- Additionally learn: Triveni Engg upbeat on sugar sector, however cautious on ethanol

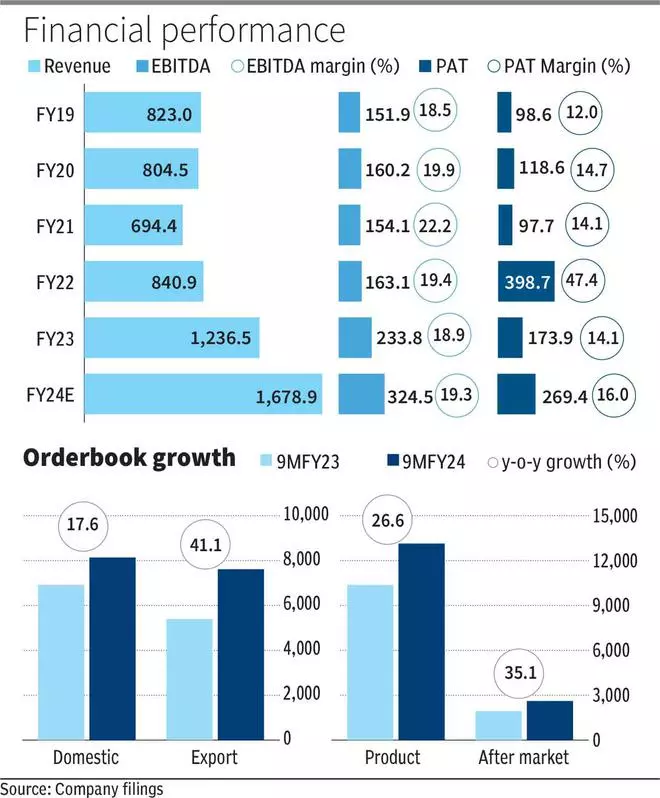

Regardless of geopolitical headwinds globally, Triveni Generators has managed to maintain greater export order inflows within the API section, with common export gross sales of round 42 per cent throughout FY19-FY23. Additional, the aftermarket section, being a high-margin and non-cyclical enterprise, has been witnessing greater traction globally, with the contribution to the whole gross sales climbing from 25 per cent in FY19 to 33 per cent in 9MFY24. Within the final 5 years, i.e., FY19-FY24E (together with consensus estimate for Q4FY24), the income and PAT CAGR of Triveni Generators are round 15.3 and 22.3 per cent respectively.

The inventory worth has given 5x returns within the final 5 years and can be up by 28 per cent year-to-date. It now trades at a ahead price-to-earnings ratio of round 48 instances, which represents a premium of over 50 per cent in comparison with its five-year common P/E of 31 instances.

Whereas premium is warranted, given the higher underlying structural development now, at present ranges it additionally seems that long-term progress prospects are factored in. Additional, as per the administration steerage, with the corporate aiming to develop manpower by 20 per cent in FY25, the EBITDA margin might stay range-bound at 19-20 per cent for the close to time period. Therefore, given the balanced risk-reward, whereas present buyers can proceed to carry the inventory, contemporary positions needn’t be thought-about at this juncture.

Enterprise

Since its de-merger from Triveni Engineering and Industries in 2011, Triveni Generators has established itself as a outstanding participant within the industrial steam turbine sector, with a home market share of 50-60 per cent within the sub-30MW section and rating second largest globally, with a share of round 20 per cent within the sub-100MW class. The corporate operates primarily in two segments: gross sales of generators (67 per cent of income in 9MFY24), and aftermarket providers (33 per cent). With 54 per cent of gross sales derived domestically and 46 per cent from exports in 9MFY24, the corporate’s footprint spans round 80 international locations worldwide, with key export areas together with South-East Asia, Africa, Europe, South America, and North America.

Triveni Generators affords customised steam generators catering to industries resembling sugar, distilleries, metal, cement, pulp & paper, and extra. It primarily operates its manufacturing amenities at two crops in Bengaluru, at Peenya and Sompura.

Whereas the corporate initially ventured into producing 30-100 MW generators via a JV settlement with Common Electrical (established in FY11), it dissolved the JV in September 2021, citing underperformance. Now working independently on this house, Triveni Generators serves end-user industries requiring captive energy crops and waste warmth restoration programs for electrical energy era from steam. This enterprise mannequin, whereas probably profitable, exposes the corporate’s income streams to fluctuations within the capex cycles of those end-user industries.

Nevertheless, the corporate has diversified into manufacturing American Petroleum Institute (API)-compliant drive generators focusing on industries resembling oil & gasoline, petrochemical, refinery, and fertiliser sectors, which current new income streams. It has been recognised as an authorized vendor by a number of OEMs. At the moment, it represents a modest single-digit portion of the corporate’s whole order e-book. By its aftermarket providers, it supplies spare components, turbine upkeep, and retrofitting/refurbishment providers (with its Triveni REFURB model) for each its generators and people of opponents.

Efficiency

As on December 31, 2023, Triveni Generators has achieved an all-time-high order backlog, reaching ₹1,575.4 crore. Throughout 9MFY24, it skilled a surge so as inflows, rising by 27 per cent y-o-y to ₹1,443.2 crore, primarily pushed by a 60 per cent y-o-y enhance in export bookings, whereas home order influx progress remained comparatively flat at 3 per cent y-o-y. This may be attributed to subdued order bookings from main capex-driven industries in Q1, and delayed order finalisations from sure prospects in Q3.

Order inflows within the aftermarket section witnessed good traction, rising by 49 per cent y-o-y. Triveni Generators has been strategically increasing its aftermarket section globally, evidenced by its acquisition of a South African agency (TSE Engineering) in March 2022 and the institution of a wholly-owned subsidiary (Triveni Turbine Americas Inc) within the US in February 2024.

The corporate reported a y-o-y working income enhance of round 36.5 per cent to ₹1,195.9 crore in 9MFY24, pushed by the next share of exports (up 50 per cent y-o-y) and strong progress within the aftermarket section (up 49 per cent y-o-y). Additional, the EBITDA elevated by 36.8 per cent to ₹229 crore whereas the margins remained flat at 19.1 per cent. The shortage of working leverage might be attributed to ongoing workforce growth efforts, alongside elevated bills associated to subcontracting expenses within the South African Improvement Group (SADC) area and journey prices. The corporate has a sturdy steadiness sheet, with a debt-free standing, low (to adverse) working capital, supported by advances from prospects, and wholesome money reserves.

Outlook

With the latest capability growth on the Sompura unit, Triveni Generators has considerably enhanced its annual manufacturing capability to 250-300 machines, up from the earlier vary of 150-180 machines, eliminating the necessity for additional capital expenditure within the close to time period.

Regardless of latest softness within the home sector, with a dominant place in sub-30MW generators, the corporate is poised to profit from an anticipated upswing in large-scale personal capex initiatives. Publish-election enhancements are anticipated to drive order inflows from giant industrial segments, probably translating to greater home order inflows.

With a sturdy order backlog, an rising share of exports, and a rising aftermarket section, the income can develop greater than 25 per cent CAGR throughout FY23-26E as per Bloomberg consensus estimates, whereas PAT can develop by round 36 per cent CAGR through the interval pushed by working leverage, and robust topline progress. Nevertheless, the inventory worth has skilled a pointy run-up in valuation following its December quarter earnings announcement. Therefore, risk-reward seems balanced for now.

#Triveni #Turbine #Traders