The choices strike costs noticed uncommon spikes on a minimum of three days, all inside a couple of micro-seconds, triggering widespread cease losses and trapping merchants on the lookout for an exit.

Such spikes have spooked many rich particular person possibility writers who’ve stopped buying and selling or are re-evaluating their methods. Buzz on the Avenue is that some massive excessive frequency merchants (HFT) could also be answerable for the sudden spikes.

- Learn: Retail, rich merchants flip to riskier choices writing

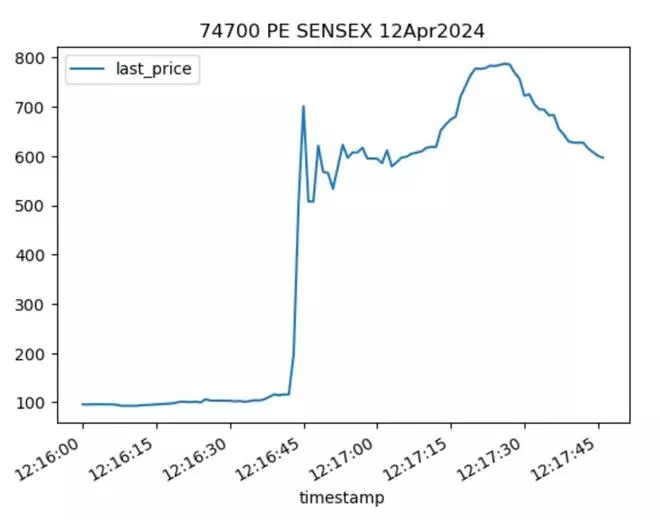

On April 12, the at-the-money choices worth for Sensex, as an illustration, surged from ₹116 to ₹750 inside a couple of seconds, leading to important losses, particularly on the 74,700 PE (put choices).

Momentary spikes

In response to Devarsh Vakil, Deputy Head of Retail Analysis at HDFC Securities, such momentary spikes in costs have additionally been seen in Nifty Monetary Providers.

“Costs come again to regular, however the stop-loss orders get triggered leading to choices writers shedding some huge cash.

“Nifty Monetary Providers and Sensex are extra weak as a result of they’re comparatively newer entrants within the derivatives house and have skinny volumes in some strike costs,” he stated.

To be clear, spikes in choices strike costs have been seen in some form or kind since 2021, when retail volumes began to select up.

The spikes, nonetheless, have been smaller and correlated with the index and will lead to losses of 3-4 per cent for these leveraged and 1-1.5 per cent for individuals who weren’t.

However the spikes have shot up previously few months after the onset of zero-dated choices buying and selling, the place daily is an expiry. The spikes seen in April resulted in losses of 7-10 per cent for individuals who had not hedged their positions.

Counter trades

“The motion in Sensex choices on April 12 is peculiar as a result of whereas the choices costs spiked, Sensex Spot didn’t transfer in any respect. After which it took nearly three minutes for the spot and choices costs to converge,” stated an choices dealer.

An e mail despatched to the exchanges didn’t get an instantaneous response.

Specialists blame the weird exercise on potential counter trades positioned by HFTs. “If it occurred simply as soon as, it might be attributed to crowded trades or methods or some noise out there. However a daily incidence signifies there may be some alpha out there that has been in a position to exploit choices writers’ positions,” stated the choices dealer. Crowding of trades in zero-dated choices by these with only some lakhs of rupees to punt is also accountable.

“Algo buying and selling funds can sniff out helps and resistances primarily based on the volumes getting triggered at every degree. If HFTs determine that they’ll trigger numerous volatility and set off stop-losses for all types of traders and make a killing, they’ll. It’s not manipulation, it’s their enterprise mannequin,” stated the pinnacle of an choices buying and selling platform.

His recommendation to retail traders: Steer clear of zero-dated choices. “HFTs have thousands and thousands of {dollars} at their disposal and their APIs can set off a whole bunch of orders each second. Orders for retail merchants could be restricted to could also be 10 a second,” he stated. “It’s like making an attempt to win a Formulation One race by driving an Alto.”

Pointers: Spikes inside a couple of secs

Nifty Midcap Choose, April 8: The ATM choices worth surged from ₹16 to ₹250. Max losses: 10925 PE (put choices)

Sensex, April 12: The ATM choices worth rose from ₹116 to ₹750. Max losses: 74700 PE

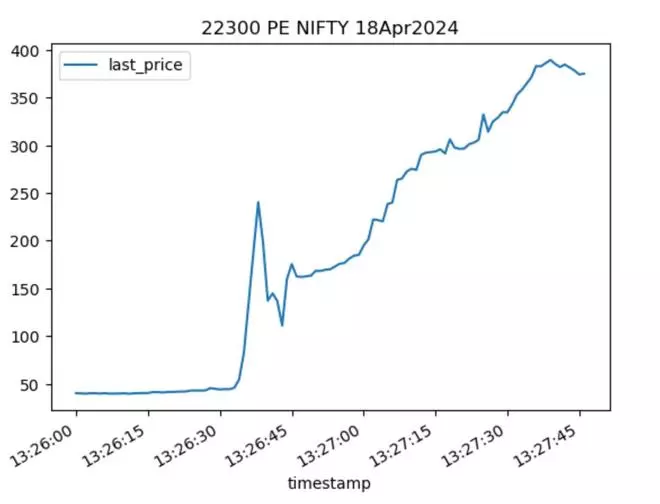

Nifty50, April 18: The ATM choices worth rose from ₹45 to ₹380.Max losses: 22300 PE and 22250 PE

#Choices #writers #enormous #losses #freak #spikes #indices