The realty sector has been on fireplace over the previous yr or so. After a decade of lifeless actions over 2010-20, the Covid period and past have seen individuals search greater and comfy homes. And with work-from-home and hybrid cultures thriving, actual property has had a sustained upswing.

Among the many mega cities which have led the revival in residential development phase, Mumbai is a key space for a number of high and mid-sized builders.

On this regard, Suraj Property Builders is popping out with an preliminary public providing of shares and is seeking to increase ₹400 crore from the difficulty at a worth band of ₹340-₹360.

The corporate is usually into redevelopment tasks within the worth luxurious and luxurious classes of residential housing. It additionally builds industrial properties and boutique workplaces for corporates.

Suraj Property Builders is concentrated completely on the south-central Mumbai market and has executed properly over the previous few many years.

At ₹360, the provide reductions its FY23 per share earnings by 35 instances on the pre-offer fairness base and almost 50 instances on a post-offer absolutely diluted fairness base. Nevertheless, although it might not be representational, if the June quarter per share earnings of FY24 are annualised, the Suraj Property Builders provide would commerce at a price-earnings a number of of 27 instances on a completely diluted foundation.

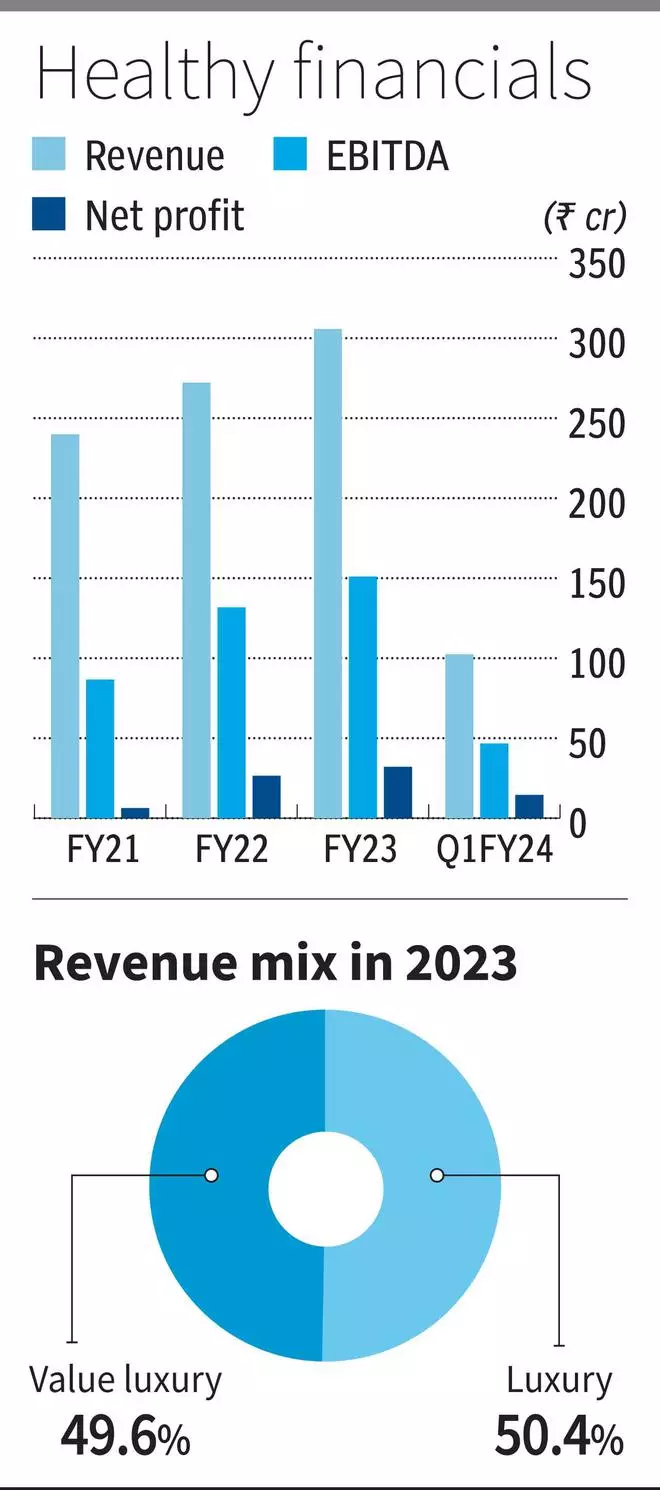

From FY21 to FY23, the corporate’s revenues grew at a CAGR of 12.9 per cent to ₹305.7 crore in FY23, whereas web income rose greater than five-fold to ₹32.1 crore from a low base in a comparatively powerful FY21, which was marked by lockdowns. The corporate enjoys an working (EBITDA) margin of above 45 per cent constantly (49.4 per cent in FY23), which is among the many finest within the business and amongst a choose few to take pleasure in double-digit web margins. In 1QFY24, the corporate recorded ₹102.4 crore in income from operations and web revenue of ₹14.5 crore, with an EBITDA margin of 45.6 per cent.

The return on capital employed in FY21 was a wholesome 21.9 per cent and has been enhancing steadily.

Suraj Property Builders’ valuations are definitely not low cost, however aren’t that costly both.

Sharp deal with profitable market segments, an asset-light mannequin centered on redevelopment tasks and a robust execution observe file are positives for Suraj Property Builders. Traders with a long-term perspective can think about subscribing to the difficulty, and never for itemizing pops, if any.

The peer set in actual property corporations is sort of troublesome to pinpoint as some are multi-city centered and a few have operations solely in a single metropolis. Additionally, the market segments of operation are totally different. The BSE Realty trades at a PE of over 84 instances. And gamers of various sizes and kinds of operation commerce from 28-80 instances their FY23 earnings, with some outliers buying and selling at three and even four-digit numbers, whereas others recorded losses.

Specialised operational segments

Suraj Property Builders is hyper centered within the sense that it operates within the sub-markets of South-Central Mumbai (SCM). Mahim, Matunga, Dadar, Prabhadevi and Parel are areas the place it has executed tasks. The corporate has been round for greater than 36 years and has constructed greater than 1 million sq. toes throughout 42 residential and industrial tasks.

It has ongoing tasks with about 6.1 lakh sq ft and upcoming tasks of seven.44 lakh sq ft.

The corporate operates in three segments — worth luxurious, luxurious and industrial. The worth luxurious residential phase is actually these in search of 1 or 2 BHK residences costing ₹1-3 crore. This phase accounts for over 54 per cent of the continued tasks’ carpet space on the market.

Luxurious phase is the half the place patrons search for 3 BHK and 4 BHK residences costing between ₹3 crore and ₹13 crore. This phase accounts for 39.4 per cent of the carpet space on the market.

Industrial buildings account for the remaining 6.3 per cent.

Suraj Property Builders is predominantly centered on redevelopment tasks within the residential phase. The builder focuses on the SCM space the place there are residences which might be fairly previous (30 or extra years) the place residents discover buildings too troublesome to restore and preserve. The corporate will get concerned in such tasks, resettles tenants, develops a brand new property by demolishing the previous one and offers residents new residences with bigger areas to stay in. The additional residences constructed because of greater FSI (ground area index) that’s allowed in redeveloped buildings, could be bought to new patrons.

The corporate is absolutely depending on exterior development corporations and designers for finishing its tasks.

The corporate is ready to purchase land parcels at cheaper fee and its focus is on redevelopment tasks. On condition that the SCM market in Mumbai has constantly had per sq ft charges north of ₹42,000, the margins have been extraordinarily wholesome for the corporate.

Debt compensation from IPO proceeds

Suraj Property Builders seems to be to make use of the difficulty proceeds to cut back debt considerably. Of the ₹400 crore to be raised from the difficulty, ₹285 crore could be used to repay its relatively excessive web debt of ₹551 crore as of June 2023. One other ₹35 crore could be used to purchase land parcels or land improvement rights.

Put up the compensation of debt, on an enhanced fairness base, the corporate would have a web debt to fairness ratio of about 0.6, which is sort of affordable.

In keeping with a current ICICI Securities report, for a listing of 10 listed gamers within the business, the net-debt to fairness ranges nil to as excessive as 2.5, with most within the 0.1-0.7 band in Q2FY24.

#Suraj #Property #Builders #IPO #Subscribe