Elevation Capital has offloaded its complete holding of 68 lakh shares in the course of the yr, held via SAIF II SE Investments Mauritius, information from the change reveals. Primarily based on costs within the unlisted market, the share sale would have fetched ₹2,300-3,200 crore. Acacia Banyan Companions has offered its complete holding of over 78 lakh shares.

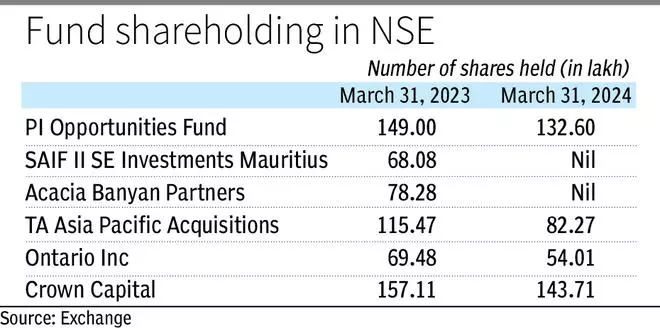

TA Asia Pacific Acquisitions, PI Alternatives Fund, Ontario Inc, and Crown Capital have trimmed their holdings, offloading wherever from 13 lakh to 33 lakh shares (see desk).

“All of us have restricted life funds and must return cash after a sure variety of years. With zero visibility of the IPO, we now have been compelled to promote at decrease charges. We’ve got made cash, however the IRR is nothing particular due to the lengthy holding interval,” stated one of many fund companions.

Basic Atlantic, the NYSE Group, Elevation Capital, and Goldman Sachs have been among the many first group of international traders to amass a 5 per cent stake every within the NSE in 2007. In the identical yr, Morgan Stanley, Citigroup, and Actis bought 3 per cent, 2 per cent and 1 per cent, respectively, within the change.

Citigroup, Goldman Sachs, and Norwest Enterprise Companions offered their complete stake in FY22.

In response to a query on the IPO throughout a name with analysts final month, the bourse’s Managing Director and CEO, Ashishkumar Chauhan, stated: “We don’t have a touch upon the IPO to be made; the state of affairs stays as is.”

An electronic mail despatched to NSE didn’t instantly get a response.

NSE’s shareholding has change into much more subtle, with high-net-worth people and household workplaces lapping up its shares prior to now few years. Over 10,000 resident people underneath the general public shareholder class held shares amounting to 13.8 per cent of the full shareholding as of March 31, 2024. The comparable determine for the earlier yr was 4,341 shareholders holding 10.72 per cent.

The bourse’s shares have seen a 75 per cent spurt prior to now yr within the unlisted market.

#Marquee #funds #trim #NSE #holdings #due #lack #IPO #visibility #restricted #fund #life #cycle #main #share #gross sales