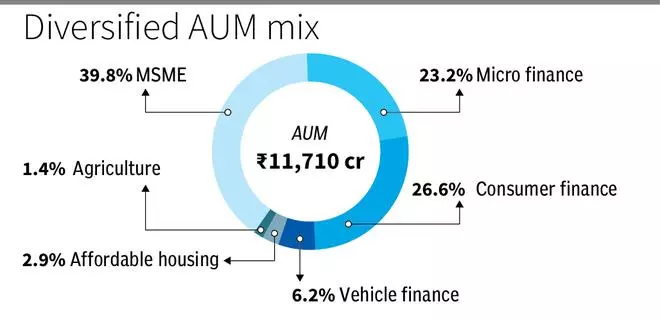

NACL has a diversified enterprise portfolio catering to the retail credit score wants of those six under-served sectors – MSMEs, micro finance (MFI), shopper finance, car finance, reasonably priced housing and agricultural finance. Its area experience stems from 15 years of expertise having facilitated financing of over ₹1.73-lakh crore. A sturdy proprietary tech stack underpins the enterprise. Its enterprise and tech stack are defined intimately later.

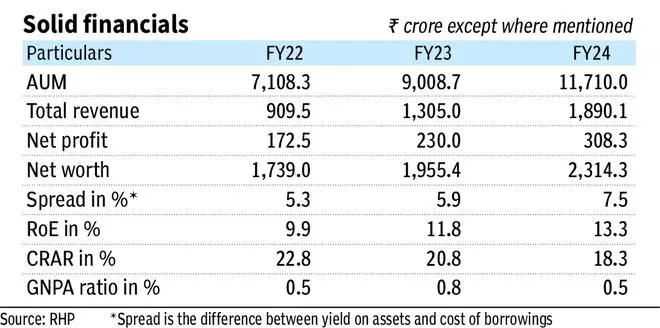

The Indian retail credit score market is anticipated to develop at a fast CAGR of 17-18 per cent between FY24 and FY26 to succeed in ₹100.9-lakh crore. Excellent AUM (property below administration) of NBFCs within the sectors that NACL operates in is anticipated to develop at a blended CAGR of about 16 per cent to ₹26.2-lakh crore by FY26. NACL with a wholesome credit standing (ICRA AA- (Steady)), stable financials and asset high quality (see desk) is properly poised to capitalise on this market alternative.

The difficulty is valued at 1.5 occasions FY24 e book worth on a post-issue foundation. NACL’s friends recognized within the prospectus are valued at anyplace between 1 and seven occasions, with median at 3.5 occasions. At this valuation, the rewards outweigh the inherent dangers of the enterprise akin to credit score danger and cyclicality, making the problem engaging.

Enterprise

NACL broadly has three enterprise verticals – lending, placements and fund administration. The gross transacted quantity (GTV) is a metric that measures the worth of those three companies finished over a monetary yr. Merely put, it’s the summation of the worth of loans disbursed (₹14,885 crore in FY24), worth of loans positioned (₹11,756 crore in FY24), and the worth of AUM of AIFs and PMS schemes managed by the corporate (₹2,683 crore in FY24). Complete GTV in FY24 was ₹29,324 crore.

Over 15 years, it has solid partnerships with 328 originator companions (OPs) and 1,158 investor companions (IPs). OPs are entities akin to NBFCs, NBFC-MFIs, housing finance corporations, fintech platforms and different corporates which have a lending publicity to the six sectors, as mentioned above. IPs embody entities akin to banks, NBFCs, DFIs, mutual funds, non-public wealth and FIIs.

Lending: On this vertical, NACL caters to the retail credit score market by means of two channels – direct to buyer (D2C) lending and intermediate retail lending (IRL).

In D2C lending, loans are disbursed on to debtors by means of the corporate’s branches and retail lending companions (choose OPs who allow NACL to lend on to debtors and from whom NACL avails providers akin to mortgage origination, KYC verification, major borrower interface, assortment and recoveries).

In IRL, the corporate advances loans to OPs or invests within the debt securities of OPs. With these funds, the OPs disburse loans to debtors from the six sectors as seen earlier. This manner, NACL has oblique publicity to such loans.

Earnings from the lending vertical consists of curiosity on loans superior and from debt securities of OPs, modifications in honest worth and realised positive aspects on sale of such securities. This accounts for 96 per cent of the income from operations. D2C loans, IRL loans and IRL investments within the debt securities of OPs make the AUM of NACL. D2C and IRL channels have equal weightage within the AUM.

Placements: On this vertical, NACL acts as a facilitator between OPs on the lookout for funds and IPs on the lookout for alternatives to spend money on the six under-served sectors. On the completion of a profitable transaction, it earns a charge. In FY24, NACL made a charge earnings of 0.28 per cent on the worth of placement transactions through the yr.

Right here’s a simplified illustration to know a typical placement transaction. Let’s say X, an NBFC (OP right here), is on the lookout for funds to disburse ₹100 crore in MFI loans. NACL is aware of Y, a DFI (IP), which is trying to make investments ₹100 crore within the MFI sector. NACL undertakes the due diligence of X on behalf of Y and facilitates the fund elevate for X.

NACL additionally co-invests with IPs in sure transactions and repeatedly screens the monetary well being of the OP to supply consolation to the IP. Such value-added providers differentiate NACL from different facilitators.

All such transactions are drastically enabled by the corporate’s in-house tech stack, a quick on which is given later.

Fund administration: On this vertical, the corporate’s subsidiary NAIM (Northern Arc Funding Managers) manages AIFs and PMS schemes, and earns a fund administration charge. As of FY24-end, NAIM was managing eight dwell AIFs and two PMS funds value an AUM of ₹2,858 crore. Such AIFs and PMS funds spend money on the debt securities of OPs and mid-market corporations working within the six sectors as seen earlier.

The location and fund administration verticals account for the remainder of the income from operations (4 per cent of FY24 income).

Proprietary tech stack

Over 15 years of operations and having facilitated financing of over ₹1.73-lakh crore, the corporate has constructed partnerships with many OPs and IPs and a repository of 35.2 million knowledge factors, which incorporates secondary knowledge from exterior knowledge sources akin to credit score bureaus. This has enabled the corporate to construct sturdy fashions which can be used for analysing pincode-level borrower traits akin to indebtedness and assortment efficiencies. There are three parts to this tech stack.

Nimbus: It’s a curated debt platform that allows circulate of credit score to OPs both by means of NACL’s stability sheet or by means of investments by IPs. It allows end-to-end processing of debt transactions, from mortgage software, credit score analysis, technology of authorized documentation to transaction execution and closure, resulting in effectivity in turnaround time. It additional helps post-transaction monitoring, enabling IPs to evaluate the underlying firm’s efficiency, in order that they are often assured of the security of their investments. NACL has enabled credit score of ₹99,716 crore by means of Nimbus to date.

nPOS: It’s a cloud-based API-enabled market infrastructure platform to streamline the mortgage course of for co-lending by connecting banks and different monetary establishments. It gives a streamlined course of for partnership-based mortgage origination, underwriting, disbursement and assortment reconciliation.

Nu Rating: It’s a customised machine-learning primarily based analytical module designed to help OPs within the mortgage underwriting course of. It presents real-time data-backed danger evaluation for evaluating a borrower. There are 30 danger fashions in all, skilled on the huge repository of information, as mentioned earlier.

This aside, the corporate operates a web based platform known as AltiFi, the place the corporate lists a small portion of its publicity to debt securities of OPs for retail traders to spend money on. Retail traders take pleasure in the advantages of due diligence and steady monitoring of OPs finished by NACL as a by-product of investing on AltiFi.

#Northern #Arc #Capital #IPO #Traders