Nevertheless, one a part of the infrastructure theme, roads and freeway building, has been within the sluggish lane for over a yr now. The Nationwide Highways Authority of India (NHAI) has been going gradual on new highway building awards this fiscal. In FY24, between April and November, the general size of latest contracts awarded by the NHAI was 2,815 km, a lot decrease than the 5,382 km accomplished within the earlier yr.

However the awarding tempo is about to extend by the top of the present fiscal and positively in FY25 and the interim Finances has allotted ₹2.78 lakh crore for roads and freeway building. Land acquisition is cited as the important thing difficulty in highway awards slowing down considerably.

Not surprisingly, many listed corporations within the house have been relative underperformers on tepid order move, and valuations have develop into engaging with their present order e-book and a constructive outlook.

KNR Constructions is one such predominantly highway building and irrigation initiatives participant whose inventory has remained lackadaisical amidst a small-cap frenzy.

A well-diversified order e-book, robust execution document and a sound debt free stability sheet are positives for the corporate.

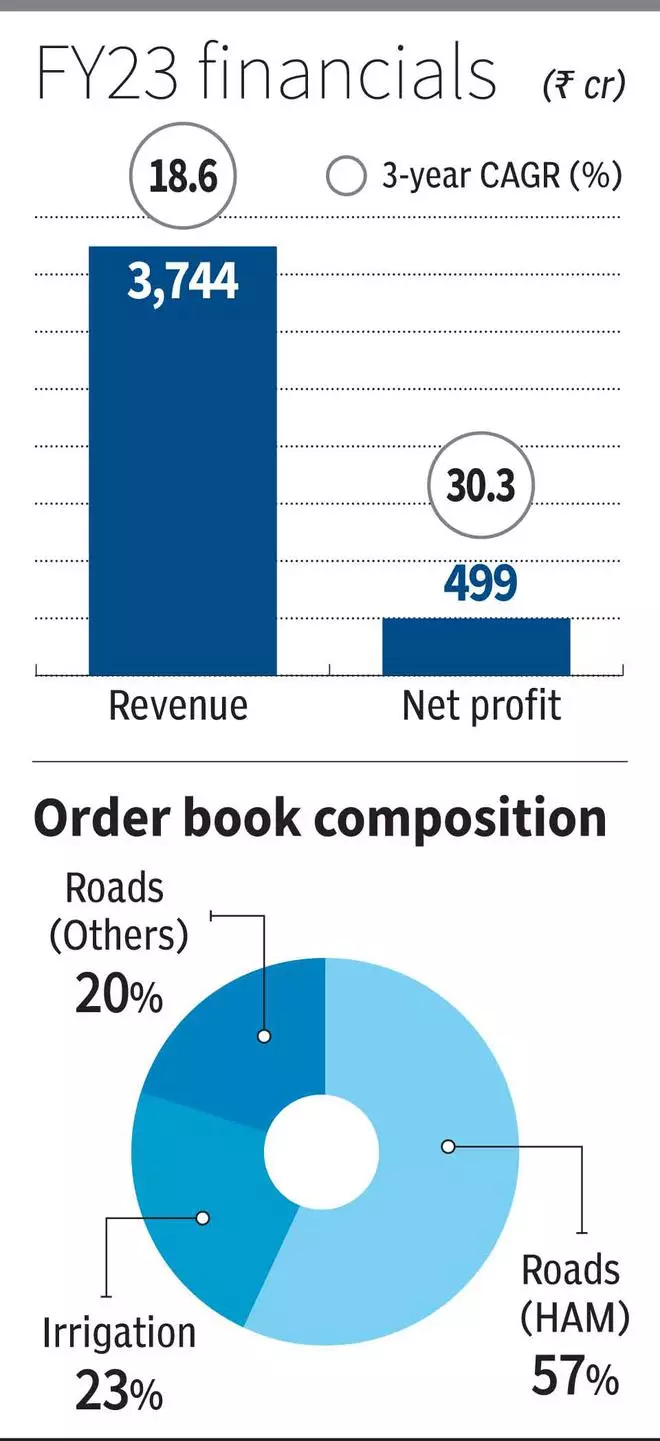

At ₹240, the KNR inventory trades at 15 instances its anticipated per share earnings for FY24 and at 13 instances its doubtless FY25 EPS. At these PE multiples, the inventory is accessible on the decrease to mid band of the 11-20 instances that highway gamers typically commerce at, making a case for purchasing the corporate’s shares with a 2-3-year perspective. Between FY20 and FY23, the corporate’s revenues grew at a CAGR of 18.6 per cent to ₹3,744 crore, whereas the online earnings elevated on the charge of 30.3 per cent over the identical interval to ₹499 crore.

In 9MFY24, KNR’s revenues grew by 8 per cent over the identical interval in FY23 to ₹2,776.5 crore, whereas web earnings declined by 20 per cent to ₹295.7 crore. The decline was largely attributable to an distinctive merchandise (round ₹138 crore) involving sale of initiatives within the earlier fiscal, which resulted in increased earnings then.

A wholesome diversified e-book

KNR Constructions is a freeway building (its key enterprise) participant and in addition has important presence within the irrigation and concrete water infrastructure administration areas.

It operates within the 5 southern States of Karnataka, Telangana, Andhra Pradesh, Tamil Nadu and Kerala.

The corporate has a reasonably large consumer base. This consists of NHAI, Andhra Pradesh Highway Improvement Company, Karnataka State Highways Enchancment Mission, GMR Initiatives, Telangana Irrigation, Engineers India, Highways Division of Authorities of Tamil Nadu and Sadbhav Engineering, amongst others. There’s a mix of captive, private and non-private sector initiatives to be executed.

KNR Constructions has an order e-book of ₹6,745 crore, which is 1.8 instances its FY23 revenues.

Round 57 per cent of the order e-book comes from HAM highway initiatives. One other 23 per cent is made up by irrigation orders and 20 per cent from different highway works.

Key initiatives embody Ramanattukara to Valanchery bypass, Bangalore-Mangalore Mission, Elevated Freeway alongside Avinashi Highway in Coimbatore Metropolis and Improvement of six-lane Chittoor-Thatchur Freeway.

The corporate has additionally indicated that it’s attempting to win orders price ₹5,000-₹6,000 crore within the subsequent one yr.

KNR has typically ensured that it completes initiatives inside and even forward of the deadlines specified by shoppers and concessionaire. There are cases the place the corporate has accomplished initiatives greater than 100 days forward of the initially scheduled deadline.

Sturdy financials

The corporate has a reasonably robust stability sheet and wholesome monetary metrics. KNR Constructions is debt free and has remained so for the previous three fiscal years.

One other key facet is that it has at all times maintained pretty wholesome margins over a really lengthy time frame.

From 2018 onwards, it has managed to take care of an EBITDA (earnings earlier than curiosity, taxes, depreciation and amortisation) of 19-20 per cent, sometimes even exceeding this band on the upside, which is among the many greatest within the business.

The return in fairness for the corporate can also be sturdy. KNR’s RoE was 18.2 per cent in FY23 and 17 per cent in FY22.

General, the corporate checks all of the containers on orders, execution capabilities and monetary metrics, and is damage solely by a short lived slowdown in awards.

Within the subsequent couple of years, KNR Constructions seems to be set to journey the infrastructure and highways story.

#KNR #Constructions #Inventory #Good #Purchase