Since our purchase reco on the inventory in bl.portfolio version dated October 2, 2022, the inventory of OFSS is up by 118 per cent to ₹6,521. Nevertheless, with valuations nonetheless not extreme at one-year ahead PE of 23 instances now, and underlying momentum displaying acceleration with 3Q outcomes, current buyers can proceed to carry the inventory. Respectable dividend yield even after enhance in share value at 3.4 per cent, which could be sustained by robust stability sheet with internet money at 8 per cent of market capitalisation and FY25 estimated free money movement yield (fcf/market cap) at 4 per cent, is an incremental optimistic.

Though OFSS isn’t comparable with IT providers friends, given it’s a merchandise firm, it is going to be value noting that its FY19-24 (E) EPS CAGR at 10 per cent is comparable with massive IT providers gamers (TCS, Infosys, Wipro and HCL Tech) which have progress EPS within the 9-13 per cent vary in the identical time interval. OFSS being a merchandise firm has superior EBIT margins at 42-44 per cent, versus EBIT margins for tier-1 IT service gamers ranging 16-24 per cent, various throughout corporations.

Enterprise

OFSS is a world chief in offering IT options to the monetary providers trade. It provides complete banking functions throughout the spectrum of retail, company and funding banking to monetary establishments. Its know-how options embody core banking know-how and canopy end-to-end necessities (entrance to again workplace) within the monetary providers trade and in addition embody threat administration, analytics and forensic finance.

It’s a software program merchandise firm and earns income by means of licensing, consulting and upkeep charges linked to the product. Its flagship product is Oracle Flexcube. The corporate additionally earns some income from allied providers and BPO. Nevertheless, these at the moment kind a small half, with merchandise income accounting for 90 per cent of complete income. Inside its merchandise enterprise, the corporate has been adapting properly to the altering dynamics within the trade with the shift in direction of SaaS (software program as a service). It has been making investments on this area and a big portion of its banking product portfolio is now obtainable as a cloud service.

OFSS is geographically well-diversified with round 25 per cent of revenues from the US, 15 per cent from Europe, 25 per cent from APAC, 16-17 per cent from the Center East and Africa, round 11 per cent from India and stability from remainder of the world. Usually within the Indian IT area, the US and Europe account for 80-90 per cent of revenues for a lot of corporations. OFSS’s a lot decrease publicity to those geographies and wholesome diversified geographic combine is working to its benefit now as slowdown dangers loom in these two main geographies.

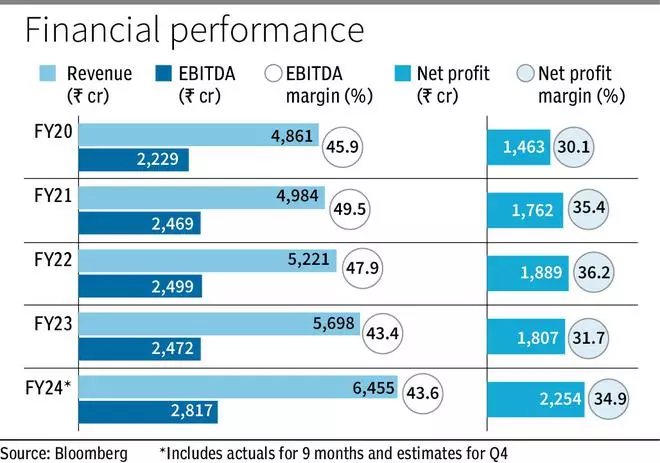

Current efficiency

Within the not too long ago reported Q3 FY24 outcomes, OFSS posted 25 per cent USD Y-o-Y income progress and 26 income per cent progress in INR phrases to ₹1,823.6 crore. This mirrored a strong rebound after progress had turned flattish in earlier two quarters. The outcomes have been pushed by robust underlying momentum with licence wins at $49.5 million, up by 80 per cent Y-o-Y. Offers have been gained throughout conventional on-premise deployments in addition to its cloud/SaaS choices. Based on administration, deal pipeline stays strong throughout areas.

EBIT in Q3 was up by 45 per cent Y-o-Y to ₹849.6 crore, with EBIT margins robust at 46.5 per cent (40.4 per cent in Q3FY23). Internet revenue was up 69 per cent to ₹740.8 crore.

Following the outcomes, the shares have seen a re-rating with trailing one-year ahead PE increasing from 16-17 instances just a few months again to 23 instances now. Given the standard of earnings beat and powerful momentum, the re-rating can maintain, though there could be fluctuations on and off.

As for friends working in comparable subject, Mind Design Area trades at one-year ahead PE of 27.7 instances, whereas Swiss firm Temenos trades at 28.7 instances.

US software program large Oracle Company owns 73 per cent stake in OFSS. On and off, the shortage of readability on what Oracle plans to do with its stake has weighed on the valuations of OFSS, however for a long-term investor, when valuations have compressed on this or different issues, it has really turned out to be a very good shopping for alternative as current share efficiency has proven.

One threat the corporate faces is of buyer focus, with largest buyer accounting for 48 per cent of income and high 5 clients accounting for 66 per cent of income. Whereas a threat to be monitored, this doesn’t seem to have triggered any disruptions to this point.

#Oracle #Monetary #Company #Traders