However traders ought to observe that the IPO is priced at 33.5 instances annualised 9MFY24 earnings (post-issue) which seems to issue the positives. GIven the truth that there are not any comparable friends, home or world, and deceleration in progress witnessed in FY24 (9M), we consider traders can wait and look ahead to now to determine the earnings progress prospects publish itemizing. An funding name might be made later after monitoring the corporate’s quarterly earnings.

Enterprise mannequin

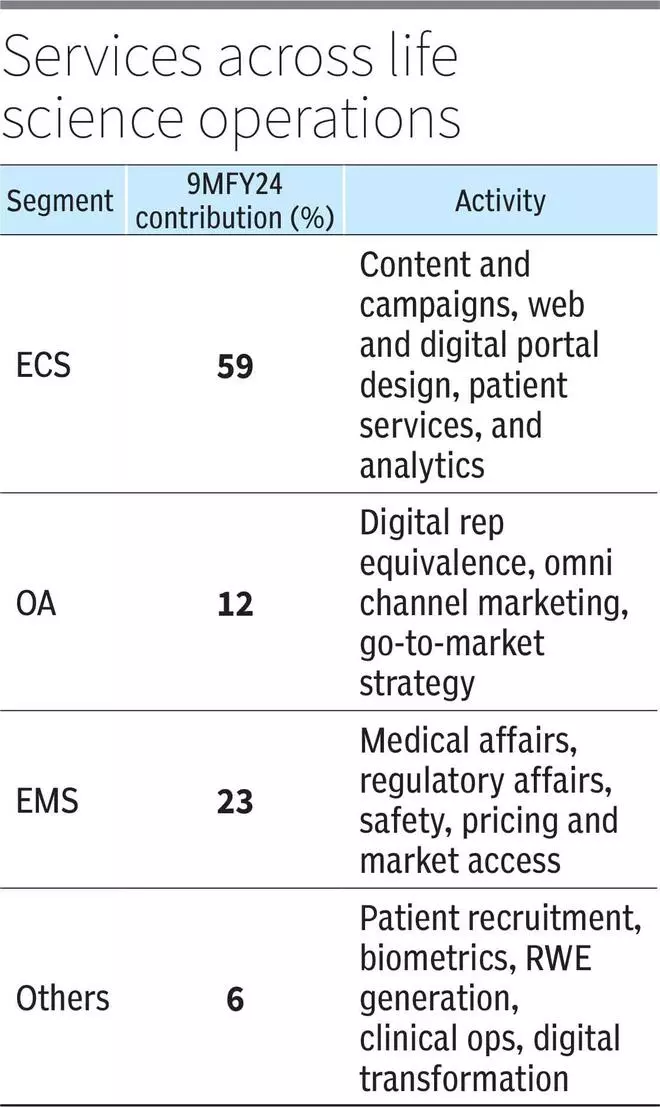

Indigene generated 69 per cent of its FY23 revenues from the highest 20 biopharmaceutical corporations by servicing their gross sales and advertising operations, regulatory compliance methods and branding and channel analytics. The corporate operates beneath 4 segments: Enterprise Business Options (ECS, 59.3 per cent of 9MFY24 gross sales), Omnichannel Activation (OA, 12.1 per cent), Enterprise Medical Options (EMS, 23 per cent) and Others (5.6 per cent). These segments tackle biopharma corporations’ huge world presence spanning 10-12 developed markets and 30-50 creating markets as nicely.

ECS serves purchasers by producing customised advertising plans and working campaigns, creating engagement fashions for docs, sufferers, and payors, and consolidating promotional exercise by means of web sites, emails and social media. Most elements of enterprise gross sales and advertising are dealt with on this phase.

OA phase handles product-wise branding and promotion actions. This phase augments gross sales drive at decrease prices and better effectivity by means of emails, digital gross sales representatives, and social media. Cult Well being, a current acquisition, aids in advertising methods and inventive design, whereas proprietary NEXT instrument assists with buyer segmentation and channel optimisation.

Whereas the above two are recurring actions, EMS referring to regulatory compliance is event-driven however finds recurring utility as nicely. The phase consolidates large-scale regulatory and medical operations, which embody writing medical content material, regulatory submissions and product labels, all of the whereas guaranteeing compliance. The phase additionally handles pharmacovigilance providers and real-world proof (“RWE”) primarily based medical analysis for backing claims of efficacy and security for docs and sufferers. The pharma trade faces excessive regulation from improvement to commercialisation, and even post-sales exercise.

The Others phase is foraying into scientific trials and information administration outsourcing.

The corporate workforce can be distinctive. Near a fifth of the non-administrative staff are from medical sciences background, together with PhDs or M.Pharm working with expertise crew in delivering options. The corporate straddles the intersection of CRO/life science specialities and digital options, which acts as an entry barrier.

Progress

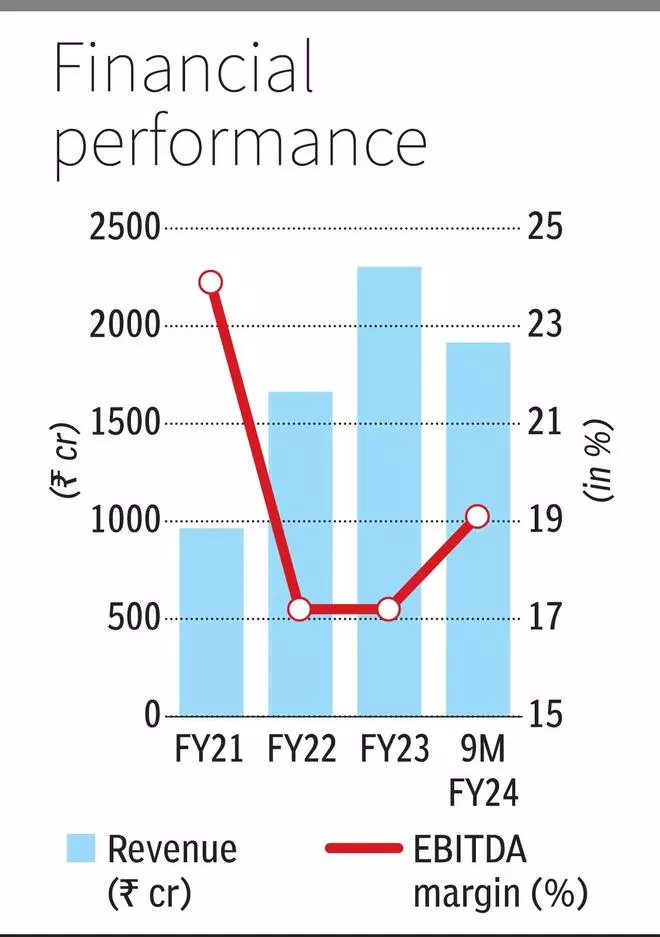

Indegene reported gross sales progress of 72 per cent in FY22, recovering from FY21 and its Covid influence however adopted it with 39 per cent progress in FY23 as nicely. The under-utilisation of digitalisation in Biopharma and life sciences has pushed such progress within the final two years, in response to the administration. Of the 65 purchasers it providers, 16 have been added in FY23 itself, which factors to the surge in demand within the final two years. Gross sales and advertising, the most important service value for all times sciences trade, has solely witnessed 7-12 per cent outsourcing in comparison with 37-42 per cent for drug discovery, as talked about within the RHP. EMS phase, addressing gross sales structure, is the most important phase for Indegene.

The corporate has additionally mined current purchasers for a bigger share of the pockets. Indegene reported three purchasers producing greater than $25 million per yr for the primary time in FY22 and elevated it to 4 in FY23. The size and vary of providers which might be provided by Indegene throughout gross sales, compliance and branding ought to drive larger outsourcing too which, mixed with fast digitalisation, ought to assist the corporate.

Excessive valuation

At 33 instances earnings, Indegene ought to maintain earnings progress of over 20 per cent over the medium time period (3-5 years) to justify valuations. The current 9MFY24 efficiency has decelerated to fifteen per cent income and 11 per cent earnings progress year-on-year as consumer addition decelerated. Whereas digitalisation presents excessive progress alternatives, the consumer base restricted to life sciences, the gradual tempo of outsourcing progress and a restricted historical past of operations don’t help excessive valuation multiples.

The tempo of contract wins for digital transformation in mainstream IT trade drove valuations to 30-40 instances in FY21-22 earlier than falling to 20-30 instances presently.

Whereas traders can wait and look ahead to now, they will look to build up the Indegene inventory publish itemizing at decrease multiples, which accommodates the chance of volatility in deal wins.

#ndegene #IPO #Subscribe