Delhivery is one in every of India’s largest fully-integrated logistics supplier with a attain of 18,675 Pin Codes out of 19,101 in India (almost 98 per cent). It operates 5 main income segments: 1) Specific Parcel (EP), 2) Half Truck Load (PTL), 3) Truck Load (TL), 4) Provide Chain Companies (SCS), and 5) Cross Border Companies (CBS). Based in 2011, Delhivery was largely a third-party B2C e-commerce logistics firm for a few years, with EP contributing over 80 per cent of income in FY20.

As e-commerce platforms diminished overdependence on third-party service companions/distributors, the publicity to a single service supplier was usually restricted to 10-15 per cent of the regional volumes by then. With elevated competitors, there was restricted pricing energy for service suppliers akin to Delhivery. Nonetheless, after the acquisition of Bengaluru-based Spoton in August ‘22, Delhivery was capable of strengthen its B2B capabilities. On the finish of FY23, EP’s income share was at 63 per cent with Half Truck Load and Truck Load contributing 16 per cent and 6 per cent respectively.

What units Delhivery aside is its prowess in expertise and automation. It is without doubt one of the few logistics corporations of scale to function a mesh community. Usually, logistics corporations function a hub-and-spoke mannequin, which is less complicated to function however has a number of drawbacks. It may result in slower response occasions, fragmented customer support and better stock prices. Then again, mesh networks are rather more environment friendly and resilient. Additionally, they are often simply prolonged.

Investments haven’t translated into outcomes

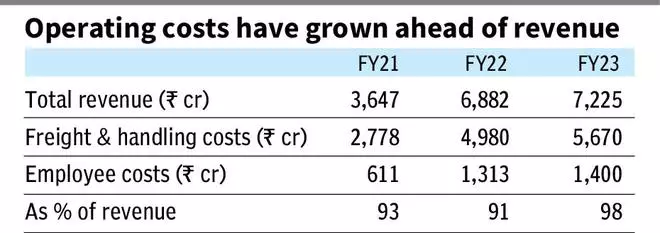

With a purpose to construct these capabilities, Delhivery has, on a median, spent 8 per cent of income on capital expenditure throughout FY19-23. That was anticipated to enhance effectivity and thereby end in higher profitability as volumes elevated. Sadly, the investments haven’t translated into higher monetary efficiency. A good portion of income continues to be spent on freight dealing with and workers. In FY23, freight & dealing with prices grew 13.8 per cent YoY even when income grew by simply round 5 per cent.

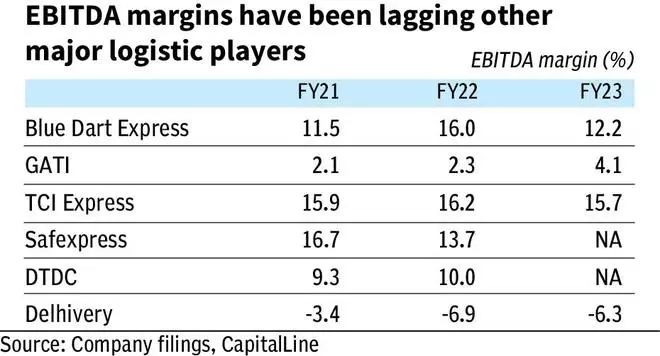

In consequence, regardless of a income CAGR of 45 per cent (FY19-23), margins on the EBITDA degree proceed to be unfavourable, lagging different main gamers within the logistics business. Blue Dart, for example, has greater than doubled its margin throughout this time.

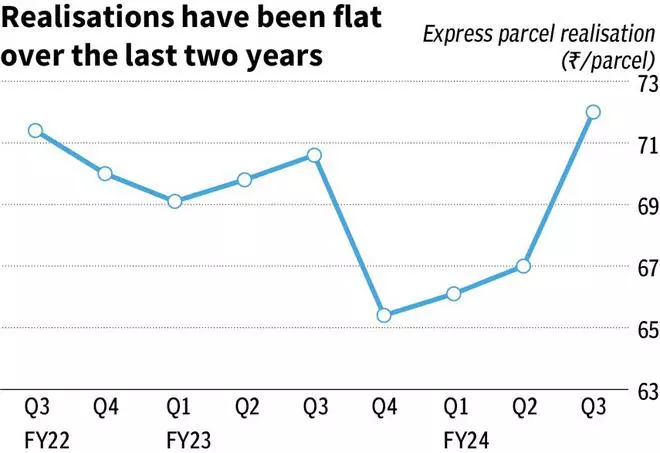

Once we break down the numbers at a extra granular degree, it’s evident that each volumes and realisations haven’t grown in keeping with the investments of the previous. Throughout 3QFY22-24, realisations in EP and PTL have been flat. Whereas EP volumes registered a CAGR of 8.7 per cent throughout this era, CAGR for PTL volumes was unfavourable 10.6 per cent.

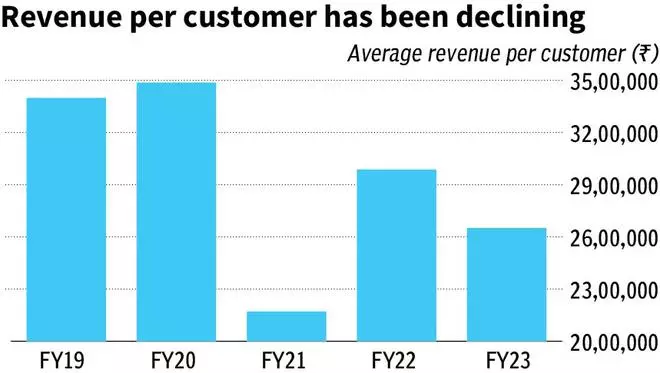

The variety of energetic clients has elevated at a CAGR of 53.8 per cent throughout FY19-23. Whereas there have been indications that many non-profitable clients have been offloaded, the typical income per buyer has declined at a CAGR of unfavourable 6 per cent.

Given the heightened competitiveness within the logistics area, realisations might proceed to be underneath stress. The inventory is at present buying and selling at 3x EV/gross sales, which is in keeping with its historic common. Bloomberg consensus estimates 18 per cent income CAGR throughout FY23-26, which seems too optimistic. We imagine that there’s extra draw back danger on the present valuations, particularly if the monetary efficiency continues to be underwhelming.

#Actuality #Examine #Progress #Report #Delhivery