Since our ‘Accumulate’ ranking in bl.portfolio dated February 5, 2023, the inventory of NHPC has gone up by round 130 per cent. Beforehand, the rationale for such ranking was engaging valuation, excessive dividend yield, assured return mannequin and robust steadiness sheet.

There was a pointy run-up within the inventory, with valuation increasing from one-year ahead P/E (Bloomberg consensus estimates) of round 10 instances to 23 instances since then. Whereas the steadiness sheet and enterprise mannequin nonetheless stay sturdy, buyers can e-book income within the inventory because the funding thesis has already performed out as a consequence of spike in inventory worth and valuation.

Enterprise

Conferred with Miniratna standing, NHPC is India’s largest hydro energy generator with round 15 per cent share of the nation’s put in hydro-electric capability. The PSU has an put in capability of round 7,097 MW, of which 98 per cent is hydro-based. It earns majority of its income by promoting energy to State distribution utilities (primarily in northern and north-eastern India) by way of long-term PPA (energy buy settlement) whereas the remaining is thru energy buying and selling, contracts, challenge administration and consultancy segments.

The tariff that the corporate earns on its PPAs is cost-plus nature based mostly on CERC rules. Right here, topic to normative plant availability issue (PAF) of every plant, NHPC earns mounted ROE (of 15.5 per cent) over and above restoration of bills reminiscent of operations and upkeep and curiosity on loans.

The corporate additionally earns incentives based mostly on its crops reporting PAF greater than the normative ranges (85 per cent) and deviation costs the place the facility station of the corporate contributes in the direction of sustaining grid stability.

A hydro-electric energy plant, as soon as commissioned, incurs decrease generation-based bills and has the next life in comparison with different sources. Nonetheless, organising a hydro plant is much more time-consuming course of and includes increased mounted value (capex) on a per MW foundation in comparison with different energy era sources.

Intermittency problems with photo voltaic and wind can result in sudden energy era shortfalls or excesses, which might have an effect on grid stability, leading to outages. Right here, hydro energy comes into the image as a consequence of its capacity to ramp up/ramp down rapidly. Therefore, combining hydro energy with photo voltaic and wind can allow clear power transition with grid stability.

Efficiency

NHPC’s general plant availability issue throughout H1FY24 was decrease at round 92 per cent towards 99 per cent in H1FY23 as a consequence of decrease water availability and outage of a few of energy techniques like Parbati-III, Kishanganga and Chamera-II. Throughout H1FY24, the corporate noticed 9 per cent decrease era YoY at about 16,797 million items primarily on account of decrease water availability and intense rain and flood in some components of Himachal Pradesh in August ‘23 which has impacted the era within the area.

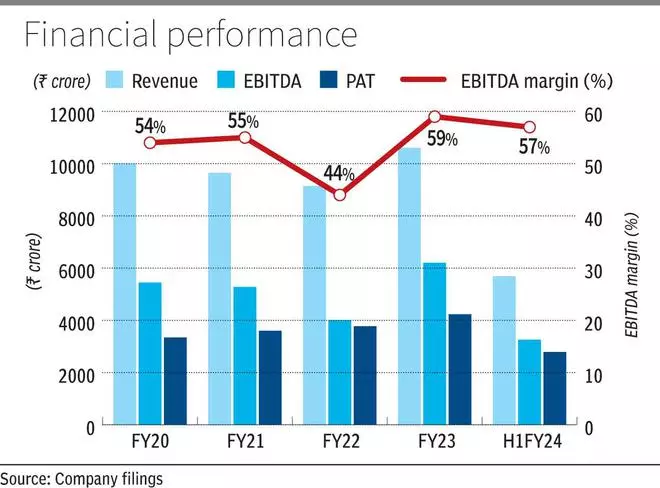

The corporate earned an working income of round ₹5,688 crore in H1FY24 i.e. 7.5 per cent decrease in comparison with H1FY23 on account of decrease era. Additional, its EBITDA decreased by round 11 per cent to ₹3,262 crore and thereby margins decreased from 60 per cent to 57 per cent. This is likely to be on account of 43 per cent improve in era bills primarily as a consequence of applicability of water cess in Uttarakhand, Sikkim and Madhya Pradesh.

Regardless of being a capex-driven firm, NHPC has a reasonably sturdy debt profile with D/E of round 0.8 instances and curiosity protection ratio of greater than 10 instances.

Outlook and valuation

The corporate has incurred a capex of round ₹4,095 crore throughout H1FY24. The administration has revised the budgeted capex at round ₹9,006 crore for FY24 (from ₹10,857 crore earlier deliberate) which is round 29 per cent increased than the capex incurred in FY23 at round ₹6,961 crore. Additional, NHPC plans to ramp up its capex in FY2024-25 at round ₹11,761 crore.

The corporate presently has an under-construction capability of round 10,449 MW. Because it appears to be like to trip the renewable power wave and the thrust on growing photo voltaic and wind power put in capacities, the under-construction capacities additionally embody 3,135 MW of solar-based.

NHPC trades at practically 23 instances its one-year ahead earnings, which is about 158 per cent increased than its historic five-year common P/E owing to the surge within the inventory worth over the past one 12 months. This has additional led to its dividend yield reducing from round 4 per cent to 1.8 per cent since our final name. Contemplating the steep rise in worth in addition to valuations, buyers can lock into some positive factors on the inventory.

#NHPC #Buyers