Do you need to know whether or not Indian equities (Nifty 50) will outperform the US (Dow Jones Industrial Common), going ahead? Are you questioning whether or not a sector will proceed to outperform the market or if its fortunes will change? Ratio charts, a instrument in technical evaluation, can provide the reply.

All about ratio charts

Ratio charts are constructed by calculating the ratio between two variables on a steady foundation. For higher understanding, allow us to take Nifty and Dow Jones as two variables, as an illustration. As talked about above, if one needs to know whether or not Nifty can outperform the Dow, step one is to calculate the ratio. Nifty divided by the Dow will give us the ratio. Then, take the historic closing values of each the indices for the time-frame that one intends to analyse and calculate the ratio for your entire collection of information. Plotting the identical as a line graph will give the ratio chart. So, a ratio calculated by taking the every day closing worth of Nifty and Dow will give us the every day ratio chart, weekly closing values will give us the weekly ratio chart, and so forth.

When plotting the graph, two situations can come up – one, a rising development and the opposite, a falling one.

The ratio graph can rise when

a) Nifty strikes up – Dow Jones falls, or stays secure/range-bound or rises, however lower than the Nifty

b) Nifty stays secure/range-bound – Dow Jones falls

c) Nifty falls – Dow Jones falls greater than Nifty

The ratio graph can fall when

a) Nifty falls – Dow Jones rises, or stays secure/range-bound or falls however lower than the Nifty

b) Nifty stays secure/range-bound – Dow Jones rises

c) Nifty strikes up – Dow Jones rises greater than Nifty

Find out how to interpret

If the ratio chart is rising, then it implies that the Nifty is outperforming the Dow Jones. Conversely, if the graph is falling, then Nifty is underperforming, and the Dow Jones is outperforming. Please be aware that right here the numerator is the Nifty and denominator is Dow Jones. So, the rise and fall in graph should be interpreted with respect to the numerator, Nifty in our case right here.

Do keep in mind, additionally, that the ratio chart will give us solely the relative efficiency of the 2 parameters getting used — and never the route of absolutely the value motion. That’s, a rising ratio chart doesn’t imply that Nifty will rise. As defined above, even when the Nifty stays secure or in a variety and the Dow Jones falls, the ratio chart can rise.

Find out how to forecast

One of many main benefits of getting a ratio chart is that technical evaluation can be utilized to interpret the chart. All indicators utilized in technical evaluation — such because the trendlines, transferring averages, and so on — might be utilized. So, utilizing these indicators, one can forecast the place the ratio graph is headed. Along with this, when you’ve got the forecast for any one of many ratio variables, you may calculate/forecast the third variable.

Say, you’ve got a forecast that the Nifty/Dow ratio can go up to a degree X from present ranges primarily based in your technical evaluation. When you’ve got the forecast for the Dow Jones as Y, then X multiplied by Y offers you the forecast for the Nifty.

The caveat

An vital issue to contemplate right here is the time interval. The forecast for the ratio and the one variable needs to be executed for a similar interval. That’s, if you’re anticipating the ratio to go as much as the purpose X in, say, three months, then you’ll have to have the forecast for the Dow Jones additionally for a similar time interval of three months. Else, the logic of figuring out the third variable will go mistaken.

Secondly, the forecast on the Nifty can go mistaken if the evaluation or the projections made on the Dow Jones, or the ratio goes mistaken.

Utilizing the above-mentioned approach, we determine how the Nifty can carry out towards the Dow Jones and the sectors over a interval of subsequent six months . Right here is the evaluation.

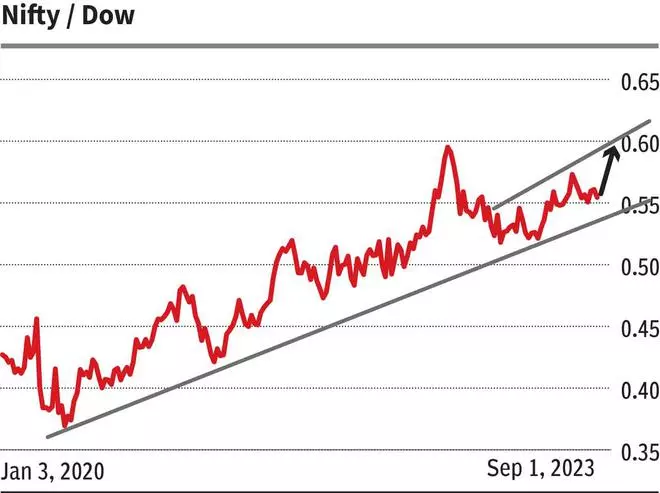

India to outperform the US

The ratio chart indicators that the Nifty is all set to outperform the Dow Jones Industrial Common, going ahead. The Nifty/Dow ratio is presently at 0.5579. It has a robust assist at 0.55, which might be examined within the close to time period. So, if the ratio dips to 0.55 and the Dow Jones stays within the vary of 34,650-34,300, then the latest fall within the Nifty can discover a backside anyplace between 19,000 and 18,850.

From 0.55, Nifty/Dow ratio can see a recent rise focusing on 0.59 and 0.60 over the subsequent six months, that’s, probably within the first quarter of 2024. That may imply that the Nifty will outperform the Dow Jones within the coming months.

On the charts, the Dow Jones has sturdy assist round 34,000. It has potential to focus on 38,000-39,000 over the subsequent six months.

So, because the ratio strikes as much as 0.59-0.60 and the Dow Jones to 38,000-39,000, Nifty might be anyplace within the vary of twenty-two,420-23,400 over the subsequent six months.

Nifty Vs Mid and Smallcap

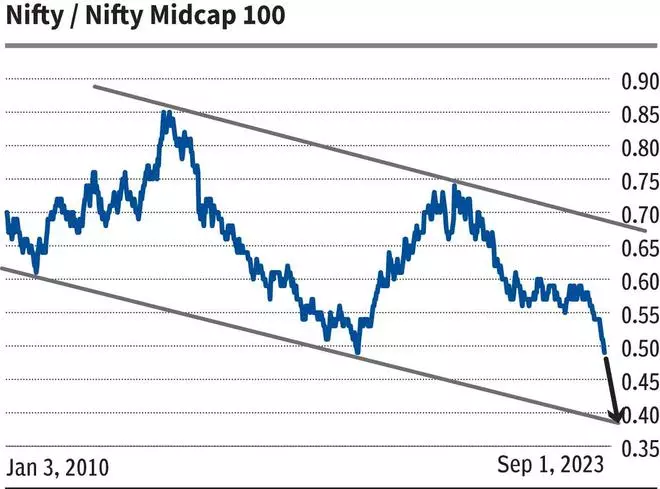

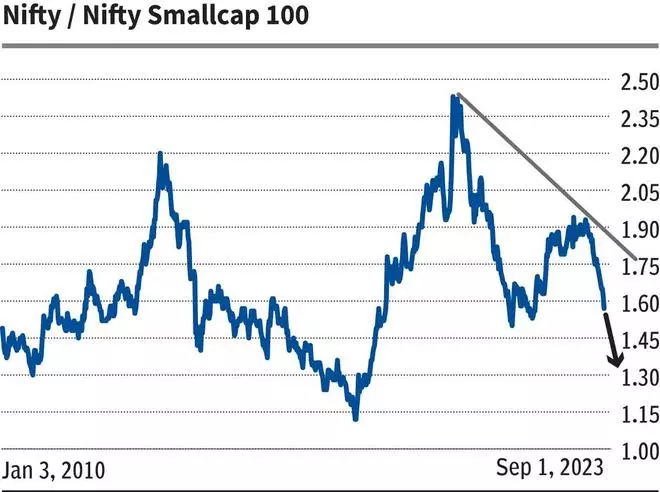

The Midcap and Smallcap indices have outperformed the Nifty this yr. The Nifty Midcap 100 and the Nifty Smallcap 100 indices are up over 25 per cent every to this point this yr whereas the Nifty 50 has risen simply over 7 per cent. Will the smallcap and midcap indices proceed to outperform? Sure, is the reply from the ratio charts.

Nifty/Midcap: The Nifty/Nifty Midcap 100 ratio is presently at 0.50. The development has been down for greater than two years, indicating that the midcap index has been outperforming the Nifty. The ratio can go down to 0.42-0.4 over the subsequent two quarters.

On the chart, the Nifty Midcap 100 index (39,445) has potential to focus on 50,000. For 0.42-0.4 on the ratio and 50,000 on the index, the resultant Nifty values could be 21,000 and 20,000.

Nifty/Smallcap: The Nifty/Nifty Smallcap 100 ratio has been coming down sharply since April this yr. The ratio has damaged beneath a key assist round 1.70. The outlook is bearish. Any intermediate bounce might be capped at 1.70. The ratio can fall to 1.4-1.3 from present ranges.

The Nifty Smallcap 100 (12,386) is trying bullish to focus on 17,000 from right here. So, Nifty will probably be within the vary of twenty-two,100 and 23,800 because the ratio strikes to 1.3-1.4 and the smallcap index rallies to 17,000.

Sectoral outlook

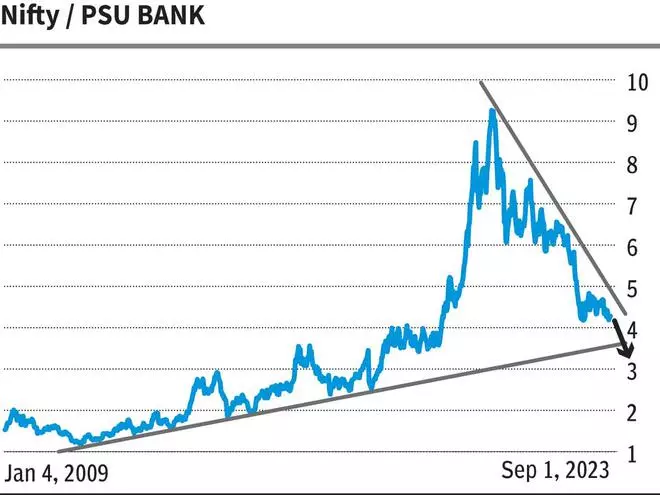

Pharma, IT and PSU Banks are three sectors which are prone to outperform the benchmark index Nifty 50, going ahead. Here’s what the charts say.

Nifty/Nifty PSU Financial institution: The long-term development for the Nifty/Nifty PSU Financial institution ratio has been down since November 2020. The ratio is presently at 4.25. Outlook continues to stay bearish. The ratio can fall to three.8-3.7.

The Nifty PSU Financial institution index (4,538) has risen effectively above its essential resistance stage of 4,000 this yr. Outlook is bullish for the index to focus on 5,800. So, the Nifty will probably be within the vary of 21,460–22,040 if the ratio goes down to three.8-3.7 and the index strikes as much as 5,800.

Nifty/Nifty Pharma: The ratio has been falling since late Might this yr, indicating that the Pharma sector is outperforming the Nifty 50 index. The Nifty/Nifty Pharma ratio is presently at 1.28. It will possibly fall to 1.15.

Nifty Pharma index (15,011) is trying bullish. The index can goal 18,000-18,300 on the upside. So, because the ratio falls to 1.15 and the index strikes as much as 18,000-18,300, Nifty 50 will then be within the vary of 20,700-21,045.

Nifty/IT: The ratio, presently at 0.63, is hovering just under a key development resistance at 0.67. This might simply be the start of a recent leg of downmove within the ratio. A fall to 0.55-0.53 might be seen from right here initially.

The Nifty IT index (31,514) has an vital resistance round 32,300. A powerful break above it will probably take the index as much as 38,000. Consequently, Nifty might be within the vary of 20,140-20,900.

From a long-term perspective, the Nifty/Nifty IT ratio has potential to fall even as much as 0.4. This means that the IT sector, which has been underperforming for greater than a yr now, will turn into sturdy over the subsequent yr or two.

Takeaway

From the entire ratio evaluation illustrated above, it’s clear that the Nifty 50 is prone to rise in the direction of 20,000 and better ranges within the coming months. As such it’s evident that the latest fall within the Nifty is only a correction throughout the total uptrend. A recent leg of upmove is prone to start quickly. So, this can be a ‘purchase on dips’ market.

Nevertheless, if the assumptions, variables forecast goes mistaken, then the view on Nifty will even change accordingly.

#Nifty #Dow #Jones #Smallcap #Midcap #Indices #Ratio #Evaluation #Device #Figuring out #Funding #Alternatives