Whereas many shares moved up with out being backed by any important information flows or fundamentals, listed below are three shares that have been the highest gainers pushed by basic information inside the BSE 500 index final week.

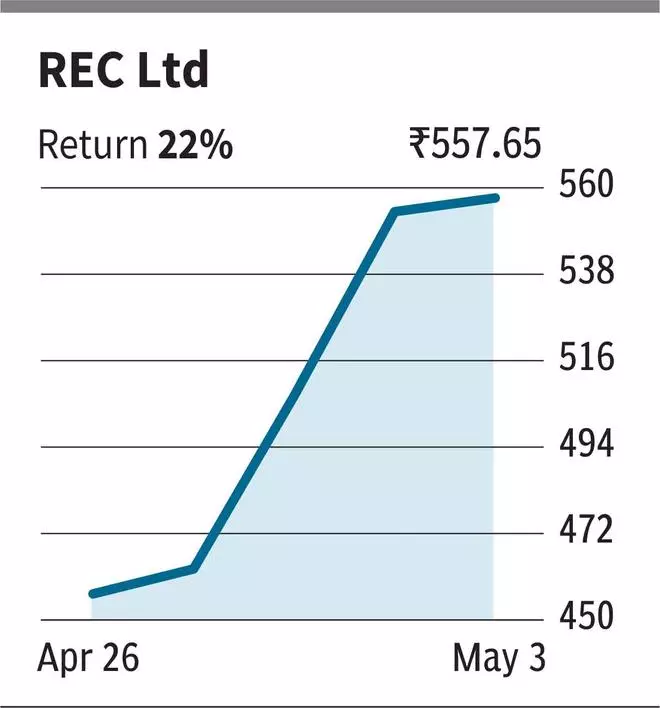

REC Ltd

The inventory of REC Ltd, a state-run energy sector Non-Banking Monetary Firm (NBFC), surged by 22 per cent over the previous week, largely attributed to its strong This autumn efficiency.

The corporate makes a speciality of financing tasks inside the energy infrastructure sector, encompassing varied sides akin to technology, transmission, distribution, renewable power, and rising applied sciences like Electrical Autos, Battery Storage, and Inexperienced Hydrogen throughout India.

Throughout Q4FY24, the corporate’s income noticed a y-o-y development of round 24 per cent whereas the online revenue elevated by 33 per cent through the interval on a y-o-y foundation.

The inventory trades at a trailing worth to e book of two.53 occasions.

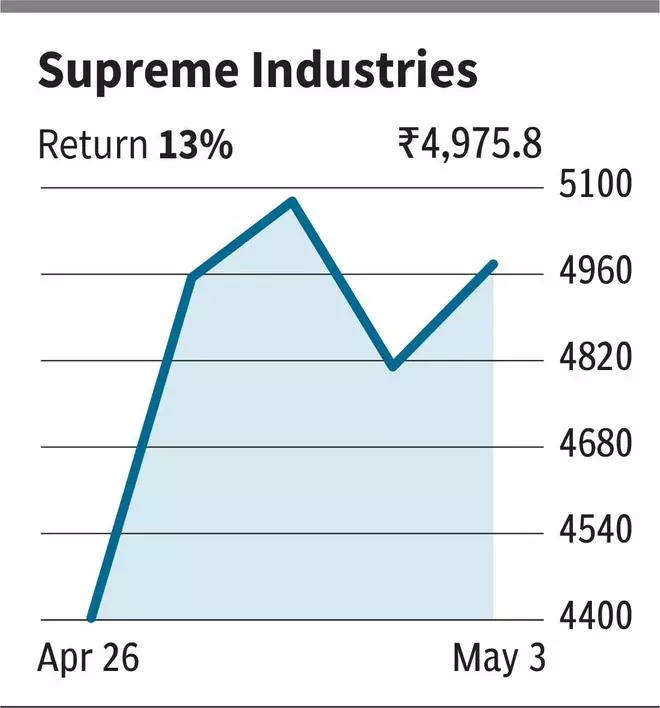

Supreme Industries

Supreme Industries’s share worth jumped by 13 per cent, propelled by strong gross sales quantity through the fourth quarter and its near-term enlargement initiatives.

The corporate primarily operates within the design and manufacturing of plastic merchandise, with 28 manufacturing amenities distributed throughout varied segments together with Plastics Piping Merchandise, Industrial Merchandise, Packaging Merchandise, and Client Merchandise.

Through the March quarter, the corporate registered a development of 33 per cent in gross sales quantity of plastic items, reaching 195,369 metric tons (MT), compared to 147,414 MT through the corresponding interval within the earlier 12 months. The corporate reported a 16 YoY income development whereas the online revenue demonstrated a marginal improve of two per cent YoY. Contemplating FY24, the corporate achieved a ten per cent YoY income development, whereas the PAT grew by 29 per cent YoY. The corporate has outlined funding plans, earmarking a capital expenditure of ₹1,500 crore.

The inventory trades at a trailing P/E of 59 occasions.

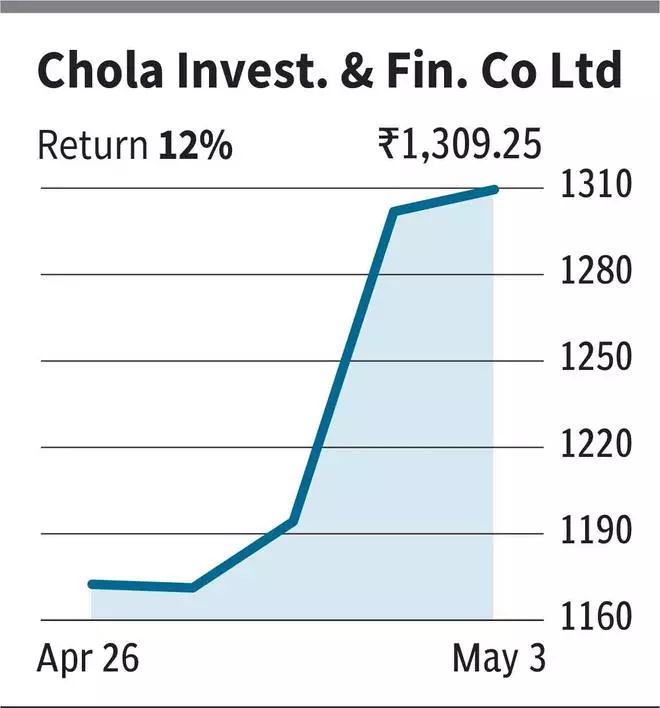

Cholamandalam Funding and Finance Co Ltd

The inventory of Cholamandalam Funding and Finance Firm Ltd (CIFCL) rose by round 12 per cent, as markets reacted positively to its earnings launch.

The corporate affords a various vary of merchandise and monetary companies encompassing car finance, dwelling loans, SME loans, shopper and small enterprise loans, mortgage towards property, insurance coverage company, dwelling fairness loans, secured enterprise and private loans, wealth administration, inventory broking, and mutual fund distribution, amongst others.

In Q4FY24, CIFCL reported a web earnings/PAT development of 41/24 per cent YoY to ₹2,913 crore and ₹1,058 crore, respectively. The corporate’s disbursement marked an 18 per cent improve, primarily fueled by a surge in disbursements for mortgage towards property and shopper and small enterprise loans, which expanded by 55 per cent and 40 per cent, respectively.

The inventory trades at a trailing worth to e book of two.81 occasions.

#REC #Supreme #Industries #Cholamandalam #Funding #Finance #Firm #shares #outperformed #weekended