The value of the yellow metallic noticed a rally within the December quarter, triggered by the Israel-Hamas conflict. When it comes to greenback, the common value of gold for Q3-FY24 was $1,972 per ounce, 14 per cent larger when in comparison with $1,726 in the identical quarter of the earlier 12 months. Within the home market, the Q3-FY24 common value of gold futures stood at ₹57,888 per 10 gram, 16 per cent larger as in opposition to ₹49,990, its Q3-FY23 common value.

The share value of Thangamayil Jewelry appreciated by 6 per cent final week as the corporate’s margins improved and internet revenue doubled for the quarter year-on-year (yoy). Quite the opposite, the inventory of Titan Firm and Kalyan Jewellers declined 4 and a couple of per cent respectively as their margins dipped. Another excuse might be profit-booking by merchants/buyers because the shares have run up on the expectations of a robust quarter on the again of festive demand.

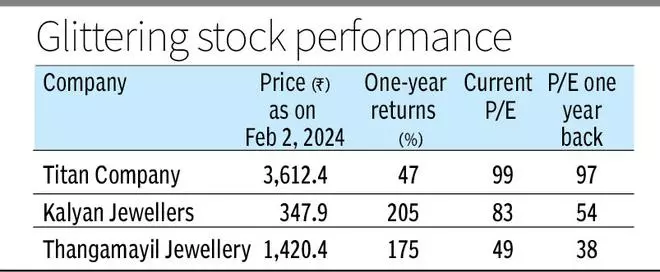

Over the previous 12 months, the jewelry shares have given a stellar efficiency (refer desk), comfortably beating the benchmark Nifty 50. Consequently, the valuation of the shares now stands stretched. The trailing price-earnings of Titan, Kalyan and Thangamayil stood at 99, 65 and 31 respectively.

Outcomes roundup

The highest line yoy progress of Titan Firm, Kalyan Jewelry and Thangamayil Jewelry for Q3-FY24 stood at 22, 34 and 20 per cent (refer desk).

For Titan, aside from EyeCare (de-grew 4 per cent yoy), different segments noticed progress in income. Jewelry, which contributes to almost 80 per cent of the whole income, noticed a progress of 23 per cent. New consumers’ contribution was at almost a wholesome 50 per cent. Income of CaratLane, a significant subsidiary, grew 32 per cent. There was a dip in internet revenue margin by 50 foundation factors (bps) yoy to 7.5 per cent in December quarter as a consequence of mushy demand in studded i.e., diamond jewelry during which the margins are typically larger than gold jewelry.

Kalyan Jewellers’ India enterprise remained strong because the home gross sales expanded by about 40 per cent pushed by robust identical retailer gross sales progress (SSSG). New buyer additions stood at over 38 per cent. Web revenue margin shrank by 30 bps to three.5 per cent due to the next share of income from franchised showrooms. General, the corporate added a internet 22 shops through the quarter.

Thangamayil Jewelry’s internet revenue doubled in Q3-FY24 to ₹28 crore versus ₹13.8 crore within the corresponding quarter of the earlier 12 months. A list achieve of about ₹65 crore boosted the underside line. Thus, the online revenue margin shot as much as 3.1 per cent for third quarter FY24 in comparison with 1.8 per cent for a similar quarter of the earlier 12 months. This was as a consequence of appreciable enhance in quantity of diamond merchandise. The corporate bought 4,098 carats in Q3-2024 versus 2,791 carats in Q3-2023, a 47 per cent soar. Nonetheless, the non-gold gross sales contribution is slightly below 10 per cent.

Going forward, gold costs are prone to go up. If the rise occurs at a modest tempo, the hit on jewelry demand may be decrease. But when the value rises sharply, the demand can take a success within the coming quarters. Additionally, the valuation has expanded significantly within the final 12 months. Therefore, broadly, the dangers now appear to outweigh the reward. Due to this fact, buyers trying to purchase jewelry inventory afresh can wait.

#Actuality #Test #Jewelry #Shares #Festive #Demand #Boosts #Income