Rule primary in basic investing is that fairness valuations are pushed by earnings potential. The upper the expansion outlook a safety guarantees, the upper can be its valuation. This holds true for the day by day grind of inventory investing and analysing.

However then there are different glacial elements that collect beneath the floor, impacting valuations. These are usually not as tangible as earnings bulletins. However both by way of quantitative software or hypothesis, these elements do affect valuations. The valuation hole left unanswered by earnings progress is partially crammed by these elements and buyers ought to concentrate on the modifications.

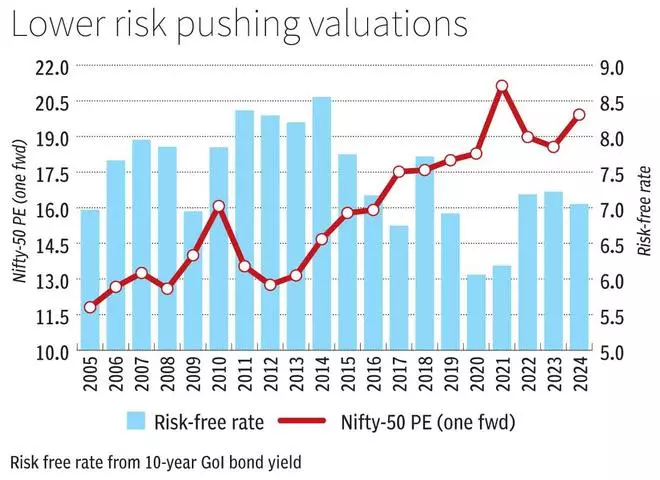

For example, the earnings progress of Nifty-50 within the final 20 years is arguably comparable: 11 per cent CAGR from 2004 to 2014 and 10 per cent CAGR from 2014 to 2024. However in the identical interval, Nifty-50 one-year ahead PE has moved from 11.8 occasions in 2004 to 14.7 in 2014 to twenty occasions now. Regardless of comparable earnings progress, the fixed growth of Nifty-50 PE through the years will be linked to decrease danger, greater length of progress and higher investing atmosphere.

We analyse the potential drivers and touch upon the sustainability of PE growth foundation these.

The bottom case

A inventory (or any safety) whose earnings develop at 11 per cent per yr (equal to Nifty-50 progress) until terminal stage (submit which 2 per cent secular progress is usually assumed) will be purchased in the present day at 18.3 occasions its one-year ahead earnings, assuming the full value of capital is round 10.5 per cent. This additionally assumes that the earnings flip into free money movement at 90 per cent, ie FCF/earnings is 90 per cent; the money is then discounted on the charge tied to financing plus a risk-premium. Assuming that is break up equally between debt (8 per cent value of funds) and fairness (13 per cent), it really works out to a complete value of capital at 10.5 per cent, additionally known as WACC.

This results in the bottom case PE of 18.3 occasions in comparison with Nifty-50 buying and selling at a peak of 20 occasions for the final one yr. This means a hole that requires a justification. What can these be?

Decrease danger assumption

A decrease danger assumption can enhance the a number of. With decrease danger related to the funding, the bids can sufficiently enhance, pushing valuations. Quantitatively, the low cost charge or WACC will be considered because the hurdle charge past which any surplus will be claimed by the fairness holder. The decrease the hurdle charge, the upper the declare of the fairness holder.

If a undertaking is absolutely financed by debt, which has an 8 per cent value, then funds left after paying debt accrue to the shareholder. Equally, fairness capital, which is the opposite capital, ought to contemplate danger free charge, danger premium and firm beta. Flowing from bigger macroeconomic elements of a rustic, these metrics are practically passive with one or two shifts per decade.

To an extent, the present premium in valuations will be partially defined by decrease danger notion in investments. The danger-free charge is drawn from 10-year GoI bond yield, which is presently at 7 per cent. In January 2014, this charge was 8.8 per cent which, when plugged into the bottom case, yields an appropriate PE of 16.4 occasions. As will be seen within the desk, PE ratios have marched upwards, egged on by decrease bond yields within the final 20 years.

An identical extrapolation of yield decline by 100 bps anticipated within the subsequent two years can present a case for growth within the PE a number of to 19.6 occasions within the base case. For a speculator, this could not be a wild commerce. India’s inflation, even when hovering above common, is faring nicely in comparison with worldwide inflation. This supplies elbow room for financial motion to induce progress by reducing charges. Within the developed economies, the query of when and never if charge cuts are introduced has evidently watered down with persistent inflation. However as soon as the cycle begins, the home charges will likely be fast to adapt after two full years of excessive coverage charges.

Alternatively, conservatism ought to discourage such extrapolation as one can be betting towards the central financial institution and even forward of it. Additionally, the present yield of seven per cent holds many of the charge minimize hypothesis. Even assuming decrease yields, the second order impact could stop the complete movement by way of to reducing the discounting charge. Forex, RM prices, credit score progress and well being, demand outlook, value competitors and different enterprise/financial variables and their affect on danger notion are unknown and much too complicated to imagine. In different phrases, what if yields decline, however earnings progress, which is taken with no consideration, doesn’t materialise as anticipated?

Additional, the speed minimize cycle could not even be as sharp as seen in earlier durations, with world charges performing as a ground. Internationally, the final 20 years witnessed extremely accommodating financial coverage with straightforward cash provides. It needs to be seen what stance developed central banks take within the present iteration when their charge minimize cycle begins.

It is very important notice that basic danger metrics comparable to WACC are to not be assumed based mostly on ahead expectations however are to be inferred from present market situations.

Earnings progress expectations

Within the base case we assumed a 10-year interval of excessive progress — 11 per cent earnings CAGR for 10 years — earlier than steady stage charge (2 per cent per yr to eternity). In instances the place there’s a sturdy visibility of progress for an extended length, another stage of progress is added. For example, within the base case, including another stage of progress for 5 extra years at 7 per cent earnings CAGR can push the ahead PE a number of from 18.3 to 19.9 occasions. In easy phrases, we’re front-loading the expansion assumption to push valuations.

That is primarily practised in valuing high-growth corporations, comparable to e-commerce, internet-based, or new-age corporations, which may take a very long time to mature and don’t have any earnings to talk of within the present time period. Nonetheless, that is additionally mirrored in mature corporations with a monitor report of progress, which is then extrapolated into the longer term, foundation the monitor report.

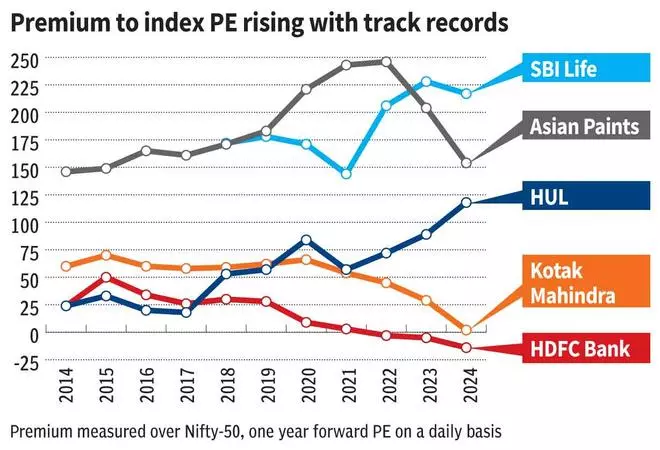

Of the Nifty-500, there are solely 17 corporations with no earnings decline up to now 10 years. Of the lot, mature large-cap corporations HUL, Asian Paints, HDFC Financial institution, Kotak Mahindra Financial institution, Abbott India are notable. These corporations have traded at a premium to the index and this premium has been on the rise as nicely. Clearly, an extended monitor report of progress (regardless of being nominal), has been rewarded with an above-average and elevated valuation a number of. Traders bid on the corporate’s ‘behavior’ of progress, which interprets into greater valuations.

Nonetheless, sooner or later, this may face a stiff problem as nicely. As will be seen within the desk, the rising premium of Asian Paints has stalled, coinciding with the corporate reporting a revenue decline within the final two quarters. For HDFC Financial institution and Kotak Mahindra, regardless of stellar report of progress, the premium is on the decline. However FMCG chief Unilever has reported a gentle enhance of premium owing to an extended progress monitor report.

However within the broader market, one can infer that longer time frames of excessive progress are actually being factored to bid-up valuations, going by the excessive 20 occasions one-year ahead PE a number of for Nifty 50.

The conservative strategy needs to be to pay for under ‘seen’ interval of progress. Even the most effective business practitioners can solely predict the present financial cycle, which lasts between 8 and 10 years. Whereas an extended profitable historical past of India Inc is inducing a better confidence to low cost even 2034 money flows, patrons ought to act with pessimism and search bargains. If there’s a tendency to be optimistic, the customer ought to take a second to assume why the vendor is pessimistic and promoting the inventory, want for money aside.

Higher investing atmosphere

There are a number of different smaller enablers that are additionally contributing to excessive multiples. Incrementally, post-Covid, these unquantifiable markers have performed their half in pushing valuations additional.

Firstly, the variety of demat accounts has grown four-fold from 2020 and in the present day stands at 16 crore demat accounts. The retail participation by way of mutual fund route has additionally been equally stellar, with SIP inflows each month rising to ₹21,000 crore in June 2024, from ₹8,000 crore in June 2020. Whereas valuations are intrinsic, there’s a demand pull to the shares as nicely.

The keenness in retail participation post-Covid has additionally been remarkably constant . That is mirrored in the truth that there has not been a major dip within the markets within the final 4 years. Whereas world indices comparable to Nasdaq and S&P 500 endured a bear market in 2022, the Nifty 50 managed to keep away from it . Home shopping for cushioned the FII promoting throughout that part.

The excessive demand that’s excessive on enthusiasm is chasing a restricted provide of shares, by worldwide requirements as nicely. As per Bloomberg, India has a free float shareholding of 48.9 per cent as on date (Nifty-50 members) in comparison with 96 per cent in Dow Jones (US), 83 per cent in Nikkei-225 (Japan), 80 per cent in DAX (Germany) and even Cling Seng’s 58 per cent. This additionally performs a component in pushing valuations additional, particularly with excessive demand.

The macroeconomic elements have improved India’s attractiveness for overseas capital. The contained inflation and progress prospects, alongside structural stability, are driving greater capital inflows. Drawing from the Chinese language expertise, India’s present per capita GDP of $2,400 is seen nearing the inflexion level of $3,000 from the place home demand can help a excessive progress part to middle-income-status nation.

Classes from the previous

The buoyancy in equities pushed by decrease danger notion, greater progress and different hygiene elements could seem to justify the index buying and selling at 20 occasions ahead PE. However at such ranges there is no such thing as a margin for error in investing to accommodate the unknown dangers that frequent markets on occasion and that may have a long-lasting affect.

The Covid affect hardly certified as a blip in markets as index surpassed earlier highs and recorded new peaks. Quite the opposite, the worldwide monetary disaster induced 2008 slowdown persevered for six years because the index peak reached in early 2008 was breached once more solely in early 2014.

The response to 2008 disaster launched a wave of inflation, which persevered from 2008 to 2014, when it sustained above 6 per cent. The interval additionally noticed the banking disaster with twin stability sheet drawback of the lender and the debtors left in shambles for the following decade. A robust dose of recapitalisation to banks has repaired the harm solely lately. Non-public sector has but to tackle capex momentum regardless of tax cuts and authorities leads, as it’s taking prolonged classes from that prior interval. On a rolling foundation decadal EPS CAGR of Nifty-50 persevered under 5 per cent for the durations 2007-17 to 2011-21, solely lately scaling again to 10 per cent.

Such optimism is driving upward revisions in earnings, progress phases and different enablers, and downward revisions in low cost charges to fulfill the sky-high optimism of sellers. Imply reversion of premium valuation multiples from 20 occasions to 18 occasions shouldn’t be with out precedent and must be monitored. Additional, markets, each every now and then, may also commerce under imply valuation ranges as they’ve traded above the imply for just a few years now. Given these, cautious optimism over unbridled optimism would stand buyers in good stead within the present context.

#Bull #Bear #Case #Fairness #Valuations