On March 5, the RBI directed JM Monetary Merchandise Restricted (JMPL), a non-banking monetary firm subsidiary of JM Monetary, to instantly stop and desist the sanction and disbursal of loans in opposition to shares and debentures.

SEBI then barred JM Monetary from officiating as lead supervisor for any recent debt concern. JM Monetary, nevertheless, has been allowed to proceed as lead supervisor for present debt public concern mandates for an additional 60 days. This comes after SEBI unearthed discrepancies and inter-group transactions in a November 2023 concern throughout a ‘routine examination’ of public non-convertible debentures (NCDs) issued that 12 months. The inventory has since been underneath strain, just lately declining by practically 24 per cent month-to-date.

We take a more in-depth have a look at the totally different segments of the JM Monetary group and the importance of latest developments. Included in 1973, JM Monetary is a diversified monetary providers participant with 4 main enterprise segments: Funding financial institution (37 per cent of FY23 income); mortgage lending (39 per cent); various and distressed credit score (4 per cent); and asset administration, wealth administration and securities enterprise (19 per cent).

Impression of regulatory actions

The 2 actions underneath the lens of the RBI and SEBI fall are within the funding financial institution section, which incorporates administration of capital markets transactions, advising on mergers and acquisitions, and personal fairness syndication. This section additionally contains the institutional equities enterprise and analysis, personal fairness funds, fastened revenue, syndication, and finance. It’s the most worthwhile section for the corporate with revenue after tax (PAT) margins of 31.4 per cent in FY23 (29.6 per cent within the 9 months of FY24).

In consequence, its PAT contribution was round 55 per cent in FY23 (round 64 per cent in 9MFY24). The entire quantity of issuances managed by the corporate within the public concern of NCDs was round ₹2,227 crore in FY23 (₹4,000 crore in FY22). With a market share of 25 per cent (down from 35 per cent in FY22), JM Monetary ranked No. 3 for FY23 within the Prime Database League Desk.

JMPL focuses on mortgage merchandise customised to the wants of corporates, establishments, small and medium enterprises (SMEs), and people. It focuses on capital market financing (21 per cent of Q3FY24 mortgage ebook of ₹4,600 crore), retail mortgage financing (20 per cent), bespoke financing (26.5 per cent), monetary establishment financing (26 per cent), and actual property financing (6 per cent). It reported a consolidated income of ₹1,023 crore (33.6 per cent year-on-year) and pre-provision working revenue of ₹404 crore (47.4 per cent YoY) in FY23.

The RBI’s directive to instantly stop and desist the sanction and disbursal of loans in opposition to shares and debentures will have an effect on progress in capital market financing

What ought to buyers do?

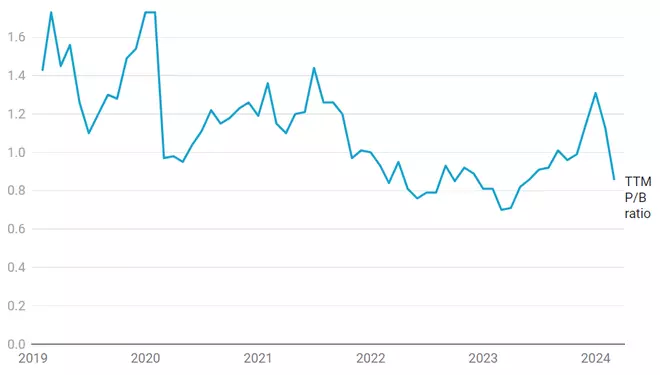

After the latest fall, the inventory at the moment trades at a trailing 12-month (TTM) price-to-book (P/B) ratio of 0.86x, a 23 per cent low cost to the five-year common of 1.11x. Despite the fact that the inventory might look like at a major low cost to historic ranges, it’s nonetheless above the March 2023 degree of 0.7x. It is very important be aware that the monetary efficiency of the corporate may be cyclical and depending on the general deal exercise, which may be unstable.

With the elevated uncertainty over two key enterprise actions, we imagine the inventory might proceed to be underneath strain within the coming days. We suggest potential buyers to attend and watch the progress of the regulatory motion earlier than deciding

#Monetary #share #worth #crash #shopping for #alternative