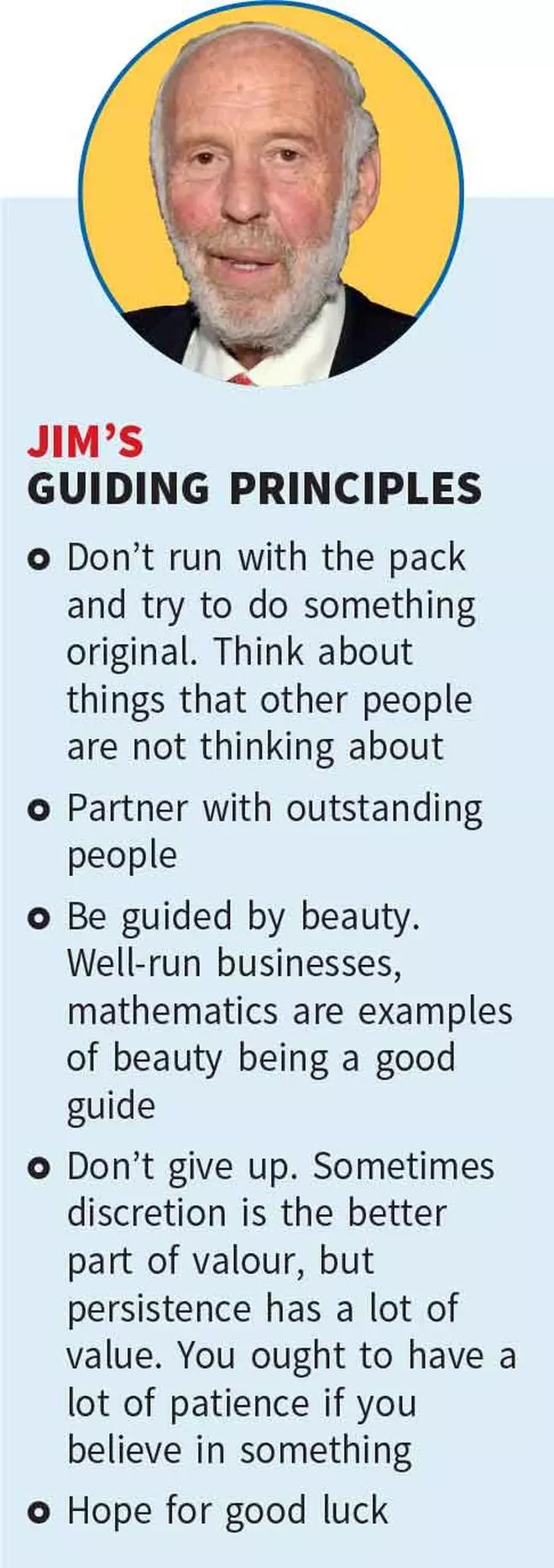

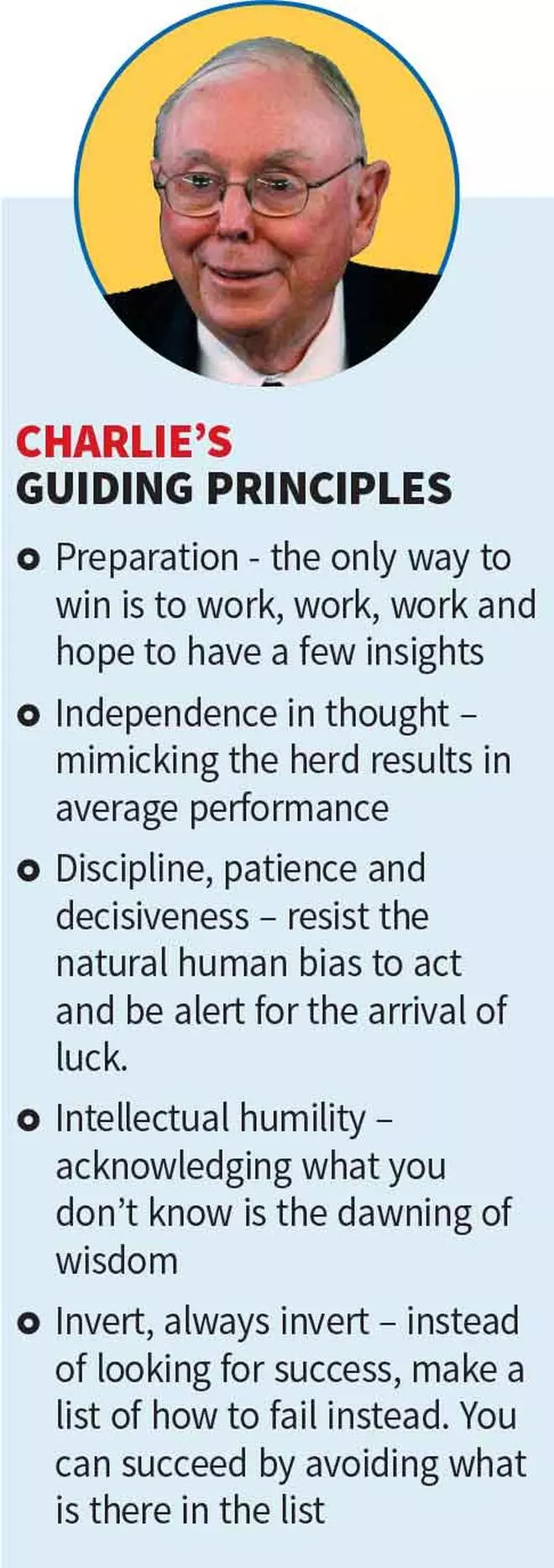

We distil right here the fundamental elements of their secret sauce, their guiding rules — which might information all investing fanatics as nicely of their wealth-creation journey.

.

Partnering with the suitable folks

Jim’s early journey after founding Renaissance Applied sciences was something however a cakewalk. Jim was a pioneer in quant investing at a time when a lot of Wall Road considered it with mistrust, and the essential side to his success early on was in recruiting the suitable expertise with the suitable talent units.

His group was crammed with PhDs in arithmetic from Ivy League faculties, a lot of them his former colleagues when he was a math professor or labored as a code breaker on a authorities contract. For a lot of of them, their thoughts was oriented in direction of mental pursuits relatively than minting cash. In consequence, the founding group needed to endure numerous churn and group points earlier than Renaissance might develop a sustainable profitable buying and selling algorithm that might be utilized throughout asset courses. Whereas not everybody who joined early on stayed put, Jim’s partnership with every of them, and the worth they added in constructing a greater algorithm, contributed immensely to its success.

In truth, one of many essential turning factors that catapulted Renaissance into progress was when one of many founders of Medallion Fund, Henry Laufer (additionally a former colleague of Jim when he was a professor) decided that it could be more practical to have a single algorithmic buying and selling mannequin with tweaks for various asset courses, relatively than having separate fashions for every asset class. This enabled Renaissance to choose frequent buying and selling alternatives throughout asset courses and likewise made it extra scalable as new asset courses might be added to it when required. The e-book chronicles many such situations the place partnering with proper folks, and good concepts that germinated from them, contributed to Renaissance’s parabolic progress

So too was the case with Charlie Munger, whose partnership with Warren Buffett laid the muse for the exceptional success of Berkshire Hathaway.

The important thing studying right here is that if we wish to succeed as an investor we too should associate with the suitable folks. These needn’t be business partnerships, however less complicated issues, corresponding to having a dialogue on a inventory with an goal individual, making certain that the individual supplying you with inventory concepts is unbiased and educated, duly contemplating why one other individual may need opposite views on a inventory.

Having the suitable associate to debate concepts helps in figuring out our blind spots, and in producing sound concepts as nicely.

Self-discipline, persistence, endurance in sticking to course of

Whereas in contrast to Charlie, Jim was a recluse and gave fewer interviews, in one among his uncommon talks he talked about how one rule they diligently caught to all through the many years of Renaissance’s journey was to by no means override the pc. If their view was completely opposite to the trades the pc prompt, they caught to what the pc prompt nevertheless strongly their feelings have been in favour of the alternative commerce. This labored wonders for them, because the outcomes present.

The one uncommon situations they intervened was within the case of black swan occasions, like a couple of days in the course of the dotcom crash and one other time in the course of the ‘Quant Quake’ of August 2007. Even throughout these instances, they avoided initiating new positions, however relatively switched off sure methods briefly or lowered positions to decrease danger. For instance, in the course of the Quant Quake, their losses over a couple of days was at 20 normal deviations from the common. Statistically, even three normal deviations is uncommon and excessive. Therefore it required the uncommon intervention in Jim’s view.

Just like Jim in terms of sticking to course of, however totally different in the best way it was carried out, Charlie had a psychological guidelines that was well-ingrained in his DNA from years of examine, studying and expertise. He caught to what his psychological pc prompt after he processed knowledge and vetted it in opposition to a guidelines. Charlie’s logic is easy – he mixes all of the elements, and if in his evaluation the hole between valuation and value is just not enticing, he strikes on to one thing else. He has by no means deviated from this course of, exhibiting exceptional self-discipline over many years. He as soon as mentioned, if required he was prepared to attend even for a decade to make a superb funding.

This raises an vital side to mirror on. How faithfully have we adopted a well-developed pre-determined framework in our investing journey? Have we been impulsive in shopping for or promoting shares and deviated from the method?

Jim and Charlie exemplify how far self-discipline in investing can take us.

Mental humility and acknowledging the position of luck

‘The perfect laid plans of mice and males usually go awry.’

Course of, self-discipline, persistence and endurance are essential elements for a profitable wealth creation journey, however with out some component of luck the vacation spot is probably not reached. Each Jim and Charlie have been upfront on the position luck has performed of their success. In truth, on Wall Road, there’s a quote that’s nicely telegraphed however normally not heeded by many – ‘if you’re not humble, the markets will humble you.’ Merchants/buyers with mental humility acknowledge this.

The advantage of incorporating the elements of course of, self-discipline, persistence and endurance is that you simply give your self a greater likelihood to remain longer within the recreation to greet woman luck when she arrives. In an extended sufficient timeline, each individual can have his/her share of excellent luck in life and investing.

So should you really feel you might have had unhealthy luck within the inventory markets, assess whether or not you had the opposite elements proper. If not, then it’s much less to do with luck. However, when you have adopted the suitable steps, then could also be some persistence can make sure you keep lengthy sufficient to get pleasure from your dose of luck.

If, nevertheless, you might have been very fortunate within the inventory markets, acknowledge the position of luck. It should go a great distance in extending your profitable stint.

Are you a dealer or an investor?

Jim and Charlie had a lot in frequent, but their method to inventory markets was fully reverse. Jim was a short-term dealer whereas Charlie, then again, was centered solely on long-term investments.

Jim discovered his early expertise in basic investing ‘abdomen wrenching’, whereas Charlie couldn’t care much less what markets would do in a yr or two, overlook a couple of days, which was the time horizon Jim was centered on. Jim’s buying and selling portfolio was loaded with 1000’s of positions throughout shares and different asset courses, whereas Charlie’s portfolio might be counted in your fingers.

Each discovered early on as to what they didn’t wish to do and what their circle of competence was.

Each believed that markets have been inefficient. Human psychology impacted markets that supplied alternatives for them. Jim’s deep curiosity in and love of math satisfied him early on, on the existence of sure patterns that play out on the earth. He wished to make use of his math expertise to foretell these patterns and revenue from them.

Charlie’s love of physics, indulgence in primary maths and his understanding of the world gifted him with a rational method that satisfied him of his skills to evaluate how issues will play out over the long run as soon as human greed and worry took shares/markets to extremes.

Each capitalised on the inventory markets primarily based on what they have been good at and caught to their weapons.

So, the takeaway right here is that this – earlier than partaking actively within the markets have you ever discovered whether or not you’re a dealer or an investor?

Do you imagine you’re a long-term investor, however but spend time making an attempt to foretell the place shares will likely be in every week or month from now? Or are you really dealer, however maintain on to losses in shares or F&O with out adhering to cease losses? Such behaviour represents the anti-thesis to path that Jim and Charlie carved out to develop into succesful.

Being a dealer or an investor requires a couple of frequent rules, however totally totally different method. A becoming tribute to Jim’s and Charlie’s legacy can be when an increasing number of amongst us establish our circle of competence and accordingly interact with the markets!

#Jim #Simons #Charlie #Munger #heroes #lived #lengthy #legends