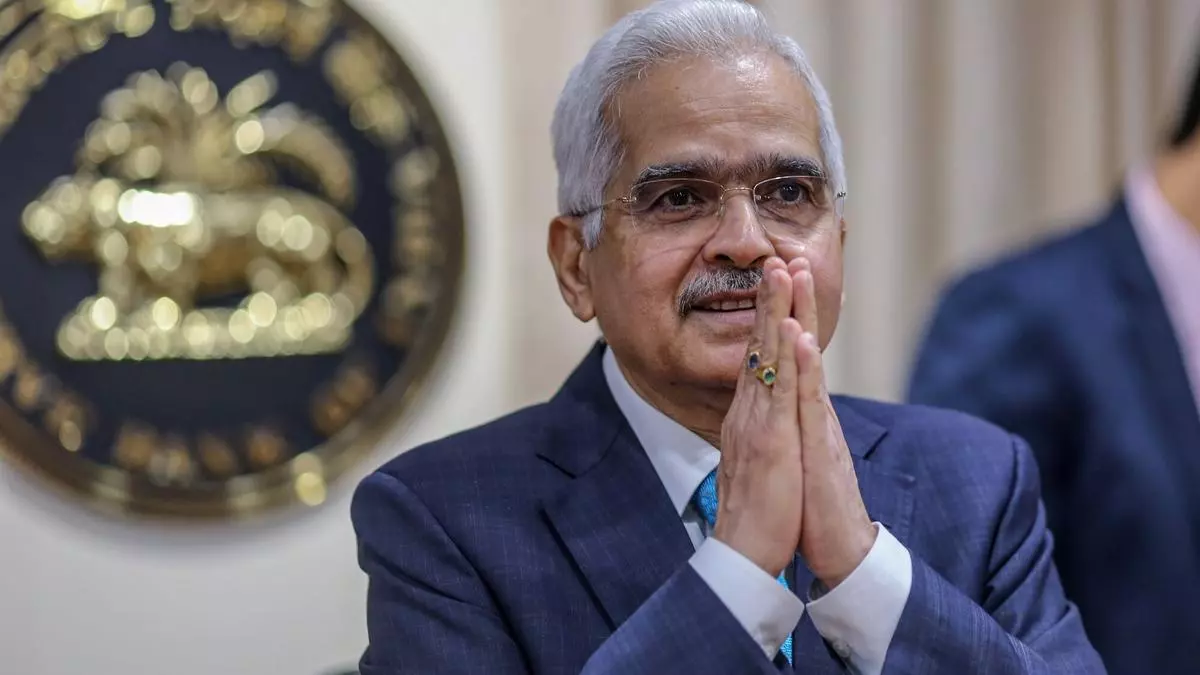

RBI Guv Shaktikanta Das alerts no coverage change regardless of dip in inflation

Reserve Financial institution of India’s governor Shaktikanta Das signalled he’s in no hurry to chop rates of interest regardless of the latest softening in inflation on this planet’s fastest-growing main economic system. “Inflation has been introduced throughout the goal band of 2-6 per cent, however our goal is 4 per cent,” Governor Shaktikanta Das stated … Read more