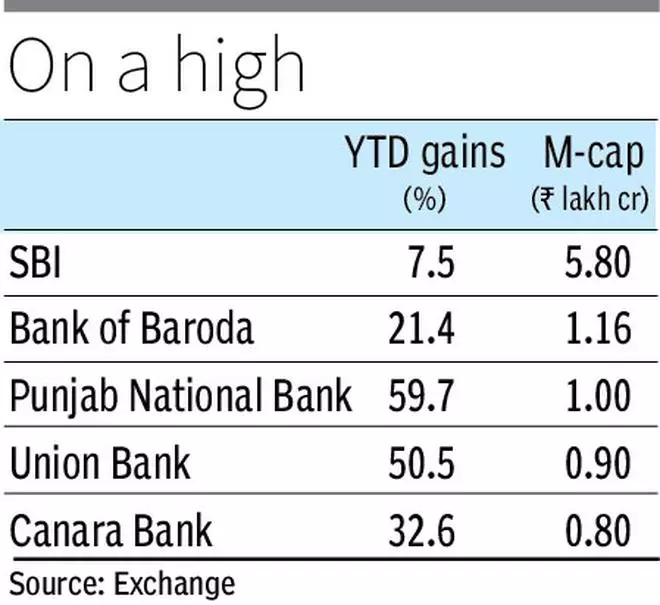

Public sector banks have continued their good run on the bourses this 12 months with the Nifty PSU Financial institution index gaining 33 per cent within the 12 months to this point. For 2- and three-year intervals, the index is up 123 per cent and 226 per cent, respectively.

“The distinction in financials and asset high quality between private and non-private sector banks has shrunk over time. PSBs had been accessible low-cost in comparison with the non-public sector banks. Now that hole is being narrowed, leading to a rally,” stated Deepak Jasani, head of retail analysis at HDFC Securities.

Supporting elements

In accordance with him, public sector banks are buying and selling at a value to adjusted e-book worth of 0.8-2x in contrast with 1.4-4x for his or her non-public sector friends. The previous’s asset high quality has remained steady, the federal government has been giving extra freedom to the financial institution administration and the banks have made nice strides on the know-how entrance.

Additionally learn: Public Sector Banks may even see additional consolidation

PSBs have demonstrated vital enhancements of their working parameters and could also be set for one more spherical of rerating.

“A mirrored image on PSBs valuation historical past could trigger buying and selling multiples to look constrained. Nonetheless, the standard of earnings, progress outlook and broader re-rating in PSU entities will nonetheless allow regular efficiency of the sector,” stated a current notice by Motilal Oswal Monetary Providers.

Choose PSBs now information for RoA of 1.2 per cent in FY25 which suggests scope of continued earnings improve. Over FY23-26, the brokerage estimates earnings CAGR of 24 per cent for PSBs versus 19 per cent for personal banks (adjusted for HDFC Financial institution merger).

Additionally learn: Sensex will hit 1 lakh in 4 years, says Anand Rathi

A number of PSBs have raised capital from the market and have a wholesome tier-1 ratio, which ought to support enterprise progress, significantly because the capex cycle revives submit normal elections.

Vivid outlook

Analysts anticipate PSBs to maintain ongoing earnings traction, aided by improved mortgage progress, margin stability and managed credit score prices, driving continued rerating of the sector.

Additionally learn: Will IREDA inventory be a redux of IRCTC on the bourses?

“PSBs will proceed to do properly in CY24 until the financial system begins to falter. The excitement round merger and privatisation additionally augur properly for these shares. The hole in valuations between PSBs and personal sector friends, nonetheless, will stay due to the better nimbleness and professionalism proven by non-public sector banks,” stated Jasani.

RBI, in its December coverage, has upgraded FY24 GDP progress estimate to 7 per cent year-on-year versus 6.5 per cent in its September coverage. It tasks GDP progress at 6.5 per cent for Q3FY24 and 6 per cent in Q4FY24. The excessive frequency indicators for October and November additionally recommend continued sturdy progress.

“Upward revision in GDP progress forecast and an unchanged financial coverage stance are prone to have a constructive affect for banking shares,” stated a notice by ICICI Securities.

#PSB #shares #maintain #rally #hopes #rerating