Rupee, ahead premiums nudge increased forward of RBI’s financial coverage resolution

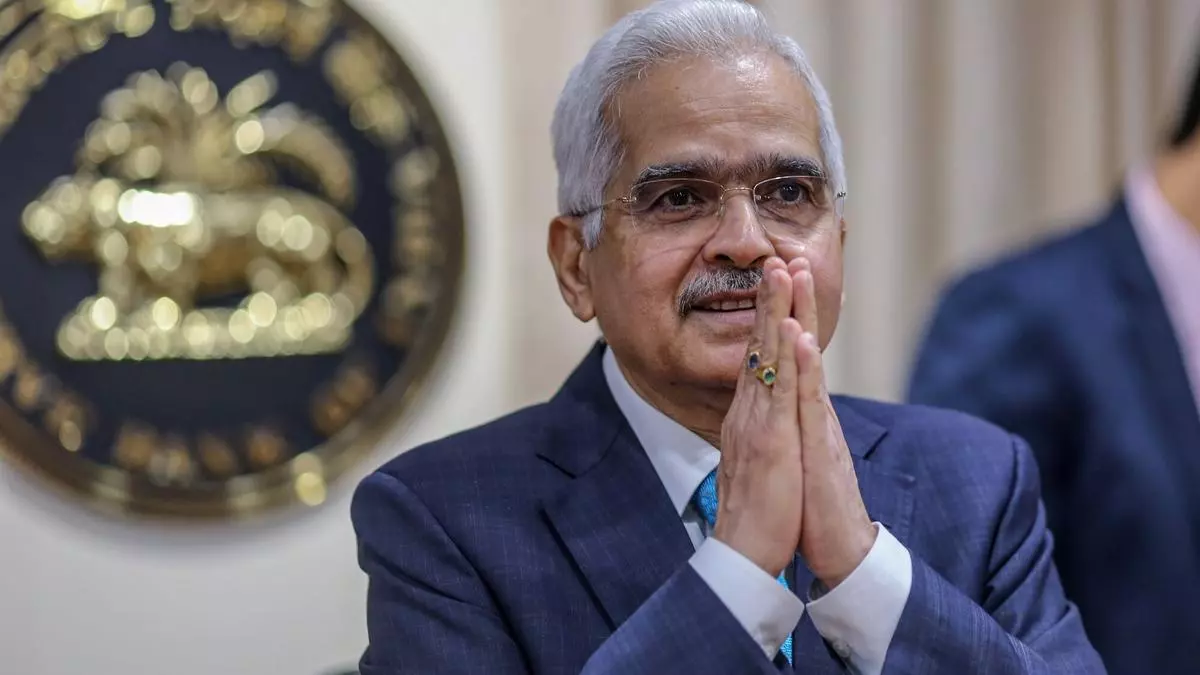

The Indian rupee rose marginally in early buying and selling on Thursday, aided by positive aspects in most Asian currencies, with dollar-rupee ahead premiums additionally ticking up forward of the Reserve Financial institution of India’s (RBI) financial coverage resolution. Additionally learn: RBI to carry charges, might sound extra assured of reaching inflation goal: Report The … Read more