istock photograph for BL

| Photograph Credit score:

iStockphoto

The primary IPO for the brand new fiscal FY25 is that of Bharti Hexacom, a 70 per cent subsidiary of telecom big Bhart Airtel (Airtel). The corporate is an built-in telecom participant providing cellular, fastened line and broadband providers in few particular circles in India – Rajasthan and North-East.

The IPO, a proposal on the market by Authorities of India entity — Telecommunications Consultants India Restricted (TCIL), which presently owns 30 per cent stake within the firm, is open until April 5. TCIL plans to offload15 per cent stake (or 7.5 crore shares) within the firm for ₹4,275 crore (at higher finish of value band of ₹542-570 ), which means a market-cap of round ₹28,500 crore.

On the higher band, the difficulty is priced at trailing PE of 76 instances (9MFY24 EPS annualised). Nevertheless, earnings throughout this era are impacted by pre-tax distinctive objects and adjusting for this, the trailing PE might be round 45-50 instances. That is as in comparison with mother or father Airtel buying and selling at estimated FY24 PE of 59 instances.

By way of EV/EBITDA, annualising 9M FY23 numbers, Hexacom is valued at round 11 instances. In comparison with this, Airtel trades at FY24 EV/EBITDA of 11.8 instances.

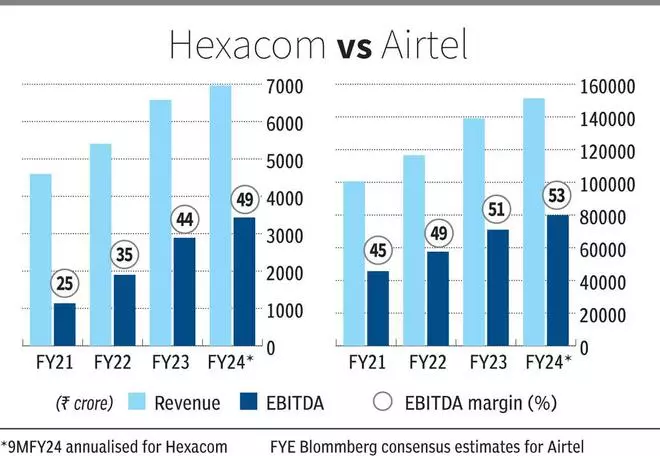

Though it’s priced cheaper than Airtel, we suggest traders can provide this IPO a cross for the next causes. One, bigger pan-India gamers like Airtel can profit from higher synergies pushed by scale and rising enterprise enterprise, which is mirrored in superior margins of Airtel (EBITDA margins at 53.8 per cent in comparison with Hexacom margins at 49.35 per cent). Therefore, this low cost in valuation versus massive gamers will stay and unlikely to get bridged.

Two, even on an absolute foundation, 11 instances EV/EBITDA seems costly given the truth that progress is now slowing (refer financials).

Enterprise

Hexacom is a communications options supplier providing shopper cellular providers, fixed-line phone and broadband providers to clients within the Rajasthan and the North-East telecommunication circles in India, which contains Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland and Tripura.

A easy strategy to perceive its enterprise is to have a look at it as Bharti Airtel or Reliance Jio, however solely with regional operations, sans different enterprise of the pan-India gamers (enterprise/enterprise providers, submarine cables, information centres). Hexacom is Airtel’s telecom arm in these areas and kind a part of Airtel’s consolidated operations and outcomes.

Therefore, not like Airtel’s India operations by which cellular income account for round 75 per cent, within the case of Hexacom 97 per cent of income is from cellular providers and the stability from fastened line/broadband providers.

Hexacom presently has 40. 4 per cent and 52.7 per cent income share in Rajasthan and the North East circles, respectively. In opposition to this, Reliance Jio’s market share was 46.1 per cent in Rajasthan and 39.8 per cent in North East.

Teledensity in Rajasthan at 79.5 per cent and within the North East at 79.9 per cent is decrease than the nationwide common of 84.5 per cent. Per Crisil estimates, the wi-fi buyer base in Rajasthan and North-East is estimated to develop throughout FY23-28 at a CAGR of 1.4-1.5 per cent and 1-1.5 per cent, respectively. That is inside the vary of progress anticipated for total nation CAGR of 1-1.5 per cent. For the foreseeable future, the wi-fi enterprise will stay the driving force, with different segments having solely a marginal affect.

Progress for Hexacom will depend upon whether or not it is ready to develop market share and enhance blended ARPU in these two circles that are round 5 per cent decrease than Airtel’s blended ARPU of ₹208. Tariff rationalisations publish elections, enhance in penetration of knowledge clients which is at 59.4 per cent for Hexacom in opposition to 60.2 per cent for Airtel and 99.8 per cent for Reliance Jio are elements to observe. In the long run, 5G might be a driver, however unlikely to have a lot affect within the close to time period.

Nevertheless, you will need to word that the efficiency of Hexacom is unlikely to be meaningfully differentiated or higher than that of Airtel. Therefore, there isn’t any sturdy case for traders to want Hexacom over Airtel.

Financials

For the 3-year interval FY21-24 (9M annualised), Hexacom income and EBITDA grew at a powerful CAGR of 15 and 44 per cent. Nevertheless, going ahead, traders must mood their expectations on progress. The expansion in earlier years was pushed by consolidation in business as Airtel (and Hexacom within the two circles) and Reliance Jio gained market share and benefitted from tariff will increase, whereas weaker friends Vodafone Concept’s and BSNL’s enterprise slumped because of monetary points.

Throughout this era, Hexacom EBITDA margins have moved up from 24.71 per cent to 49.35 per cent now. It must be famous that margin enchancment from right here at finest is more likely to be marginal and never vital, given the truth that even pan-India gamers which profit from increased synergies like Airtel and Reliance Jio have EBITDA margins of 53.8 and 52.7 per cent.

The deceleration in progress is already mirrored within the prime line for 9MFY24. Throughout this era, y-o-y income progress for Hexacom has decreased to eight per cent versus progress of 21.7 per cent in FY23.

Given decrease progress going ahead and far of EBITDA enhancements already behind, the inventory seems dear at 11 instances EV/EBITDA.

#subscribe #Bharti #Hexacom #IPO