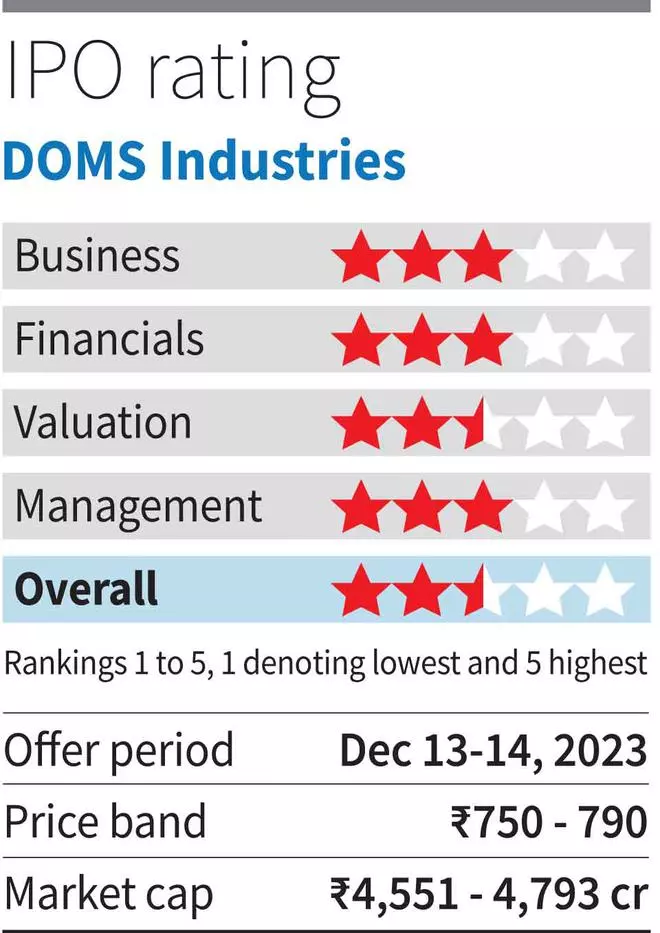

Following the profitable itemizing of Aptitude Writing Industries which now trades at a premium of 27 per cent to its IPO worth, the IPO of DOMS Industries is open for subscription from December 13-15. Capital base growth, established presence in pencils market and a large distribution channel are positives for DOMS. However valuation appears to be a little bit of a dampener. DOMS is coming at a valuation much like Aptitude now.

Nevertheless, Aptitude has an edge in margins and income progress prospects. We therefore advocate that buyers can look forward to higher entry factors to take publicity to DOMS.

Robust established base

The corporate began operations in 1973 with manufacture of pencils and crayons. It was in 2005 that the DOMS model of pencils had been first marketed. Later in 2012, the corporate tied up with Italy-based listed MNC, F.I.L.A which was into manufacture of pencils, crayons and artwork works internationally. F.I.L.A is now a promoter entity together with the unique promoter group. FILA owns 51 per cent previous to the problem and can retain 31 per cent shareholding post-issue as effectively, following the OFS (supply on the market) led by FILA stake sale. The corporate gained publicity in worldwide markets with assist from the strategic partnership with F.I.L.A. The corporate generated 19 per cent of H1FY24 revenues from exports, of which exports to FILA accounted for 11 per cent; 8 per cent had been branded exports from DOMS.

The corporate now operates throughout segments with scholastic stationery, artwork supplies and paper segments accounting for 46/26/10 per cent of H1FY24 revenues. Going by merchandise throughout segments, DOMS has a number one market share in pencils which contribute 36 per cent to H1FY24 revenues and compass bins (5 per cent).

Together with product breadth, the corporate additionally has a large distribution attain. The corporate largely operates by way of unique super-stockist mannequin with a minimal buy amount. The DOMS portfolio reaches 1.2 lakh retail contact factors throughout 3,500 cities and cities.

Growth plan

DOMS has a ₹450-crore growth plan for recent situation portion of the IPO proceeds. The present capability is optimally utilised starting from 85-98 per cent utilisation for prime merchandise in FY23, in response to the RHP. The land for capital growth, close to the present amenities, has been secured at a price of ₹73 crore in FY23. Out of ₹350 crore from recent situation, ₹280 crore will likely be used for growth and the remaining will likely be funded internally in response to the corporate. The power will be anticipated to contribute to revenues from FY26.

Comparability

On the margin entrance, Aptitude has the next gross and EBITDA margin of 46/20 per cent in FY23 in contrast with DOMS’ 37/15 per cent. We assume particular product combine inside the corporations might be accounting for the distinction. The upper margins may lend a margin of security to Aptitude’s operations in any market volatility and supply a greater return expertise for buyers over a long term.

Distribution attain is relatively comparable for each corporations. The gross sales progress of 75 per cent CAGR for the 2 entities within the final two years, each owing to a Covid base, additional strengthens the same finish market rationale. This could indicate the same progress runway for the 2.

On the growth entrance, DOMS is committing the next capital to growth in contrast with Aptitude, even adjusted for distinction in toplines. With the same asset turnover ratio of three.5 occasions, DOMS’ ₹450-crore addition must be anticipated to double the topline by FY27 in contrast with 50 per cent addition to Aptitude’s topline anticipated by FY25. However Aptitude, with 65 per cent of latest output (water bottles) dedicated to a OEM buyer, has the next income visibility comparatively. DOMS is increasing in writing devices together with pens which faces larger competitors and better branding prices.

On the time of the IPO, Aptitude was valued at 27 occasions and is now buying and selling at 32 occasions, submit the positive factors. DOMS is now valued at 32 occasions, however Aptitude positive factors a little bit of an edge on financials.

#subscribe #DOMS #IPO