At bl.portfolio, since our purchase score on the inventory in version dated January 17, 2021, it has delivered a complete return (inclusive of dividends) of 260 per cent. We had remained optimistic all through this era with follow-up calls recommending accumulating the inventory, owing to PGCIL’s close to monopoly standing, cheap valuation, a wholesome dividend yield and an assured earnings mannequin.

At present, from a valuation perspective, PGCIL’s inventory is buying and selling at a trailing Value to E-book (P/B) ratio of three.4 instances, a premium of 80 per cent in comparison with its five-year common of round 1.9 instances. Whereas PGCIL’s enterprise mannequin and stability sheet stay sturdy, offering enough space for incremental capex, buyers would possibly take into account reserving partial earnings as a result of spike in inventory value and valuation. Nevertheless, we don’t advocate an entire exit, as the corporate will proceed to play an important function in India’s vitality transition.

Enterprise

Conferred with Maharatna standing, PGCIL transmits 45 per cent of the facility generated in India by its in depth transmission community, which spans over 1,77,699 circuit km as of March 2024. The majority of PGCIL’s income comes from the facility transmission section, accounting for 96.5 per cent in FY24, with the remaining income derived from different enterprise segments, together with telecom (1.5 per cent) and consultancy (2.0 per cent).

Throughout the transmission section, round 95 per cent of income is generated from regulated tariffs set by the Central Electrical energy Regulatory Fee, with the remaining 5 per cent earned underneath tariff-based aggressive bidding (TBCB). The regulated tariff mannequin ensures an entire pass-through of prices plus a 15.5 per cent pre-tax Return on Fairness (RoE) on accomplished initiatives awarded underneath the regulated tariff mechanism (RTM).

Nevertheless, the RoE for brand spanking new initiatives has been marginally diminished by 50 foundation factors to fifteen.0 per cent, efficient from April 2024 to March 2029. Regardless of this discount, the impression on PGCIL’s earnings is predicted to be minimal, as many of the incremental capability addition shall be primarily based on TBCB fairly than RTM. Underneath TBCB, PGCIL competes with personal sector gamers reminiscent of Adani Vitality Options and Sterlite Transmission.

Efficiency

Over the previous decade, PGCIL has constantly achieved a plant availability issue exceeding 99.5 per cent, properly above the normative degree of 98 per cent. This excessive availability permits it to get well annual transmission prices, which embody the Return on Fairness (RoE), curiosity on time period and dealing capital loans, operations and upkeep, and depreciation.

On the TBCB entrance, PGCIL received 13 initiatives in FY24. The corporate has demonstrated a powerful monitor file in securing TBCB initiatives, profitable one out of three in FY21, three out of 9 in FY22, and 12 out of 18 in FY23. In keeping with the administration, the EBITDA margin for TBCB initiatives has been virtually equal to that of initiatives executed underneath the RTM. As on Might 1, 2024, PGCIL has ₹86,700 crore price of ongoing initiatives, together with ₹26,872 crore in TBCB initiatives.

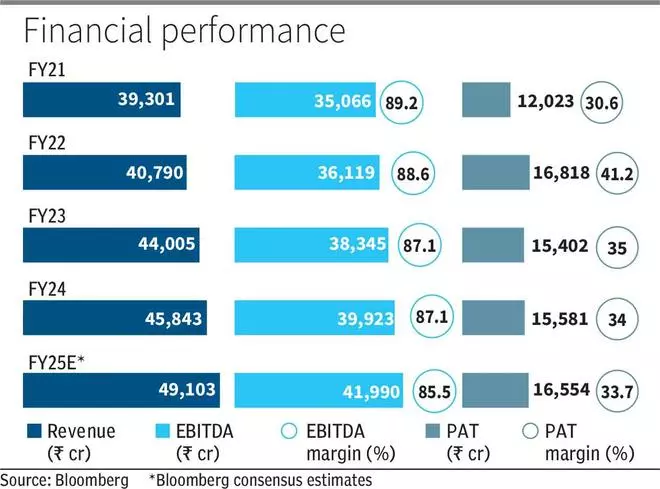

On a consolidated foundation, the corporate’s income from operations in FY24 grew by a modest 4.2 per cent year-on-year (YoY), primarily resulting from a slight decline in gross sales within the transmission section (-0.14 per cent). This decline may be attributed to the slower tempo of asset capitalisation (or venture commercialisation) of ₹7,618 crore, in comparison with earlier steering of over ₹10,000 crore. EBITDA elevated by 4.1 per cent YoY resulting from decrease transmission prices, with margins remaining steady at 87 per cent. Moreover, web revenue noticed a flattish development of 1.2 per cent YoY.

The corporate has constantly diminished its debt-to-equity ratio, from 2.4 instances in FY19 to 1.4 instances in FY24, pushed by steady earnings visibility underpinned by the regulatory return mannequin. In FY24, the corporate paid out dividends of ₹11.25, implying a dividend yield of three.5 per cent with a payout ratio of 67 per cent. In FY24, PGCIL incurred a capital expenditure of ₹12,500 crore, surpassing its dedicated capex of ₹10,000 crore. Wanting forward, administration has revised the capex steering upwards to ₹15,000 crore and anticipates doubling asset capitalisation from ₹7,618 crore in FY24 to ₹15,000-16,000 crore in FY25.

Valuation name

Total enterprise stays steady and good. Nevertheless, the valuations are stretched and deceleration in development in FY24 and subsequent yr or so, may lead to inventory underperforming. PGCIL’s inventory value has returned 190 per cent (290 per cent together with dividends) within the final 5 years whereas the earnings in absolute phrases have elevated by solely 32 per cent on account of modest capitalisation throughout the identical interval.

As per Bloomberg Consensus Estimates, PGCIL is presently buying and selling at a one-year ahead Value to Earnings (PE) ratio of 17.6 instances, a premium of 72 per cent in comparison with its five-year common of 10.3 instances. This additionally seems dear contemplating FY25 earnings development is estimated at 7.1 per cent. Whereas incremental capex within the forthcoming years indicators higher earnings prospect from the next capitalisation base, the inventory value has already factored it in. Therefore, on account of steep rise in valuation leaving much less consolation on margin of security, buyers can take into account partial e book earnings.

#Energy #Grid #moved #sharply #buyers