Since then, in a interval of 9 months, the inventory has carried out effectively and returned round 150 per cent. At its present worth of ₹800 the inventory now trades at a trailing PE of 35 instances as in comparison with 15 instances on the time of IPO. Low cost valuations and cheap enterprise prospects have been elements driving our subscribe name. Now, with valuation on the costly aspect, we suggest that buyers lock in on the positive factors and guide income.

Whereas Senco Gold nonetheless trades cheaper than friends equivalent to Kalyan Jewellers and trade chief Titan, two elements should be taken observe of right here. One, being a smaller participant as in comparison with them, Senco will doubtless proceed to commerce at a reduction. Two, the peer valuations too seem very costly now.

Jewelry enterprise is fiercely aggressive the place the businesses function with skinny margins. Senco’s internet margin within the final three years have ranged between 3 and 4 per cent. Moreover, there are dangers equivalent to demand sensitivity to costs. The current rally in gold costs may weigh on the demand for gold jewelry as consumers may defer their purchases.

Though the corporate’s efficiency has been good put up IPO, given the unfavourable risk-reward now, buyers can guide income.

Enterprise

Senco Gold primarily operates within the East and North-East (E&NE) a part of the nation and has a powerful presence. As on February 2, 2024, the corporate has 158 shops unfold throughout 16 States within the nation. Whereas 90 shops are company-owned and company-operated (COCO), 65 are franchisee showrooms.

In metros, Tier-1 and Tier-2 cities, the showrooms are largely COCO. Franchisee shops are predominantly current in Tier-3 and Tier-4 cities, thereby increasing by means of asset-light mannequin. Franchisee shops contributed 32 per cent to the overall income of the corporate.

The corporate’s development is determined by how the East and North-East (E&NE) States develop as most of their shops (117 out of the overall 158) at the moment are current on this area. However observe that this area contributes to solely about 15 per cent of India’s whole market.

That stated, the corporate is increasing within the northern area of the nation, which holds 18-23 per cent of India’s whole jewelry demand. The administration’s plan is to open 18 to twenty shops a yr. Whereas the trade continues to be dominated by unorganised gamers, the organised gamers are gaining market share steadily. By FY26, the share of organised gamers is estimated to enhance to 42-47 per cent in comparison with 33-38 per cent in FY22. Regulatory developments equivalent to HUID (Hallmark Distinctive Identification) and implementation of GST have given a push to the organised gamers.

Bridal jewelry holds the largest chunk of whole demand by constituting 50-55 per cent. That is adopted by each day put on, 35-40 per cent after which vogue jewelry, 5-10 per cent.

Senco Gold affords a big selection of merchandise and caters to clients in all three above-mentioned segments.

These constructive elements seem totally priced at present ranges.

Efficiency

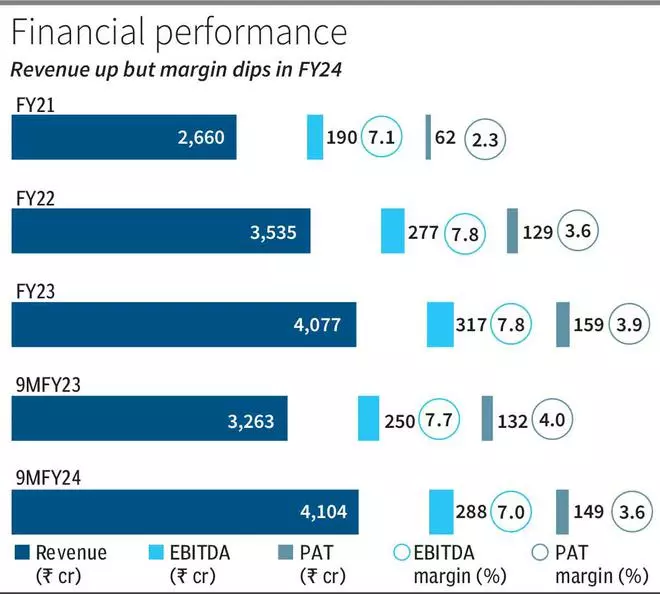

Income from operations has expanded 26 per cent to ₹4,104 crore in 9MFY24 versus ₹3,263 crore in 9MFY24. EBITDA grew to ₹288 crore from ₹250 crore in the identical interval. The corporate registered a profit-after-tax (PAT) of ₹149 crore in 9MFY24, a development of 12 per cent in comparison with the corresponding interval of the earlier fiscal.

Notably, the common transaction worth has expanded to ₹64,400 in 9MFY24 in comparison with ₹57,300 in FY21.

Nevertheless, the EBITDA margin moderated to 7 per cent in 9MFY24 as towards 7.7 per cent in the identical interval final yr. Additionally, PAT margin shrank to three.6 per cent from 4.1 per cent within the interval into account. The margins dropped regardless of an enchancment in stud ratio (share of diamond jewelry within the income) to 11 per cent in 9MFY24 in comparison with 8 per cent in FY22.

The margin decline was due to the affords and reductions the corporate provided to draw clients, as a result of competitors.

#Senco #Gold #Traders