Specialists imagine these tendencies clearly spotlight that persons are holding their investments for longer durations whereas maintaining previous age safety in thoughts. They anticipate reform in capital acquire calculation norm within the price range.

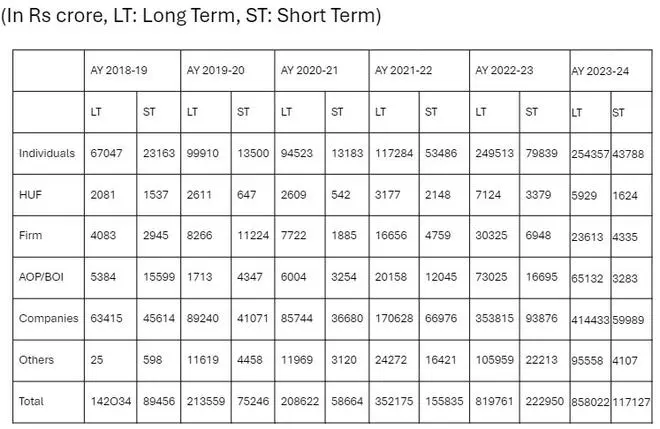

An evaluation of over 7.97 crore returns by the Earnings Tax Division confirmed that assesses declared whole short-term capital acquire of over ₹1.17 lakh crore for AY24 (Fiscal 12 months 2022-23) as towards over ₹2.22 lakh crore throughout AY23 (Fiscal Year2021-22). Throughout the identical interval, the quantity proven below LTCG rose to over ₹8.58 lakh crore as towards over ₹8.19 lakh crore.

SIP funding advantages

“Very simplistically, we will see an increase within the capital good points being realised and reported, displaying larger financial exercise. Moreover, the bent in direction of holding on property to profit from long-term capital good points tax remedy may be very clear,” Gouri Puri, Companion with Shardul Amarchand Mangaldas & Co.. In the meantime, Harsh Bhuta, Companion with Bhuta Shah & Co. attributed greater tax charges for short-term capital acquire in contrast to long-term capital acquire as cause a for fall within the quantities proven in Earnings Tax Returns. “Many individuals has began utilizing SIP mannequin for the funding objective for his or her long run future advantages in addition to retirement advantages resulting in rise in LTCG vis-a- vis STCG,” he stated.

Capital good points framework

Capital acquire refers to income or good points arising from the switch of a capital asset effected within the earlier yr, and it’s chargeable to earnings tax. Primarily based on holding, these property are categorised into short-term and long-term. An asset held for 36 months or much less is a short-term capital asset. Nevertheless, the factors is 24 months for unlisted shares (not listed in a recognised inventory trade in India) and immovable properties similar to land, buildings, and home properties from FY2017-18.

Additionally, 12 months is used for the quick time period for fairness or choice shares in an organization, bonds , debentures, and so on. listed on a recognised inventory trade, and securities (like debentures, bonds, govt securities, and so on.). The speed of tax on capital acquire for the quick time period is 15 per cent of the acquire (for securities) or, in response to tax slabs (for others). Equally, long-term capital acquire tax is 10 per cent (for securities) to twenty per cent (for others).

Holding durations for capital good points

Specialists really feel these norms are very sophisticated and should be made less complicated. Based on Puri, the expectation this price range is extra round simplification of the capital good points tax regime (at current these are scattered throughout the Earnings tax Act and completely different holding durations apply to comparable asset lessons (similar to listed fairness shares, models in REIT and InviT) for long run capital good points tax remedy. Equally, there isn’t a parity within the tax fee relevant to resident sellers and non-resident sellers in reference to unlisted securities.

Bhuta suggests taxing all long-term capital good points arising from the switch of securities, whether or not listed, unlisted, debt or fairness, at 10 per cent plus relevant surcharge and cess with out the good thing about indexation no matter the residential standing of the taxpayer. “Introduction of a uniform holding interval, similar to 12 months, for all securities whether or not listed, unlisted, debt or fairness for classification as short-term or long-term capital asset,” he suggested.

#Shortterm #capital #good points #halve #AY24 #returns #consultants #urge #complete #capital #good points #tax #overhaul