Moreover, Indian Railways is within the technique of organising greater than 3,000 km of devoted freight hall (DFC) to draw extra freight visitors.

Concurrently, the Nationwide Railway Plan (NRP) Imaginative and prescient 2030 has been formulated to create a ‘future prepared’ railways by 2030. This Plan is aimed toward growing capabilities to extend modal share of the Railways in freight to 45 per cent. The NRP states that the typical pace is inversely proportional to the transportation price. It’s estimated that if the typical pace of freight practice is elevated to 50 kmph, from 37.8 kmph (as of FY22), then the share of choose commodities transport by railways will rise to 40 per cent from the present 28 per cent.

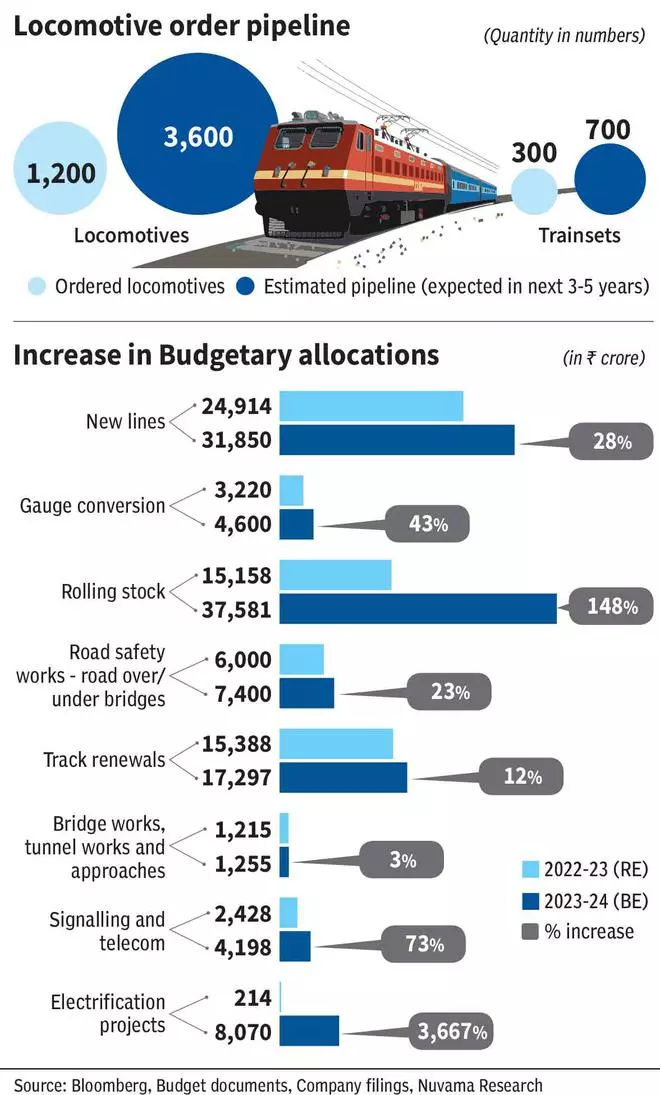

This could require important funding by Indian Railways in modernisation of know-how, high-powered locos, fashionable coaches, and higher tracks. In Price range 2023-24, the allocation for brand spanking new traces, gauge conversion, doubling and observe renewals has elevated by 28 per cent, 43 per cent, 28 per cent and 12 per cent, respectively.

Just some days in the past, the Cupboard Committee on Financial Affairs authorised seven tasks that may improve the railway capability to function passenger and freight trains. These tasks, value ₹32,500 crore, are anticipated to broaden the prevailing community by 2,939 km.

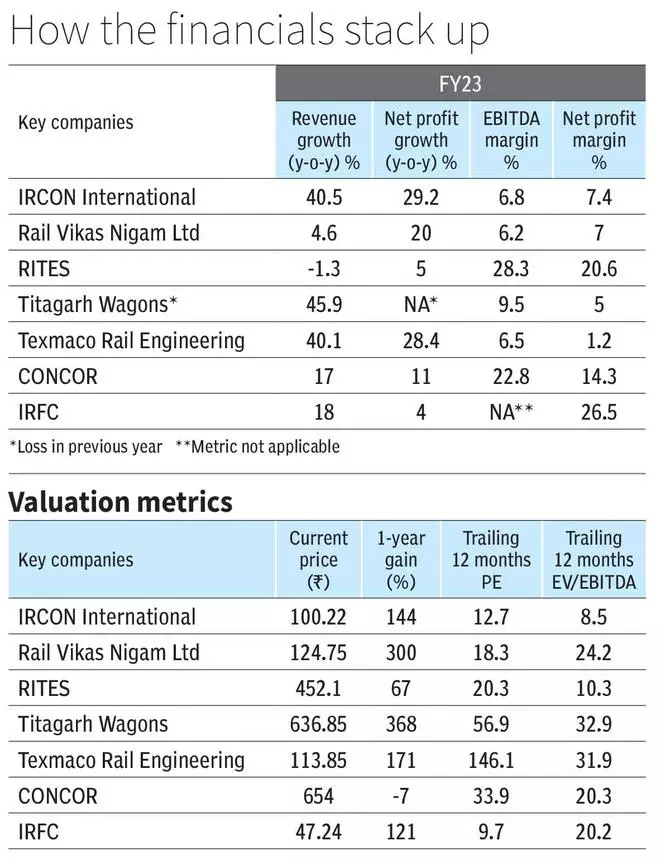

Contemplating all of the motion occurring on this area, here’s a lowdown on the alternatives and the way key gamers are faring.

Rolling inventory

Price range 2023-24 has an allocation of ₹37,581 crore for rolling inventory, which is 148 per cent greater than the earlier Price range. Rolling inventory contains locomotives, wagons, coaches, or every other car(s) utilized by the Railways. Based on a, April 2023 Nuvama report, “Transmission and Railways: Decadal thrust”, the longer term tender pipeline of Railways contains 600-700 Vande Bharat practice units over 4-5 years, 1,100-1,200 electrical loco tenders annualy over subsequent 3 years ,new RRTS (Speedy regional transport service) corridors and metro expansions throughout city and tier-2/3 cities.

This implies monumental potential for the producers of rolling inventory and its worth chain companions. The principle gamers on this phase are Siemens, Alstom and Medha Servo; out of those, Siemens is listed on Indian bourses. In January 2023, Siemens acquired an order to fabricate 1,200 electrical locomotives and to offer service and upkeep for 35 years. The overall worth of the undertaking is ₹26,000 crore.

Among the many different distinguished listed gamers on this area are Titagarh Wagons, Texmaco Rail & Engineering, Rail Vikas Nigam Ltd (RVNL), Bharat Earth Movers (BEML) and Bharat Heavy Electricals (BHEL). BHEL, Siemens and Alstom have the capability to fabricate sure locomotives on their very own whereas different corporations enter into joint ventures with Indian or overseas producers.

In current instances, Indian Railways known as for tender to award undertaking value ₹58,000 crore for manufacturing and upkeep of 200 Vande Bharat practice units. The three way partnership of RVNL and Russian producer Metrowagonmash secured the contract to fabricate and preserve 120 Vande Bharat trains. The order for the remaining 80 trains was bagged by the JV of BHEL and Titagarh Wagons.

Railway Infrastructure improvement

In Price range 2023-24, the allocation to gauge conversion works was ₹4,600 crore, 43 per cent greater YoY; new traces works was allotted ₹31,850 crore, which is 28 per cent greater YoY; observe doubling has been offered ₹30,749 crore and highway over/underbridges was allotted ₹7,400 crore, which is 23 per cent greater YoY. That is constructive for EPC corporations that perform railway works. Railway tasks are largely awarded on EPC foundation and would not have variants like BOT (Construct function switch) or HAM (Hybrid Annuity mannequin) not like highway tasks. The notable corporations working on this area are RVNL, Ircon Worldwide, L&T Building, ARSS Infrastructure Initiatives, and Okay&R Rail Engineering.

RVNL and Ircon worldwide are two PSUs of Indian Railways that specialise within the building of transport infrastructure. Being railway enterprises, each have tasks akin to tunnelling, observe works and electrification, as their core competency however in addition they undertake different tasks, akin to roads and bridges. Ircon Worldwide, because the identify suggests, operates in overseas markets additionally — primarily in central Asia, Africa, South-East Asia and Australia.

Being PSUs, these corporations have a bonus, i.e., they might generally obtain orders from authorities on a nomination foundation. Ircon worldwide has 55 per cent of order e book (Q1FY24) on nomination foundation and RVNL practically 65 per cent of its FY23 order e book. Ircon has acquired contract for 2 packages in Ahmedabad-Mumbai excessive pace rail, for round ₹6,857.2 crore, RVNL has acquired a contract for tunnel design and building together with observe and electrical works for ₹1,088 crore from Haryana Rail Infrastructure Improvement Company.

Rail India Technical and Financial Service (RITES), an engineering and consultancy agency, is an Indian Railways enterprise. It supplies a complete vary of providers — from idea to commissioning — in all sides of transport infrastructure and associated applied sciences. The corporate derives 53 per cent of income from consultancy; 33 per cent income flows from turnkey tasks and 6 per cent and eight per cent, respectively, from leasing and exports. In Q1FY24, RITES secured new tasks and extensions value ₹306 crore.

IRFC is an NBFC owned by Indian Railways, whose mandate is to finance the enlargement plans of the latter. The funds raised by this firm are further budgetary assets i.e., off Price range. The corporate raises funds in an effort to purchase rolling inventory property after which leases to Railways in lieu of lease funds, which is 38.87 per cent of its AUM (Belongings underneath administration) as on June 30, 2023. The second element is leasing of railway infrastructure property and nationwide tasks of the federal government, which is 59.86 per cent of its AUM. The corporate has a hard and fast markup on the lease funds which is 0.4 per cent for rolling inventory leases and 0.35 per cent for undertaking property. Along with this it additionally offers loans and advances to PSUs like IRCON and RVNL. Since 98.73 per cent of its AUM is to railways and balace to Railway PSUs the default danger is low.

Metro Rail

Moreover the normal segments ofRailways, i.e. freight and passenger trains, new segments in passenger trains, akin to high-speed railways and RRTS (Speedy regional transport providers), are being added. To reinforce city infrastructure, new metros are being established in tier 2 cities and current metros are being expanded. This opens up alternatives for each locomotives and practice units producers as additionally EPC contractors.

In June 2023, RVNL acquired orders value ₹11,256 crore from Chennai Metro to assemble 5 underground metro stations. In April 2023, the three way partnership of RVNL and Siemens secured two main contracts from Gujarat Metro Rail Company, value ₹1,057.46 crore, for provide and electrification techniques for Ahmedabad Metro part 2. French locomotive producer Alstom, in March 2023, began the manufacturing of Movia metro passenger trains for the Bhopal and Indore Metro tasks. The corporate was awarded the contract in July 2022, for manufacturing 156 trains with 15 years of complete upkeep.

A significant participant having end-to-end functionality in growing metro community in India is Larsen & Toubro (L&T). L&T has presence in each India and overseas international locations, in growing metro stations and contours. By way of its Heavy Civil Infrastructure enterprise vertical, L&T can construct elevated rail corridors, station buildings; the observe laying will be achieved by its Transportation Infrastructure & Railways companies; observe electrification by Energy Transmission & Distribution companies and whole mechanisation by its Railways enterprise and expansive depots.

L&T has developed Hyderabad Metro, Chennai Metro, Delhi Metro, Ahmedabad Metro and Lucknow Metro in India and Riyadh Metro, Doha Metro and Dhaka Metro globally. In June 2023, L&T was awarded two track-work contracts with a complete worth of ₹500.94 crore for Bengaluru Metro’s 56-km Line-5.

Signalling, observe administration techniques and energy transmission

Railways requires a complete and dependable signalling and observe administration system. In Price range 2023-24, the allocation for signalling and telecom was ₹4,198 crore — 73 per cent greater YoY. The signalling and telecom of Indian Railways is taken care of by its Sign and Telecommunication division.

There are additionally personal corporations that offer Signalling, Prepare Collision Avoidance system and Prepare Administration system. The key corporations offering these techniques are KEC, Kernex Microsystems and HBL Energy Methods. These corporations could get direct orders from Railways or subcontracts from the unique EPC contractors of Indian Railways. Kernex Microsystems secured orders value ₹563 crore through the fiscal 12 months 2022–23. The corporate has additionally acquired orders from Integral Coach Manufacturing facility (ICF) Chennai value ₹26.7 crore for provide, set up, and commissioning of a Prepare Collision Avoidance System (TCAS) (also called Kavach) for 39 items, with a focused completion date of July 31, 2023. In June 2023, HBL Energy Methods gained an order from Ashoka Buildcon value ₹135 crore.

KEC is an infrastructure developer and EPC contractor with numerous experience. Its railways phase is concerned in overhead electrification, signalling and telecommunication, traction substations, doubling of tracks, and many others. The corporate, in June 2023, acquired two orders value ₹600 crore for Prepare Collision Avoidance System. Kalpataru Initiatives Worldwide can be into comparable enterprise lwhere it undertakes civil works like bridges, tunnels, stations, and many others, alongside observe upkeep and energy transmission. In February 2023, the corporate bagged orders value ₹299 from Railways.

These are the broad avenues throughout the Railways and the important thing corporations collaborating within the ongoing infrastructure constructing/capex theme. Do notice, only some corporations talked about above have both their full enterprise or a significant a part of their enterprise coming from the Railways. Subsequently, buyers must verify the proportion of railways within the total enterprise of a participant to get the fitting perspective.

Devoted Freight Corridors

Based on a Jefferies report launched final 12 months, transportation above 330 km is cheaper on railways than roadways. Nevertheless, whereas solely 36 per cent of the overall cargo in India has a lead distance of lower than 300 km, roadways carry practically 60 per cent of whole freight within the nation. Railways transfer a mere 31 per cent of whole freight. Although freight visitors generates greater revenues for the Railways, passenger trains and freight trains share the identical infrastructure and therefore, there was a limitation on utilization of this mode.

Subsequently, the federal government has give you Devoted Freight Corridors or DFCs.

DFC will cater to the rising freight transportation demand and assist deal with capability constraints. At present two DFCs are being developed; Western DFC connecting Dadri in Uttar Pradesh to Jawaharlal Nehru Port in Mumbai, which will likely be 1,506 route kilometres (Rkms) and Jap DFC connecting Ludhiana in Punjab to Dankuni in West Bengal, of 1,875 Rkms.

Round 1,046 Rkms of Western DFC has been commissioned, which is 69 per cent of the overall route, and the steadiness is figure in progress. In case of Jap DFC, 1,150 Rkms have been commissioned, constituting 61 per cent of the overall route.

Devoted Freight Corridors are anticipated to carry effectivity to freight transportation by rail. The key profit is the diminished working price. For e.g., the double stacking of containers and longer trains can scale back the per unit working price; the usage of electrical locomotives could scale back the general vitality price. DFCs are anticipated to allow trains to journey at speeds as excessive as 100 kmph, which can scale back the transit time of the cargo being carried. They’ll profit logistics corporations like CONCOR, Gateway distriparks and Allcargo logistics.

#Railway #shares #Driving #infrastructure #increase #Alternatives #Key #Gamers