That is aimed toward offering a extra up-to-date image of a borrower’s indebtedness.

At current credit score establishments (CIs) or lenders are required to report the credit score info of their debtors to credit score info corporations (CICs) at month-to-month or such shorter intervals as mutually agreed between the CI and CIC.

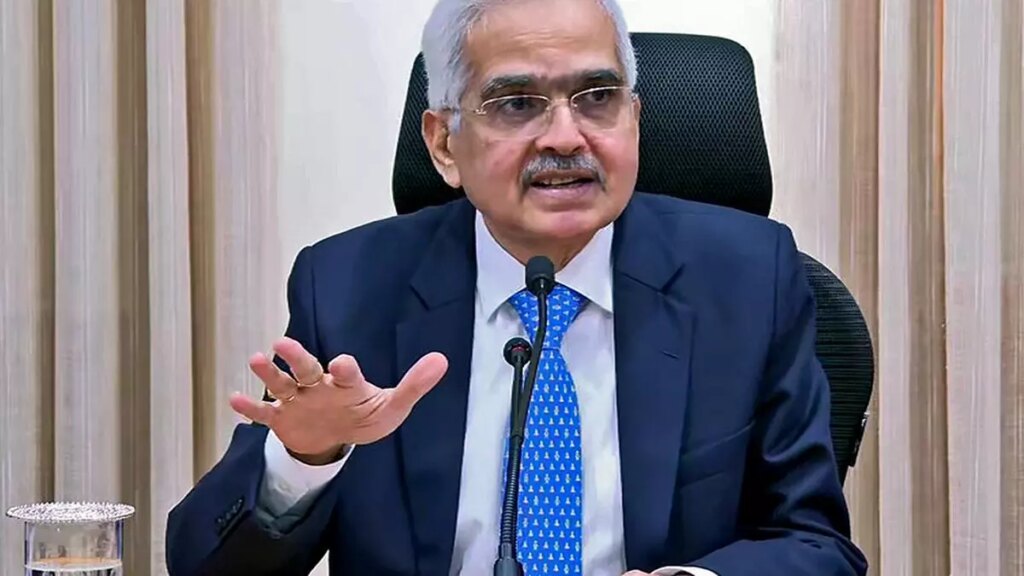

“The fortnightly reporting frequency would be certain that credit score info experiences offered by CICs mirror a more moderen info. This shall be helpful to each debtors and lenders (Cis),” RBI Governor Shaktikanta Das stated.

Debtors will benefit from sooner updation of data, particularly after they have repaid the loans. Lenders will be capable to make higher threat evaluation of debtors and in addition scale back the danger of over-leveraging by debtors.

CICs will now be required to ingest credit score info/ information acquired from the CIs, as per their information acceptance guidelines, inside 5 calendar days (in opposition to seven calendar days earlier) of its receipt from the CIs.

The central financial institution stated its directions on “frequency of reporting of credit score info by CIs to CICs” shall be efficient from January 1, 2025. Nonetheless, the CIs and CICs are inspired to provide impact to those directions as expeditiously as possible however not later than January 1, 2025.

CICs have been requested to supply a listing of CIs which aren’t adhering to the fortnightly information submission timelines to Division of Supervision, Reserve Financial institution of India, Central Workplace at half yearly intervals (as on March 31 and September 30 annually) for info and monitoring functions.

#RBI #will increase #frequency #reporting #credit score #info #lenders #credit score #information #corporations