What binds them is the enticing valuations which the 2 banks are searching for within the IPO. At lower than 1.2x one-year ahead worth to e-book, Jana has actually held out a carrot to draw traders. At 1.5x one-year ahead valuations, Capital additionally gives a proposition price contemplating. Although as compared, the latter’s asking worth for its dimension of enterprise appears to be a tad larger, it’s properly throughout the acceptable valuations for banks at 1–2x worth to e-book.

However past valuations, there may be nothing related between them. Whether or not by way of mortgage e-book composition, yield and margin profile or the enterprise focus, Jana and Capital are very totally different. What explains Capital’s marginally larger asking charges over Jana is its totally secured e-book over the latter’s 43 per cent share of unsecured loans. Nonetheless, contemplating that Jana is a a lot larger entity this shouldn’t be considered negatively.

As for dangers, traders shopping for into each or both of the shares ought to notice that the IPO is primarily to lift capital from the market and not one of the massive traders in both financial institution are liquidating their holdings within the financial institution considerably. Nonetheless, publish itemizing, given the requirement to cut back the promoter holding to 40 per cent and subsequently to 26 per cent, one ought to brace for secondary market sale by promoters.

Jana SFB

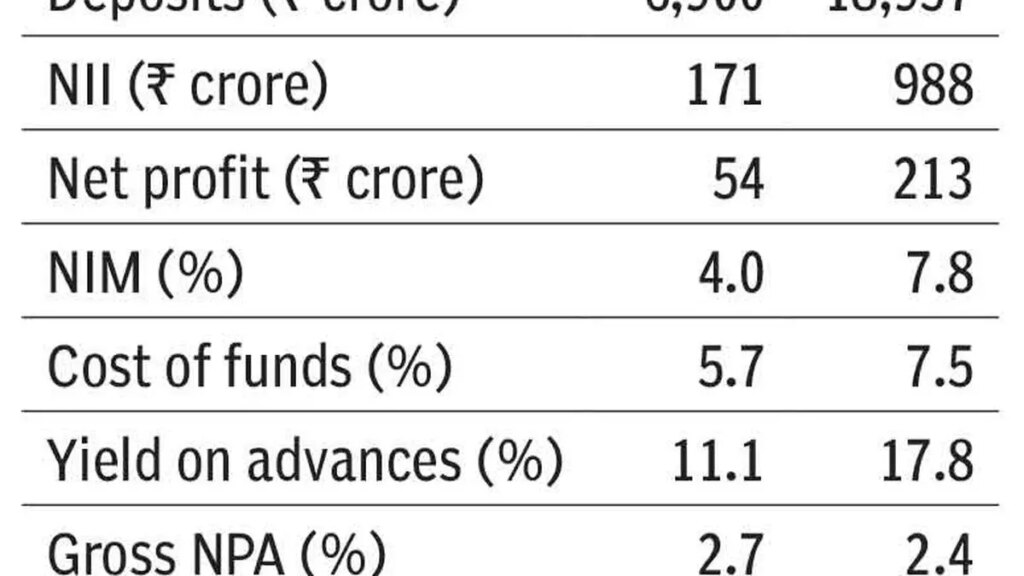

Within the two unhealthy spells encountered by SFBs — 2016’s demonetisation and Covid which impacted the banking sector for nearly two years beginning March 2020, Jana was the worst affected. To that extent, previous efficiency is barely an indicator of the financial institution’s capabilities. What’s considerable although is the financial institution’s potential to remain targeted on increasing its secured loans e-book, which accounts for 57.4 per cent whole loans now, from round 40 per cent three years in the past. The financial institution rebounded in FY23 posting spectacular development and return ratios (see desk). Having gone by crises and funding constraints up to now, the financial institution has adopted a mannequin the place it is going to originate and sell-down a small a part of its MFI loans which helps the financial institution in preserving a lid on its unsecured loans and preserve wholesome capital pool, liquidity and yield on property. Immovable properties largely account for collaterals within the secured enterprise, with micro LAP and reasonably priced housing accounting for 32 per cent of whole loans, MSME loans account for 15 per cent, 7 per cent publicity to time period loans and the remainder cut up between mortgage towards deposits, two-wheeler loans and gold loans. That stated, in H1 FY24, unsecured advances accounted for 43 per cent of whole disbursements and traders must be careful whether or not this pattern persists. Additionally, because the share of secured loans improve, NIM or web curiosity margin (7.8 per cent in H1 FY24) might proportionally decline. Nonetheless whether it is maintained within the 7 – 8 per cent vary, traders shouldn’t be involved.

Capital SFB

If Jana, like many different SFBs, is a case of microfinance lender changing to a financial institution, Capital SFB stands as the one native space financial institution to turn out to be a SFB. To that extent, Capital’s enterprise mannequin is tried, examined and has withstood extra cycles. Other than the truth that practically 100 per cent of its enterprise is secured, the distinctive promoting proposition is its major give attention to small companies. Capital’s core mannequin is to make sure that all the cash of a enterprise and/or the individuals operating it’s retained by the financial institution, whether or not as deposits and/or loans secured by some collaterals. The financial institution gives agriculture loans, MSME and buying and selling loans (for working capital, equipment purchases and so on) and mortgages (housing loans and loans towards property). In comparison with a pan-India outfit like Jana, Capital is essentially concentrated in north India and operates out of Punjab, Haryana, Delhi, Rajasthan, Himachal Pradesh and Union Territory of Chandigarh. Being secured loans-focused, Capital’s NIMs are the bottom amongst SFBs at 4.04 per cent in H1 FY24. Whereas an enchancment in operational efficiencies and scale may assist transfer the needle, it’s probably that Capital might at all times stay a laggard within the section as all its friends are helped by a component of high-yielding unsecured loans, which may by no means be the case for Capital.

When it comes to asset high quality, Jana and Capital posted gross non-performing property of two.7 per cent in H1 FY24. Whereas 1.5 – 2 per cent gross NPA is changing into the suitable threshold for SFBs, with a very secured e-book Capital’s numbers appear to be on the upper aspect. This can be due to larger share of restructured loans through the Covid interval.

#subscribe #Jana #Capital #SFB #IPOs