In keeping with the corporate, the funds raised can be used to arrange 12 new shops in Maharashtra, compensation of sure borrowings and common company functions.

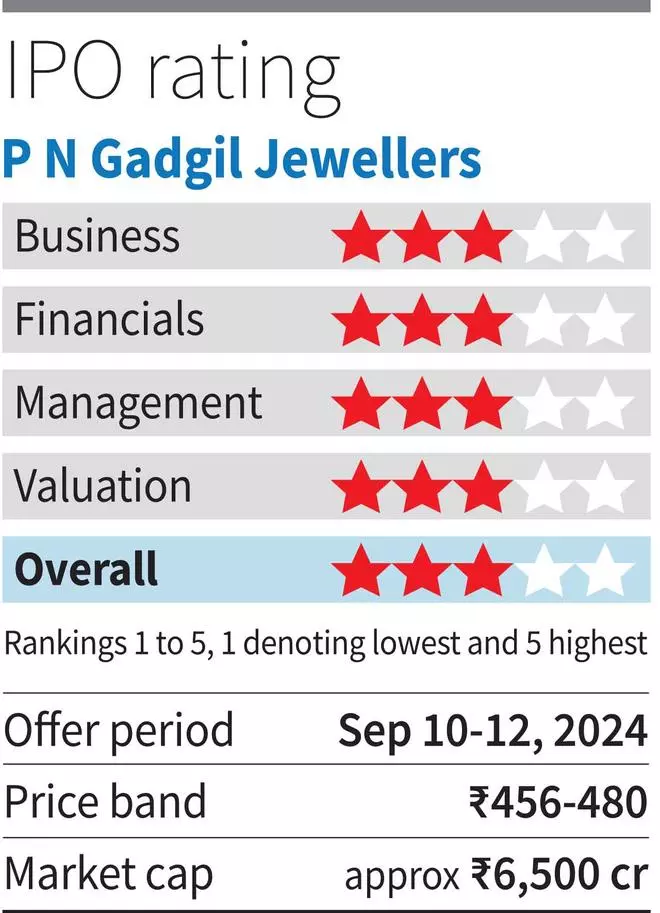

The supply value band is ₹456-480. The corporate is valued at a PE of round 22 occasions its FY24 earnings and the market capitalisation on the higher finish of the worth band is ₹6,514 crore.

Demand for the IPO is powerful, with the difficulty being subscribed by a bit of over two occasions on Day 1 (September 10). Subsequently, there’s a good likelihood the inventory will return good beneficial properties within the quick time period.

Nevertheless, in case you are a basic long-term investor, we suggest that buyers wait and look ahead to the next causes. At a PE of twenty-two occasions, the corporate is cheaper in comparison with friends, however its margins are decrease, and the corporate primarily operates in Maharashtra, and has a better geographic focus danger. Additional, whereas relative attractiveness versus friends may be a plus within the quick time period when market sentiment is buoyant, absolute valuation issues from a long-term perspective. On that side, whereas the corporate isn’t costly, it isn’t low cost both.

Enterprise and progress

The jeweller predominantly operates within the Western area of the nation. As on July 31, the corporate had 39 shops, of which 35 are in Maharashtra. They’re the second largest participant within the state by variety of shops.

Of the 39 shops, 28 are COCO (firm owned firm operated) shops and 11 are FOCO (franchisee-owned and firm operated) shops. Income share of FOCO shops stood at 7.5 per cent in FY2024.

As talked about earlier, the funds raised within the IPO can be used to deepen their presence within the western state.

Though the corporate offers in gold, silver, diamond and platinum, round 92 per cent of the income in 2024 was generated by promoting gold jewelry. Following this, silver jewelry accounted for 3 per cent.

The corporate additionally runs an installment scheme named FPP (future buy plan) via which they’ll generate futures gross sales.

The jewelry trade per se is dominated by unorganised gamers all through the nation. Nevertheless, there was a structural shift in recent times – the share of organised gamers has improved from 30 per cent in FY18 to an estimated 38 per cent in FY24. That is additional estimated to develop to 43 per cent by FY28, in response to a research by Technopak.

Regulatory developments like HUID (Hallmark Distinctive Identification) and implementation of GST have helped the organised gamers. A latest reduce within the gold import responsibility can also be a optimistic for the trade.

Given its geographic focus, the expansion of the corporate is pinned to how Maharashtra grows.

Aside from the precise elements above, as disposable earnings will increase, demand for jewelry, which contributed 7.3 per cent within the retail consumption basket of the nation, can go up. The share of jewelry is forecast to extend to eight.7 per cent of the retail consumption basket in FY27. Additionally, the Indian home jewelry market is anticipated to develop at 16 per cent CAGR to $145 billion in FY28, versus an estimated $80 billion in FY24.

Financials

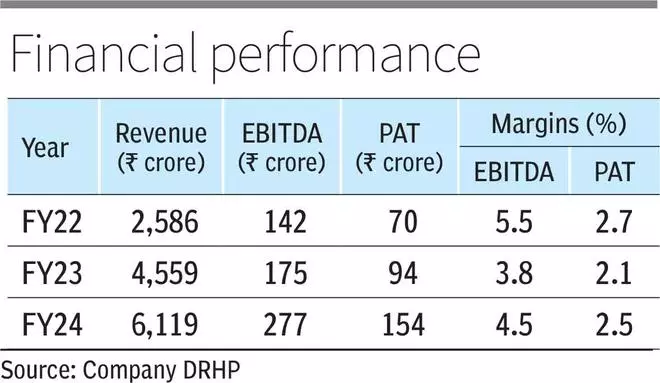

Income expanded 36 per cent year-on-year in FY24 to ₹6,119 crore in FY24. Throughout this time, gold costs, by way of {dollars}, appreciated 13 per cent. Gross sales rising at over and above the rise in value of gold, is indicative of quantity progress.

For the fiscal 2024, EBITDA and PAT stood at ₹277 crore and ₹154 crore, respectively. Thus, EBITDA and PAT margins had been at 4.5 per cent and a couple of.5 per cent respectively.

P N Gadgil Jewellers can also be capable of churn capital effectively as their working capital days, at 51 days, in FY24 is among the lowest. Additionally, income from operations per sq. ft, at ₹6,02,974 within the monetary yr 2024 is among the highest.

Dangers

The jewelry trade per se is extremely aggressive and the margins are often decrease. Significantly for P N Gadgil Jewellers, EBITDA and PAT margins of 4.5 and a couple of.5 per cent, respectively, are low in comparison with key listed friends whose web revenue margins are above 3 per cent.

As well as, fluctuations in gold value can have an effect on profitability and the enterprise additionally requires a big quantity of working capital as gold is their uncooked materials.

Importantly, the corporate primarily operates in Maharashtra and notably, Pune contributed almost 65 per cent of the income in FY24. Subsequently, there exists a substantial focus danger.

The IPO is priced at trailing PE of twenty-two occasions as in comparison with listed friends like Titan Firm, Kalyan Jewellers India and Senco Gold and Thangamayil Jewelry buying and selling at 96, 105, 45 and 48 respectively. Peer valuations have gotten a big increase from optimistic sentiment within the markets and their valuations seem stretched. The identical optimistic sentiment could lead to doable itemizing beneficial properties and near-term efficiency additionally. Nevertheless, absolute valuation issues when one takes a long-term perspective, and on that foundation the IPO isn’t enticing sufficient.

#Gadgil #Jewellers #IPO #subscribe