- Additionally learn:RBI Financial Coverage 2024 reactions

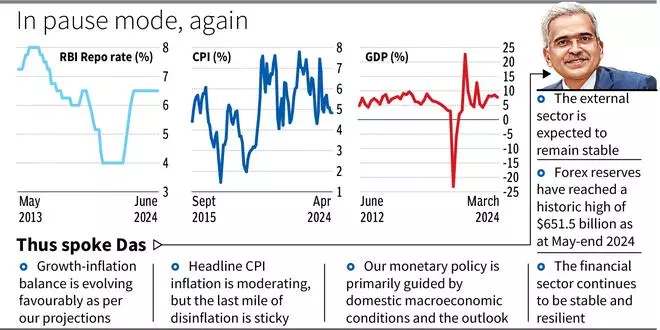

The MPC has been on pause mode for about 16 months now. The final time there was a charge motion was on February 8, 2023, when the repo charge (the rate of interest at which banks draw funds from RBI to beat short-term liquidity mismatches) was upped from 6.25 per cent to six.50 per cent.

“Development-inflation stability is evolving favorably as per our projections. Headline CPI inflation is moderating, however the final mile of disinflation is sticky; our goal is 4 per cent on a sturdy foundation and we are going to work in the direction of that,” Governor Shaktikanta Das stated on the post-Financial Coverage press convention.

Vibrant GDP development outlook

The Governor emphasised that the GDP development outlook is vivid, and the momentum of financial exercise is effectively sustained. The central financial institution has revised FY25 actual GDP development projection upwards to 7.2 per cent from the sooner 7 per cent projection in an indication that financial exercise is more likely to decide up additional momentum.

Nevertheless, CPI (retail) inflation projection for FY25 has been left unchanged at 4.5 per cent.

Elephant (inflation) strolling slowly

“The elephant (inflation), as standard, is strolling very slowly…We’re watchful, and we wish the elephant to enter the forest and be there (within the sense that we wish inflation to align with the goal and be there on a sturdy foundation).

“The final mile of our journey in the direction of 4 per cent (inflation goal) may be very sticky and that’s the case world over….As soon as inflation reaches 4 per cent on a sturdy foundation, we are able to then consider additional financial coverage motion,” Das stated.

The Governor noticed that whereas the MPC took notice of the disinflation achieved to date with out hurting development, it stays vigilant to any upside dangers to inflation, significantly from meals inflation, which may presumably derail the trail of disinflation.

Therefore, financial coverage should proceed to stay disinflationary and be resolute in its dedication to aligning inflation to the 4 per cent goal on a sturdy foundation. Sustained value stability would set robust foundations for a interval of excessive development, Das stated.

On proper observe

On inflation, the Governor stated RBI is heading in the right direction, however there may be nonetheless work to be finished.

He stated that globally, there are considerations that the final mile of disinflation may be protracted and arduous amidst persevering with geopolitical conflicts, provide disruptions and commodity value volatility.

“In India, with development holding agency, financial coverage has larger elbow room to pursue value stability to make sure that inflation aligns to the goal on a sturdy foundation.

“In its present setting, financial coverage stays squarely targeted on value stability to successfully anchor inflation expectations and supply the required basis for sustained development over a time period,” Das stated.

Not guided by ‘observe the Fed’ precept

Referring to a view that in issues of financial coverage, the RBI is guided by the precept of ‘observe the Fed’. the Governor stated: “I want to unambiguously state that whereas we do maintain a watch on whether or not clouds are build up or clearing out within the distant horizon, we play the sport in accordance with the native climate and pitch situations.

“In different phrases, whereas we do take into account the impression of financial coverage in superior economies on Indian markets, our actions are primarily decided by home growth-inflation situations and the outlook. “

Abheek Barua, Chief Economist and Government Vice-President, HDFC Financial institution, stated the RBI stays in a wait and watch mode to evaluate home developments just like the monsoon efficiency, meals inflation and the brand new fiscal technique earlier than transferring on charges.

- Additionally learn: RBI plans a digital intelligence platform to detect fraud

“We proceed to see the potential of a charge lower in This fall (October-December) 2024.

“Regardless of the Governor’s emphasis that financial coverage choices are pushed primarily by home issues, we predict that any charge lower motion may find yourself being aligned with the timing of the Fed’s charge lower cycle to restrict monetary market volatility,” Barua stated.

#RBI #coverage #charges #unchanged #waits #inflation #fall #durably