The whole provide is price round ₹423 crore, of which ₹173 crore is a contemporary concern and ₹250 crore an offer-for-sale. The proceeds from the difficulty could be utilised for funding working capital necessities (₹54 crore), funding in IT infrastructure (₹33 crore), organising of latest buyer expertise centres (CEC) and laptop aided telephonic interview centres (CATI) (₹22 crore), and capital expenditure on a digital video content material manufacturing studio (DVCP Studio) (₹11 crore). The difficulty is priced within the vary of ₹270 to ₹288 per share.

On the time of publishing on Day two of the IPO, the provide was subscribed over 4 instances. March 6 being the final day, must you too go for it? The provide has many positives, together with RK Swamy’s observe file, its endearing relationships with many purchasers constructed over many years, and the lengthy runway of progress within the advertising options house, as a consumerism growth performs out in India over the following decade. Nonetheless, on the identical time, the offset is the excessive cyclicality of the enterprise.

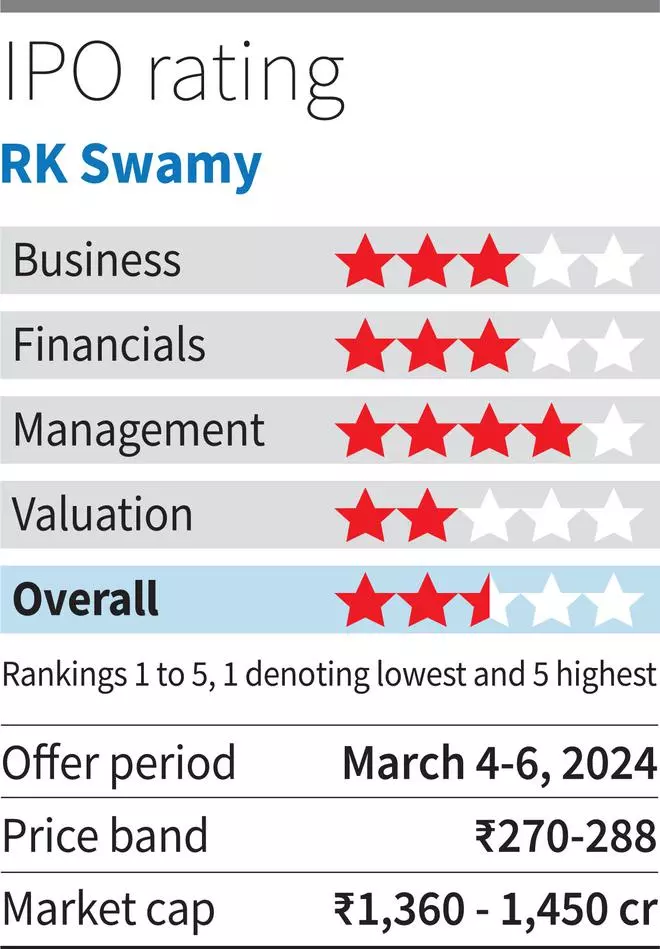

Whereas progress has been good lately (see desk) coinciding with an financial upcycle in India, the IPO priced at 46 instances FY23 earnings, could not provide satisfactory margins of security from a long-term investing perspective for the cyclicality danger talked about above. Whereas itemizing good points are doubtless given good curiosity within the IPO, we suggest that long-term traders needn’t subscribe for now. We suggest retaining the corporate on the radar, whereas gaining readability on how margins can fare in a downcycle, and take into account investing at higher valuations.

One other facet to be careful for – whereas it could not seem vital now – is the potential danger from an rising (though unproven but) menace from AI or any disruptions it could result in. Though the corporate has made investments in tech and makes use of proprietary AI algorithms to supply options to shoppers, whether or not there will be surprising disruptions from generative AI must be monitored.

Enterprise and prospects

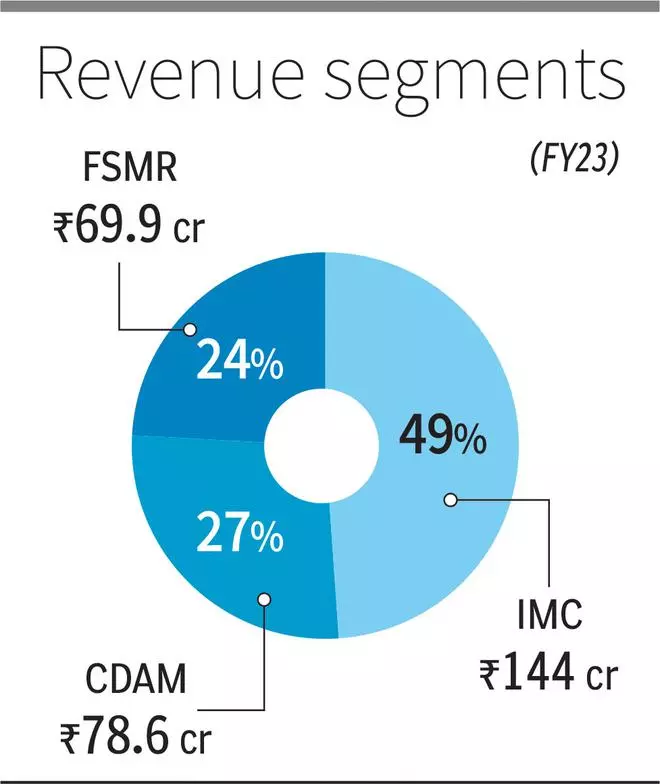

RK Swamy is a number one built-in advertising providers group in India, providing a single-window resolution for inventive, media, knowledge analytics and market analysis providers. They’ve been ranked eighth by way of estimated working income among the many built-in advertising communications providers groupsin the nation. Their enterprise segments embody — Built-in Advertising and marketing Communications (IMC, 49 per cent of FY23 income); Buyer Information Analytics and Advertising and marketing Expertise (CDAM, 27 per cent), and Full-Service Market Analysis (FSMR, ~24 per cent).

IMC encompasses promoting, inventive and digital content material, occasions and activation planning, and social media administration. Companies supplied beneath CDAM embody buyer knowledge analytics, supply and administration of buyer expertise, on-line fame administration, marketing campaign administration/ monitoring, and so forth. FSMR choices embody shopper surveys, buyer expertise administration and shopper intelligence. Whereas IMC providers are housed beneath the father or mother entity RK Swamy, two wholly-owned subsidiaries, Hansa Client Fairness and Hansa Analysis Group, present CDAM and FSMR options, respectively.

The corporate served 475 shoppers in FY23. A few of their notable shoppers embody ICICI Prudential Life Insurance coverage, Aditya Birla Capital, Union Financial institution, Mahindra, TVS, Havells and Khazana. Srinivasan Okay Swamy and Narasimhan Krishnaswamy are the promoters of the corporate. The promoter group holds 79 per cent pre-offer, which is able to drop to round 62 per cent after the provide.

In line with CRISIL, the advertising providers market in India was valued at ₹1,93,600 crore in FY23 (CAGR of 5.6 per cent between FY19-23) and would doubtless attain ₹3,50,000-3,75,000 crore by FY28 (CAGR of 12.5-14.5% between FY23-28). Particularly, the entire market worth of the segments RK Swamy operates in are more likely to develop from ₹28,000-29,000 crore in FY23 to succeed in ₹51,500 to 56,000 crore in FY28 (FY23-28 CAGR of 12-14%).

With over 5 many years’ expertise within the advertising providers business, RK Swamy is effectively positioned to capitalise on the sturdy business progress. Their skill to accumulate and retain shoppers has been a key determinant of their longevity. The common variety of years of relationships with their high 10 shoppers is ~19 years, and the highest 50 shoppers is ~11 years as of FY23. Repeat shoppers contributed ~84% of FY23 income. In a extremely fragmented business with quite a few companies and repair suppliers providing commonplace providers, RK Swamy has maintained its market share at round 1%. Its diversified buyer base has helped the corporate counter the intrinsic cyclicality of the business. Moreover, knowledge insights associated to the Indian market gained over time places them at a definite benefit.

Nonetheless, one potential danger to pay attention to is that of the 475 shoppers served in FY23, the highest ten shoppers contributed almost 42 per cent of its working income. Though the corporate has long-standing relationships with its shoppers, any lack of key shoppers may considerably affect progress. Their revenues are depending on sure key industries. BFSI, Auto and FMCG/Client/Retail have been the highest contributing sectors with share of 33%, 18% and 17% respectively. BFSI and Auto are cyclical industries and the corporate’s fortunes from these segments will rely upon the financial cycle enjoying out in these segments as effectively.

Financials and Valuation

.jpg)

RK Swamy reported income from operations of ₹293 crore in FY23, a CAGR of 29.8 per cent over FY21-23. EBITDA/PAT margins improved by almost 530/870 bps to 21/10 per cent throughout this time. The corporate’s gearing ratio for FY23 stood at 0.36, down from 0.93 in FY21. Improved profitability helped enhance RoE from 3.1 per cent in FY21 to 22.2 per cent in FY23. In H1FY24, working income stood at ₹141 crore, whereas EBITDA/PAT margins declined to 14.7/5.6 per cent, respectively. The enterprise of the corporate is seasonal in nature with usually low income recognition within the first half. Profitability in RK Swamy’s IMC section is broadly in-line with its friends, whereas CDAM and FSMR function at decrease ranges.

After the provide, the inventory will commerce at 91x annualised earnings for FY24, with the market cap on the higher band at round ₹1,450 crore. Nonetheless, to weed out affect of seasonality, if one values it based mostly on FY23 earnings, the IPO is valued at a PE of 46x. In line with the administration, on an approximate foundation, the primary half of the fiscal accounts for 40 per cent of income, and the second half 60 per cent. Therefore, profitability tends to be significantly better within the second half given the advantage of working leverage.

Globally, notable friends and world giants within the house – Interpublic group, Omnicom group – commerce at a trailing PE of 11.4 and 12.3 instances respectively. Whereas some premium for such companies in India is warranted given higher progress prospects right here, traders within the IPO can wait and look ahead to now, and enter later, as soon as there’s readability on how margins/ income fare in a downcycle.

#Swamy #IPO #closes #immediately #subscribe