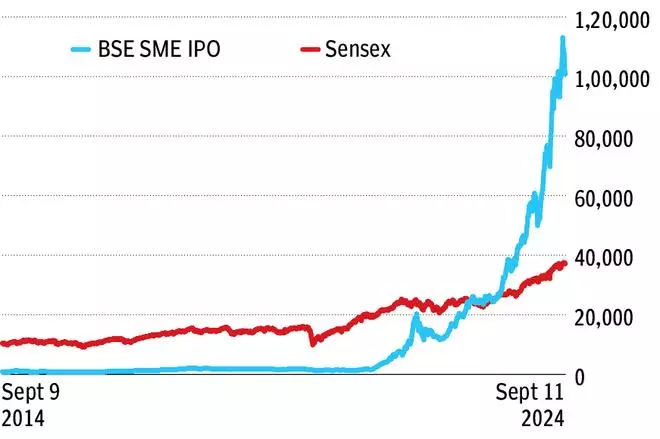

BSE Sensex has risen 3.56 instances within the final 10 years. If you happen to thought that was good, right here is a few attention-grabbing knowledge. On this identical interval, the BSE SME IPO index, which tracks the businesses within the SME phase, has risen a whopping 110 instances until September 11, 2024. A lot of the positive factors are within the final three years, publish Covid, when the index rose 16 instances in contrast with the mainboard index’s 1.6 instances rise. In a self-propagating cycle, whereby traders should analyse their funding with little or no institutional analysis, the liquidity deluge has powered the rally. Common subscription has ballooned from the astronomical ranges of 80 instances in FY23 to 200 instances in FY24. Common valuations, which had been at 20 instances for FY24 IPOs on the time of provide, have been swiftly moved to round 40 instances for a similar set of firms now. Right here is the SME IPO story in 5 charts.

Index rally: Evidently, the SME index is in bubble territory. After the inflection level post-Covid, the BSE SME IPO index has rallied to astronomical heights

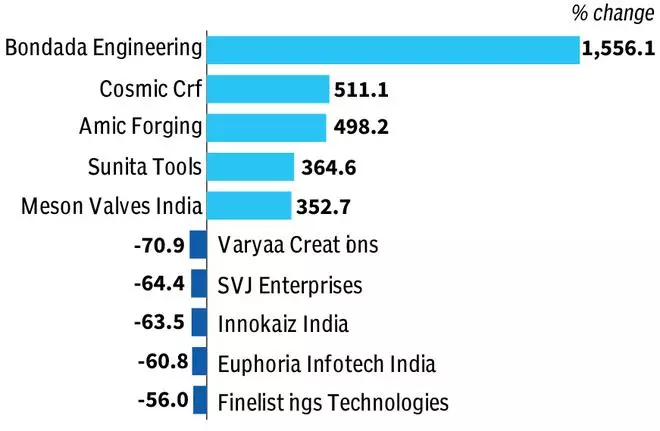

Leaders and laggards: Regardless of the rally, 68 index members misplaced a median of 25 per cent final yr in contrast with 69 members gaining a median of 90 per cent.

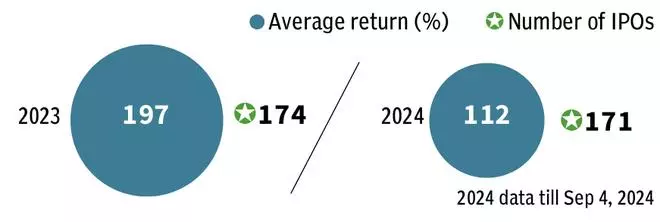

Robust returns briefly span: SME IPO phase is buzzing with exercise. Whereas 2023 SME IPOs tripled on common, an equal variety of IPOs in 2024 until September 11 have already doubled.

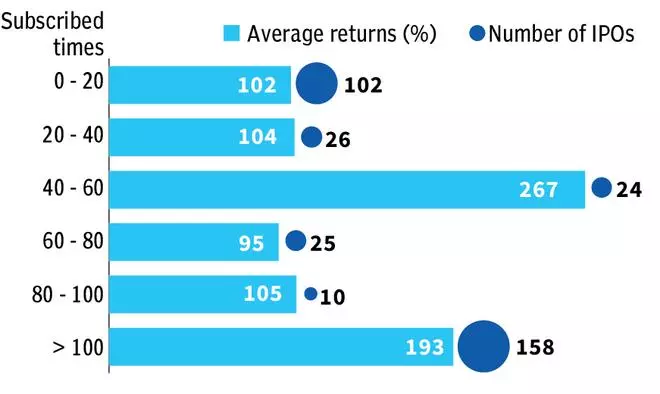

Robust subscriber base: Robust subscriber curiosity in SMEs evidenced by subscription tendencies. Common subscription has greater than doubled from 81 instances in 2023 to 201 instances in 2024. However the returns will not be correlated to subscription.

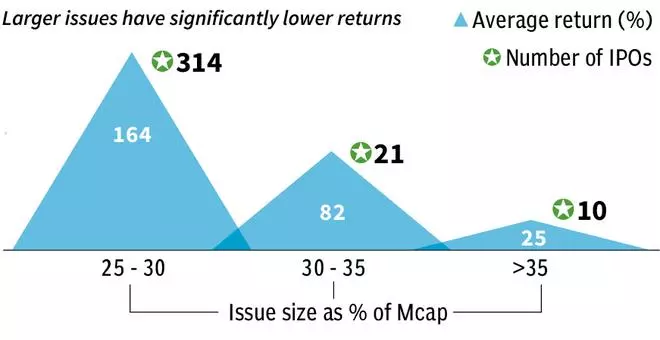

Concern measurement to m-cap: Common difficulty measurement is 1 / 4 of the market cap and bigger points have considerably decrease returns.

SHARE

- Copy hyperlink

- Electronic mail

- Fb

- Telegram

- LinkedIn

- WhatsApp

- Reddit

Printed on September 12, 2024