SJVN’s inventory has surged by 41 per cent on a year-to-date foundation, at present buying and selling at a ahead price-to-earnings ratio of round 28.7 occasions, representing a premium of greater than 100 per cent in comparison with its two-year common P/E of 13.5 occasions, indicating a steep valuation. Nonetheless, the forthcoming thermal plant is poised to considerably improve the corporate’s capability by over half of its present put in capability, doubtlessly translating into increased income streams.

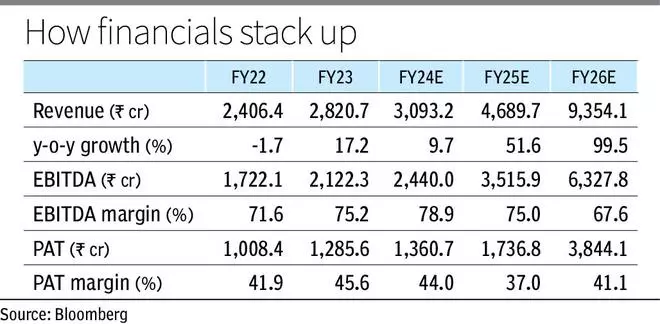

In keeping with Bloomberg consensus estimates, SJVN is projected to expertise income and PAT CAGR development of 44 per cent and 36 per cent, respectively, from FY23 to FY26. The corporate’s hydro and upcoming thermal mission profit from regulatory-based earnings, providing income visibility over the long run. Moreover, whereas photo voltaic and wind vitality sources could pose intermittency challenges, hydropower’s flexibility can mitigate these points, facilitating a smoother transition to scrub vitality.

Contemplating the balanced risk-reward state of affairs, current buyers could maintain on to their investments in SJVN. Nonetheless, initiating recent positions might not be advisable at this juncture.

Enterprise

Established in 1988 by way of a three way partnership between the Authorities of India and the Authorities of Himachal Pradesh, Satluj Jal Vidyut Nigam Ltd (or generally often known as SJVN) operates India’s largest single put in hydro energy plant capability of 1,500 MW in Himachal Pradesh. The corporate’s vitality portfolio contains hydro (83 per cent), photo voltaic (13 per cent), and wind (4 per cent) sources, with an general put in capability of round 2,377 MW. Income technology primarily stems from long-term energy buy agreements (PPAs) with State distribution utilities, supplemented by energy buying and selling, transmission, and consultancy segments.

The tariff construction for SJVN’s PPAs follows a cost-plus mannequin regulated by the Central Electrical energy Regulatory Fee (CERC), guaranteeing a set return on fairness (ROE) above operational bills and curiosity on loans. Incentives are awarded for surpassing normative plant availability components and contributing to grid stability. Moreover, SJVN extends its operations by way of wholly owned subsidiaries and joint ventures, together with SJVN Thermal Non-public Ltd, SJVN Arun-3 Energy Improvement Firm Non-public, SJVN Inexperienced Vitality Ltd (SGEL), and Cross Border Energy Transmission Firm Ltd (a JV with 26 per cent stake), specializing in thermal, hydroelectric, renewable and energy transmission tasks in India and Nepal.

Moreover, SJVN has been appointed as a Renewable Vitality Implementing Company (REIA), the opposite three entities being SECI, NTPC, and NHPC. With this, it is going to be tasked to evaluate renewable vitality demand from state discoms and solicit bids from builders, thereby incomes a buying and selling margin of ₹0.07/KWH.

Efficiency

Within the first 9 months of FY24, SJVN witnessed a decline in energy technology to 7,606.3 MUs, marking a ten per cent lower in comparison with the earlier 12 months. This discount might be primarily attributed to a 12 per cent drop in hydro technology, on account of antagonistic climate circumstances, together with flooding in Himachal Pradesh throughout Q2FY24 and low water discharge within the river Sutlej throughout Q1 and Q3.

Regardless of near-term challenges in hydro technology, SJVN maintained a plant availability issue (PAF) exceeding 100 per cent for its most important vegetation, Nathpa Jhakri HEP (NJHPS, 1,500 MW) and Rampur HEP (412 MW), since FY20, surpassing the Normative PAF (NAPAF) of 90 per cent and 85 per cent, respectively. This ensured full restoration of annual mounted fees and entitled the corporate to incentive revenue, totalling ₹210.3 crore in FY23 in comparison with ₹192.8 crore in FY20.

Income from operations decreased by 14 per cent to ₹2,096.46 crore in 9MFY24 in comparison with the identical interval final 12 months, primarily on account of diminished hydro technology, with a gross sales drop of over 17 per cent in hydro energy whereas the gross sales of renewable energy (together with photo voltaic and wind) elevated by greater than 50 per cent. The corporate reported a 36.6 per cent YoY drop in internet revenue to ₹850 crore for 9MFY24, resulting in a margin contraction from 55.1 per cent to 40.6 per cent. Nonetheless, the Bloomberg consensus estimates count on the total 12 months income and revenue in FY24 to develop by round 10 per cent and 6 per cent YoY, respectively. Falling in need of the estimates could elicit a destructive market response.

On a constructive notice, in March, the Himachal Pradesh (HP) Excessive Courtroom declared the State authorities’s imposition of water cess on hydropower technology as unconstitutional. This ruling is anticipated to yield appreciable tax financial savings for SJVN, as 80 per cent of its put in (1,912MW) and upcoming capability (658 MW) relies out of HP. The corporate’s D/E elevated to 1.22 as of Q3FY24 from 0.77 within the corresponding interval final 12 months, whereas the curiosity protection ratio fell to 4.5 occasions in comparison with 14 occasions.

This rise in leverage might be attributed to elevated long-term and short-term borrowings for the tasks beneath building and fluctuations in change charges on international foreign money loans. However, the corporate’s administration has deliberate to boost funding by monetisation of partial earnings of the NJHPS by way of Securitisation of its Future RoE.

Outlook and danger

SJVN has invested ₹3,800 crore out of ₹10,000 to this point within the first half of FY24. Wanting forward, administration goals for a capex of ₹12,000 crore in FY25. The corporate presently has an under-construction capability of about 4,778 MW, distributed throughout 4 hydro tasks, one thermal mission, and 9 renewable tasks, with capacities of 1,558 MW, 1,320 MW, and 1,900 MW, respectively. Moreover, SJVN is conducting feasibility research for pumped hydro storage tasks with a possible capability of about 5,000 MW. Administration has set bold targets, aiming for a capability addition of 12 GW by FY26 and 25 GW by FY30.

Regardless of promising development prospects, buyers ought to train warning concerning the inherent dangers related to hydro-electric tasks, resembling geological uncertainties, potential time and price overruns, authorized complexities, and opposition from stakeholders. Additional, as per CARE Edge Ranking company, the acquisition of beneficial PPAs stays an important problem on this sector.

Nonetheless, it’s noteworthy that SGEL has efficiently secured tie-ups for the whole 1,000-MW solar energy capability from the Bikaner Photo voltaic Energy Venture. Moreover, the upcoming Buxar thermal energy plant, with a capability of 1,320 MW and anticipated to start operations by September 2024, has already secured a PPA for 85 per cent of its output with the Bihar State Energy Holding Firm Restricted. Alongside, SJVN has demonstrated assertiveness within the renewable vitality sector, evident from its procurement of a number of orders.

Nonetheless, these constructive developments are juxtaposed towards issues concerning premium valuation. Nonetheless, contemplating the balanced risk-reward state of affairs, buyers could discover it prudent to take care of their holdings in SJVN’s inventory.

#SJVN #Buyers