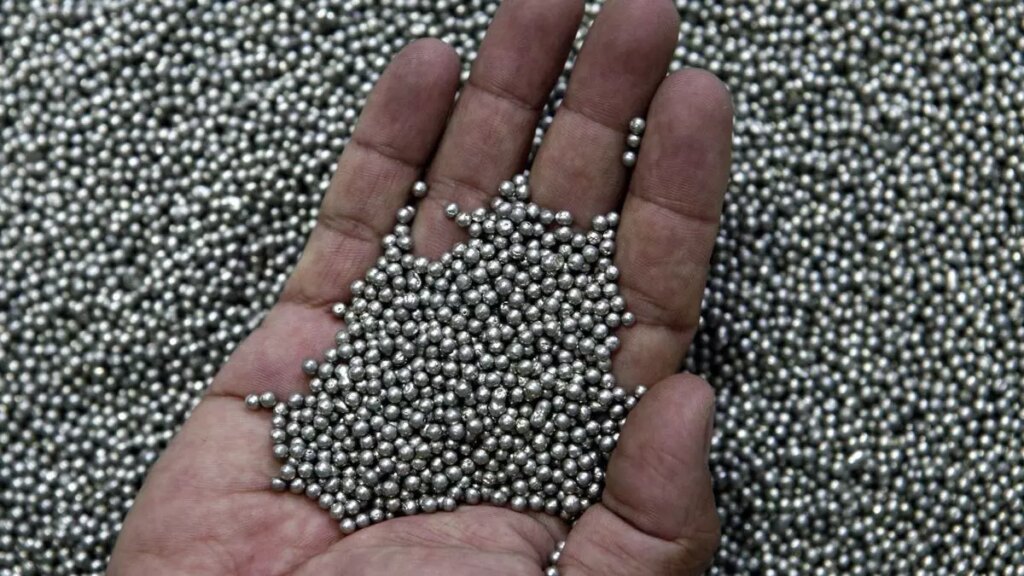

The value of tin, a white soft-silvery steel utilized in soldering, for plating metal cans and in bearings, has elevated by over 20 per cent in 2024. On the London Steel Alternate, the three-month tin contract was quoted at $30,850 a tonne. For money, the steel was quoted at $30,875 a tonne.

In line with Tom Langston, Senior Market Analyst on the Worldwide Tin Affiliation (ITA), tin has recovered from its July low and elevated 9 per cent in August. Hypothesis in tin has elevated over the previous few weeks, rebounding from oversold circumstances.

Indonesia exports down 54% YoY

Analysis company BMI, a unit of Fitch Options, mentioned on the one hand, mining on the Man Maw mine, accounting for nearly all of Myanmar’s tin provide, has not been reinstated but regardless of the ban being lifted for all different mining operations from January 4.

“Then again, Indonesian tin exports have confronted important disruption in H1 2024, with delays in approvals of mining firms’ annual work plans, identified domestically as RKAB, inflicting important panic amongst market members,” it mentioned.

In line with the ITA, In line with the Worldwide Tin Affiliation, Indonesia, the world’s largest exporter and second-largest producer of refined tin, exported solely 14,752 tonnes of refined tin within the first half of 2024, lower than half of the entire in H1 2023 and a 54 per cent year-on-year decline.

Value forecast

BMI mentioned due to these developments, it has raised its tin value forecast for 2024 from an annual common of $28,000/tonne beforehand to $30,000, as provide considerations drove tin costs to an unprecedented year-to-date excessive of $36,050/tonne on April 22.

“Costs stay elevated as of August 28 regardless of ebbs and flows as provide considerations persist,” the analysis company mentioned.

Langston mentioned the (tin value) uptick happens amidst current market volatility and combined macro alerts together with anticipated Fed charge cuts beginning in September and persisting weak financial knowledge from China.

The Procurement Useful resource web site mentioned tin costs are anticipated to proceed rising within the coming months as nicely. “… the alarming provide scenario amidst quickly depleting inventories will information tin costs upwards,” it mentioned.

Myanmar ‘in-kind’ tax

BMI mentioned, “On the availability facet, first, the Man Maw mine stays closed as of August 28 regardless of the mining ban in Myanmar having been lifted on January 4 2024.”

Procurement Useful resource mentioned the Man Maw Mine stays closed regardless of a tax coverage change in Myanmar. ITA mentioned a “30 per cent in-kind tax” was imposed in February this yr on all grades of tin focus exports.

BMI mentioned the mix of a fall in Myanmar’s tin exports and disruptions to Indonesia’s exports of tin considerably boosted sentiment for many of 2024 thus far. “…however we count on this to now stabilise as Indonesia’s tin exports get again on observe over the approaching months,” it mentioned.

Langston mentioned tin fundamentals stay strong because the feedstock market in China tightens and Indonesian provide takes time to recuperate.

Semiconductor gross sales rise

BMI mentioned it expects some resilience on the demand facet within the remaining months of 2024 as world semiconductor gross sales at the moment are exhibiting indicators of a pick-up, and stay traditionally excessive.

“In April 2024, Taiwan Semiconductor Manufacturing (TSM), the world’s largest contract chipmaker, introduced a 16.5 per cent year-on-year rise in its Q1 revenues throughout its Q1 2024 earnings report. The corporate manufactures semiconductors for purchasers together with Apple, AMD, Qualcomm and Nvidia,” mentioned the analysis company.

International semiconductor gross sales knowledge present that the decline in demand for semiconductors since mid-2022 has reached its trough, with gross sales growing steadily since July 2023, it mentioned.

International tin shares have began declining in current months, particularly shares on the Shanghai Futures Alternate, BMI mentioned.

#Tin #costs #rule #elevated #the rest #yr