- Additionally learn:RBI intently monitoring incoming information on unsecured retail loans

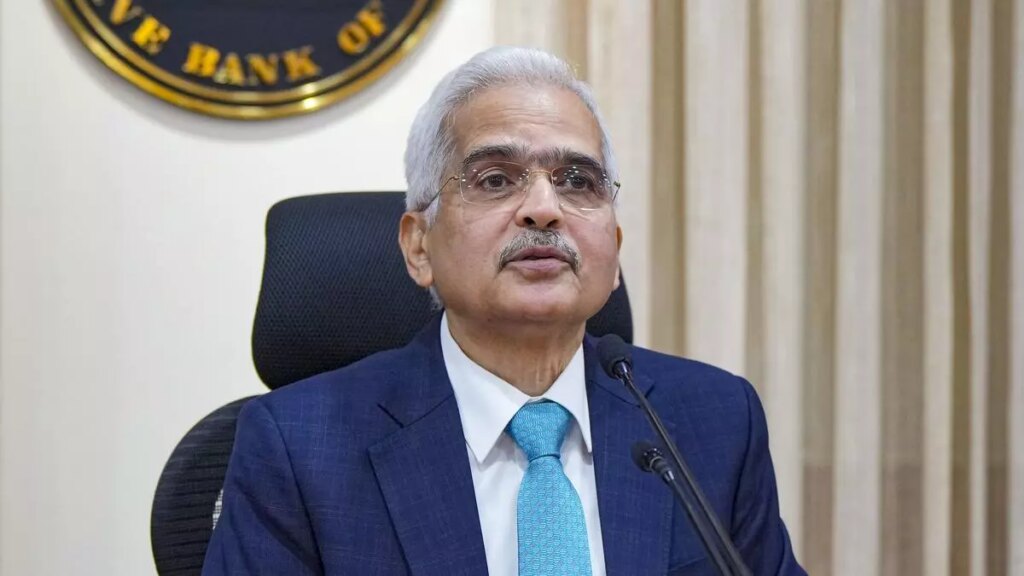

Shaktikanta Das, Governor, RBI, mentioned rising situations of digital fee frauds spotlight the necessity for a system-wide strategy to forestall and mitigate digital frauds.

It’s, due to this fact, proposed to ascertain a digital funds intelligence platform which might share date on information real-time throughout the digital funds’ ecosystem, he mentioned.

Panel shaped

RBI has constituted a committee to look at numerous features of establishing the platform, he mentioned.

Digital fee fraud has witnessed a pointy bounce of over five-fold to a document ₹1,457 crore within the fiscal yr ended March 2024, in line with the RBI annual report.

The alarming improve coincides with explosive progress of 137 per cent in UPI transactions previously two years to the touch ₹200-lakh crore, as per RBI information. Digital funds, together with card and web transactions, accounted for 10 per cent of the full fraud quantity in FY24, a rise from 1.1 per cent within the earlier fiscal yr.

Anand Kumar Bajaj, Founder, MD & CEO, PayNearby, mentioned the digital funds intelligence platform initiative by the RBI will improve the safety and transparency of monetary system, lowering fraud dangers and constructing belief amongst customers.

Prashanth Ramdas, Associate, Khaitan & Co mentioned whereas the RBI and NPCI have been implementing safety measures on every buyer going through fee system, this transfer would leverage know-how and real-time information sharing structure to detect and mitigate frauds.

This could even be important in bolstering buyer confidence and boosting monetary inclusion, he added.

Amit Sachdev, COO, M1xchange, mentioned the proposed platform will allow entry to very important further info on frauds and improve the efficacy of Digital Credit score Analytics enabled on TReDS.

- Additionally learn:RBI plans to boost bulk deposit restrict to ₹3 crore from ₹2 crore

Ankit Ratan, Co-founder & CEO, Signzy, mentioned the platform will leverage superior applied sciences comparable to AI and machine studying to establish and mitigate fraud dangers, in the end resulting in a safer digital funds’ setting.

The excellent measures will empower the trade to ship a safer and trusted digital ecosystem for all, he added.

#RBI #plans #digital #intelligence #platform #detect #fraud