Siyaram Khandelwal

Container Company of India (₹893.45): The inventory has been in a powerful downtrend since June this yr. It made a excessive of ₹1,180 in early June and has come down sharply from there. The downtrend is powerful. There is no such thing as a signal of a reversal. Sturdy resistance is within the ₹950-1,050 area. So long as the inventory trades beneath ₹1,050, the downtrend will stay intact. Container Company of India share worth can fall to ₹840 from right here.

A break beneath ₹840 will see the value tumbling in the direction of ₹750 within the subsequent two-three quarters. Thereafter, a revival is feasible. Because the probabilities of rising again is sort of nil, we advise you exit the inventory at present ranges and settle for the loss. You possibly can take into account reinvesting the quantity in another inventory that appears good on the charts. Please learn the subsequent question on ACC. That inventory appears to be like good to purchase on dips. You take into account reinvesting the sale proceeds from this inventory to ACC.

I’ve purchased shares of ACC at ₹2,424. What’s the long-term outlook for this inventory?

Rahmath M

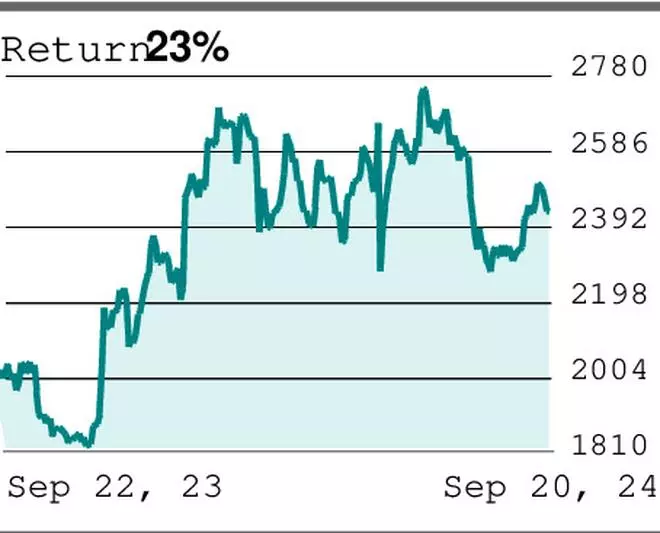

ACC (₹2,442.90): The broader development is up. Inside that, the inventory is presently consolidating. ACC is going through resistance within the ₹2,750-2,850 area now. There are probabilities for a fall to ₹2,150 and even ₹2,000 from present ranges. Nevertheless, that can simply be a correction inside the broader uptrend. The area round ₹2,000 is a powerful assist and a fall past it’s much less possible. A contemporary rise from round ₹2,000 can have the potential to interrupt above ₹2,850.

Such a break can take ACC share worth as much as ₹3,300 first after which to ₹3,800 finally. Assuming which you could maintain the inventory for long run, accumulate on dips at ₹2,180 and ₹2,070. Preserve a stop-loss at ₹1,960. Transfer the stop-loss as much as ₹2,700 when the inventory goes as much as ₹2,920. Transfer the stop-loss additional as much as ₹3,250 when the value strikes as much as ₹3,500. Exit the inventory at ₹3,750. Lengthy-term buyers who want to enter this inventory may purchase on dips on the degrees talked about above and observe the identical technique.

I’m holding the shares of Happiest Minds Applied sciences for greater than three years. My buy worth is ₹1,030. What’s the long-term outlook for this inventory?

Balaji Singaram, Thanjavur

Happiest Minds Applied sciences (₹799.65): This inventory has been oscillating in a variety of ₹700 and ₹1,000 for about two years now. The development is totally unclear. Because the inventory is poised across the decrease finish of the vary, there are probabilities to go up in the direction of ₹900-950 from right here. Some robust optimistic set off is perhaps wanted for the Happiest Minds Applied sciences inventory to breach ₹1,000.

That isn’t within the neighborhood in the meanwhile. Contemplating the extended sideways motion, it isn’t advisable to build up at present ranges additionally, though the value is near the vary backside. It won’t be definitely worth the wait anticipating a bullish vary breakout. So, we advise you come out of this inventory and settle for the loss.

Ship your inquiries to techtrail@thehindu.co.in

#Technical #Evaluation #Container #Company #India #Concor #ACC #Happiest #Minds #Applied sciences