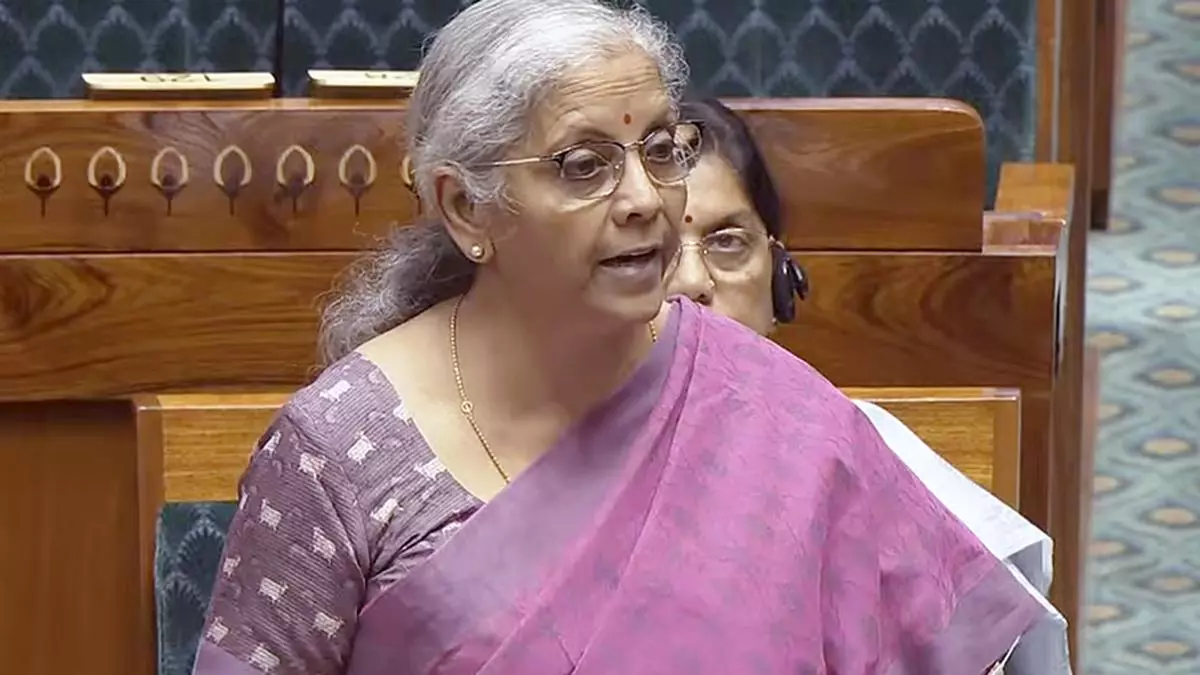

FM Sitharaman directs Public Sector Banks to launch particular drive to garner deposits

Finance and Company Affairs Minister Nirmala Sitharaman on Monday suggested Public Sector Banks (PSBs) to make concerted efforts to garner deposits by conducting particular drives. This recommendation is essential as PSBs are experiencing a tough scenario of slower deposit progress in comparison with the sharp improve in mortgage advances within the latest years. Additionally learn: … Read more