Additionally learn: Final day to subscribe Mukka Proteins IPO

Enterprise

Integrated in 1973, RK Swamy Restricted is a number one built-in advertising and marketing companies teams in India, providing a single-window resolution for artistic, media, knowledge analytics and market analysis companies. They’ve been ranked eighth when it comes to estimated working income among the many built-in advertising and marketing communications companies teams working in India. Their enterprise segments embody (i) Built-in Advertising and marketing Communications (IMC, ~49 per cent of FY23 income from operations) comprising promoting, media, model activation, digital, content material and technique; (ii) Buyer Knowledge Analytics and Advertising and marketing Expertise (CDAM, ~27 per cent), and (iii) Full-Service Market Analysis (FSMR, ~24 per cent). The Firm served 475 purchasers in FY23. A few of their notable purchasers embody ICICI Prudential Life Insurance coverage, Aditya Birla capital, Union Financial institution, Mahindra, TVS, Havells, Khazana and so on. Mr. Srinivasan Ok Swamy and Mr. Narasimhan Krishnaswamy are the Promoters of the Firm. The promoter group held 79 per cent pre-offer which can drop to round 62 per cent after the supply.

Key strengths

In response to CRISIL, the worth of the advertising and marketing companies market in India stood at ₹1,93,600 crore in FY23 (CAGR of 5.6 per cent between FY19-23) and can possible attain ₹3,50,000-3,75,000 crore by FY28 (CAGR of 12.5-14.5 per cent between FY23-28). Particularly, the whole market worth of the segments RK Swamy operates in, is prone to attain ₹51,500 to ₹56,000 crore in FY28 (FY23-28 CAGR of 12-14 per cent). With over 5 many years’ expertise within the advertising and marketing companies trade, RK Swamy is properly positioned to capitalise on the robust trade progress. Their capacity to amass and retain purchasers has been a key determinant of their longevity. The typical variety of years of relationships with their high 10 purchasers is nineteen years and the highest 50 purchasers is 11 years as of FY23. Repeat purchasers contributed 84 per cent of FY23 income. Moreover, knowledge insights associated to the Indian market gained through the years places them at a definite benefit.

Dangers

Out of the 475 purchasers served in FY23, the highest ten purchasers contributed practically 42 per cent of its working income. Although the Firm has long-standing relationships with its purchasers, any lack of key purchasers may considerably impression progress. Their revenues are extremely depending on sure key industries. BFSI, Auto and FMCG/Client/Retail have been the highest contributing sectors with shares of 33 per cent, 18 per cent and 17 per cent respectively. Any lower in demand for advertising and marketing companies in these trade verticals may adversely have an effect on their monetary efficiency. The enterprise is seasonal in nature so fluctuations in earnings and excessive working capital necessities might have an effect on operations. Additional advertising and marketing companies as enterprise is cyclical in nature which can end in volatility in income, profitability and earnings over financial cycles.

Additionally learn: IPO craze continues: Three companies to lift ₹1,325 crore subsequent week

Financials and Valuation

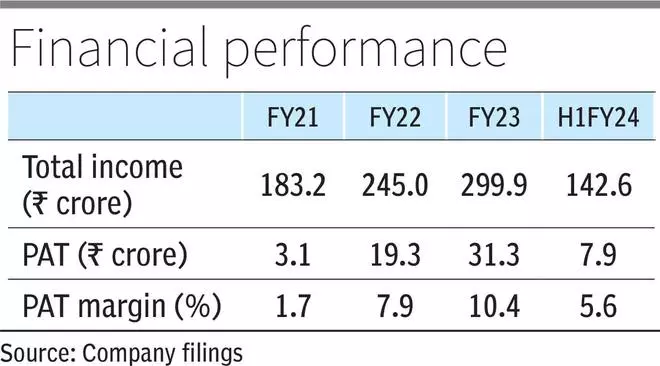

RK Swamy reported income from operations of ₹293 crore in FY23, a CAGR of 29.8 per cent over FY21-23. EBITDA/PAT margins improved by practically 530/870bps to 21/10 per cent throughout this time. The Firm’s gearing ratio for FY23 stood at 0.36, down from 0.93 in FY21. Improved profitability helped in growing RoE from 3.1 per cent in FY21 to 22.2 per cent in FY23. In HIFY24, working income stood at ₹141 crore whereas EBITDA/PAT margins declined to 14.7 per cent/5.6 per cent respectively. The enterprise of the Firm is seasonal in nature with sometimes low income recognition in first half.

After the supply, the inventory will commerce at 91x annualised earnings for FY24 with the market cap on the higher band at round ₹1,450 crore. Nonetheless, to weed out impression of seasonality, if one values it based mostly on FY23 earnings, the IPO is valued at a PE of 46x.

Globally, notable friends together with Interpublic group, Omnicom group and Dentsu commerce at 11-13x one yr ahead earnings. Whereas some premium for such companies in India is warranted given higher progress prospects right here, buyers within the IPO should contemplate dangers from cyclical nature of enterprise.

#Swamy #Restricted #IPO #Key #elements #subscribing