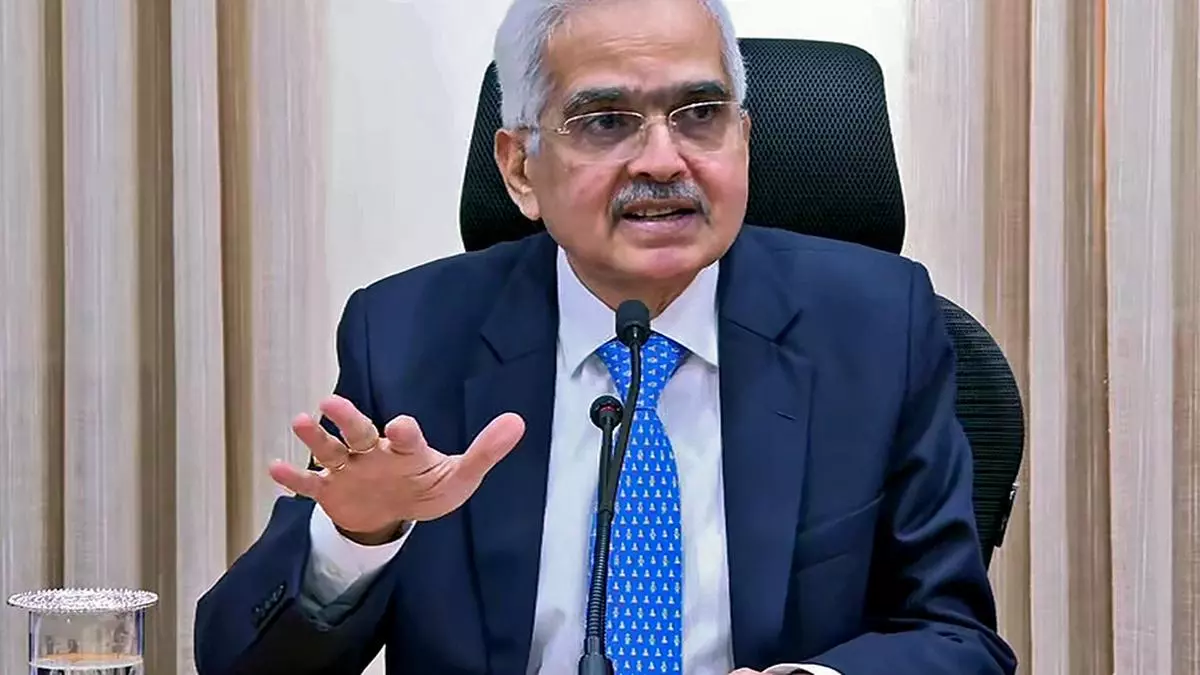

Overseas banks, brokerages anticipate RBI to start out easing from December

Overseas Banks and Brokerages anticipate the Reserve Financial institution of India (RBI) to maintain coverage charges unchanged until December given the present bout of excessive meals inflation being “persistent” and having led to greater inflation expectations. This is able to imply that almost all of those banks and brokerages don’t anticipate a fee lower within … Read more