- Additionally learn:RBI’s financial coverage committee maintains repo price at 6.50%

Noting that the most recent RBI financial coverage assertion was “marginally hawkish”, Pranjul Bhandari, Chief Economist, India and Indonesia, HSBC International Analysis, mentioned “we count on a shallow price slicing cycle of fifty foundation factors, taking the repo price to six% by March 2025”.

HSBC International Analysis at present have a 25 foundation factors price minimize pencilled in for August, however dangers are for it to be pushed to later (October).

She additionally mentioned that HSBC International Analysis was watching 3 developments and in the event that they align, the RBI might give hints of looser financial coverage within the subsequent assembly. The three issues that will decide the easing timeline are monsoon rains; authorities finances and impartial charges, in line with Bhandari.

Shreya Sodhani, Regional Economist, Barclays mentioned {that a} majority of MPC stays hawkish on inflation, whereas a rise in its progress forecasts suggests no urgency to chop charges. “We now suppose the RBI will minimize charges solely twice on this cycle in contrast with our forecast of 4 cuts earlier. In our baseline, we expect cuts are available December and Q2 25, though we word the chance that easing could also be delayed”, Sodhani added.

Goldman Sachs Analysis continued to count on a shallow easing cycle of complete 50 foundation factors price cuts, with 25 foundation factors every in This fall calendar 12 months 2024 and Q1 calendar 12 months 25. “The primary minimize will probably be within the December 2024 assembly”, Santanu Sengupta, Chief Economist, Goldman Sachs India mentioned in a analysis word.

Home precedence

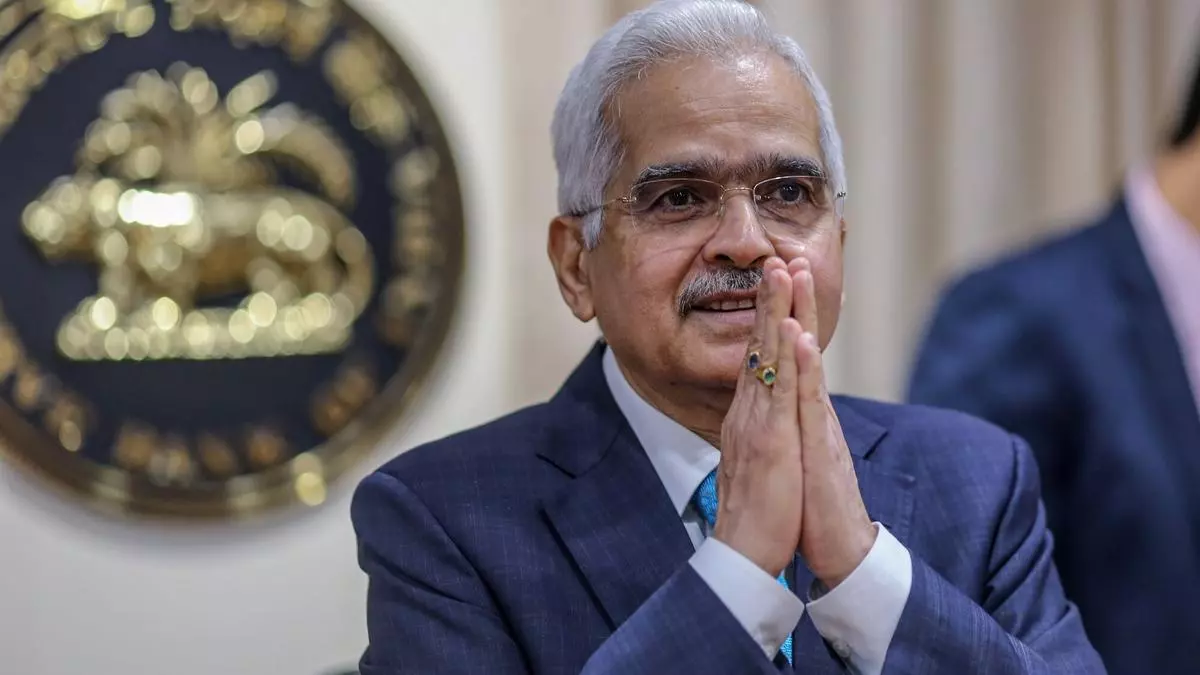

RBI Governor Das on Friday made it clear that whereas RBI does have a look at what superior economies central banks are doing, it doesn’t observe the US Fed and the RBI’s coverage choice will likely be primarily based on home issues.

“We interpret this assertion to imply that even when the Fed easing cycle will get pushed out due to US growth-inflation dynamics, the RBI can ease if inflation in India eases by This fall. However, if inflation in India stays sticky, the RBI is unlikely to ease even when a Fed easing cycle is underway”, Sengupta mentioned.

- Additionally learn:RBI could preserve coverage price unchanged amidst sturdy progress

“In our view, India’s FX reserves at $650bn+ will proceed to permit the RBI to insulate FX transmission channel from US financial coverage cycle into home financial coverage. Now we have been highlighting that the Indian Rupee’s carry-to-vol ratio stays among the many highest in EM FX, and we proceed to love incomes risk-neutral carry by way of our quick EUR/INR advice”.

#Shallow #easing #International #banks #RBI #slicing #coverage #charges #March